The Consumer Supplement Market: Attitudes and Awareness

Executive Summary

To better understand the U.S. supplement market, MarketPlace surveyed these supplement consumers regarding their awareness, attitudes, and behaviors related to vitamins, minerals, and nutritional supplements (VMS). This white paper presents the findings of this study.

Key Findings

- General disease prevention and overall wellness was indicated by over half of respondents (58%) as a reason to take supplements. However, many others noted specific conditions, such as digestive health (48%), heart health (45%), joint health (42%), and immunity (41%). Brands should consider positioning toward both general wellness and specific outcomes.

- There is strong interest among supplement consumers for personalized nutrition. Two-thirds (66%) would consider purchasing a supplement specially formulated for them.

- Regarding CBD, there remain broadly varied beliefs about the cannabinoid, its origins, and its applications. Many consumers believe it may have medicinal benefits. However, trust is a major barrier for consumers to try CBD-based supplements. Brands should invest in lab testing and seek to be transparent in the claims they make.

- Most supplement users regard efficacy and purity as very important (84% and 72%, respectively). Brands should invest in clinical trials, certifications, and better delivery systems to address these concerns of supplement consumers.

- While pills are the preferred delivery method for most supplement users, there is an emerging market for gummy consumers. Those who prefer gummies are more informed and tend to have stronger opinions about supplements than the average supplement user.

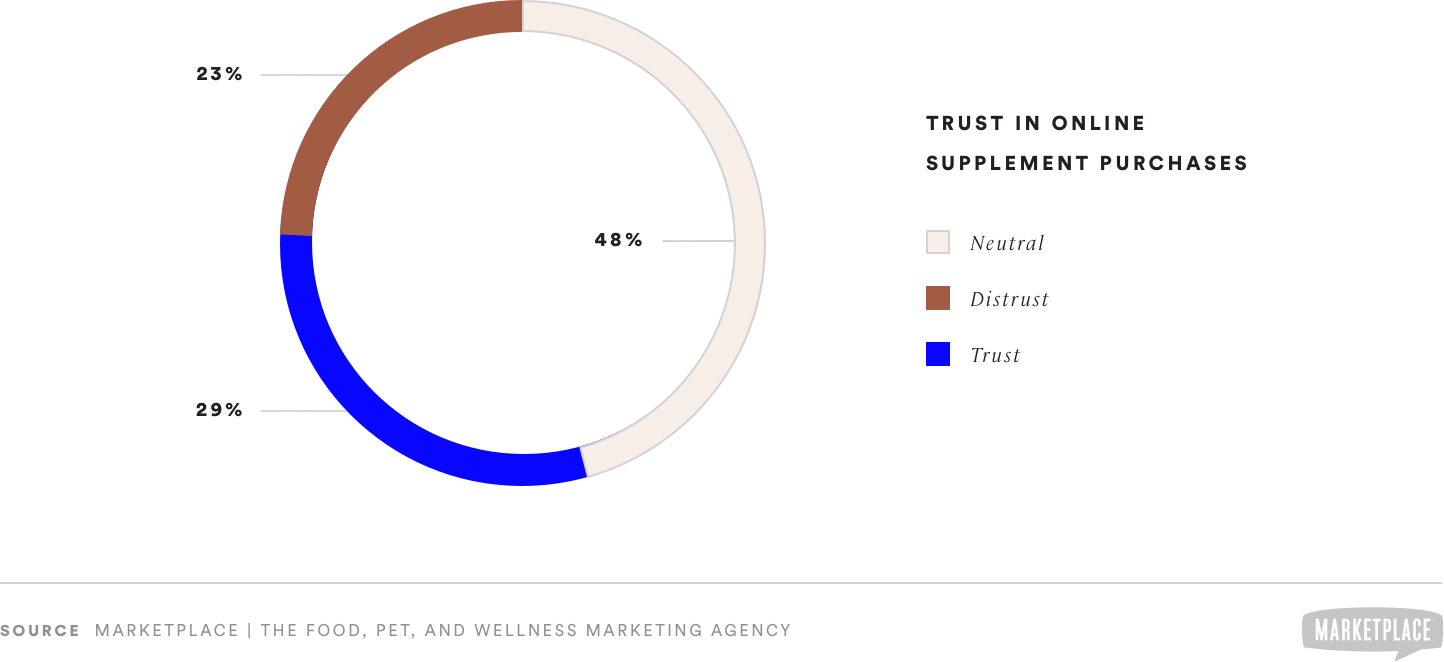

- Nearly half of consumers are comfortable with online shopping for supplements. Being able to read reviews helped these individuals in their decision making. However, there is a significant number (23%) who are skeptical, citing a lack of trust in the quality of supplements purchased online. About 29% of respondents did not have any experience with online shopping for supplements.

Methodology

In September 2019, MarketPlace partnered with Toluna USA, Inc. to conduct a survey of 500 U.S. consumers who currently purchase supplements. Survey respondents were weighted by gender according to demographics from the U.S. Census Bureau. Qualitative responses were collected via open-ended survey questions as well as video capture technology provided by LivingLens. Certain qualitative responses were coded for sentiment and reported by percentage.

Detailed Findings

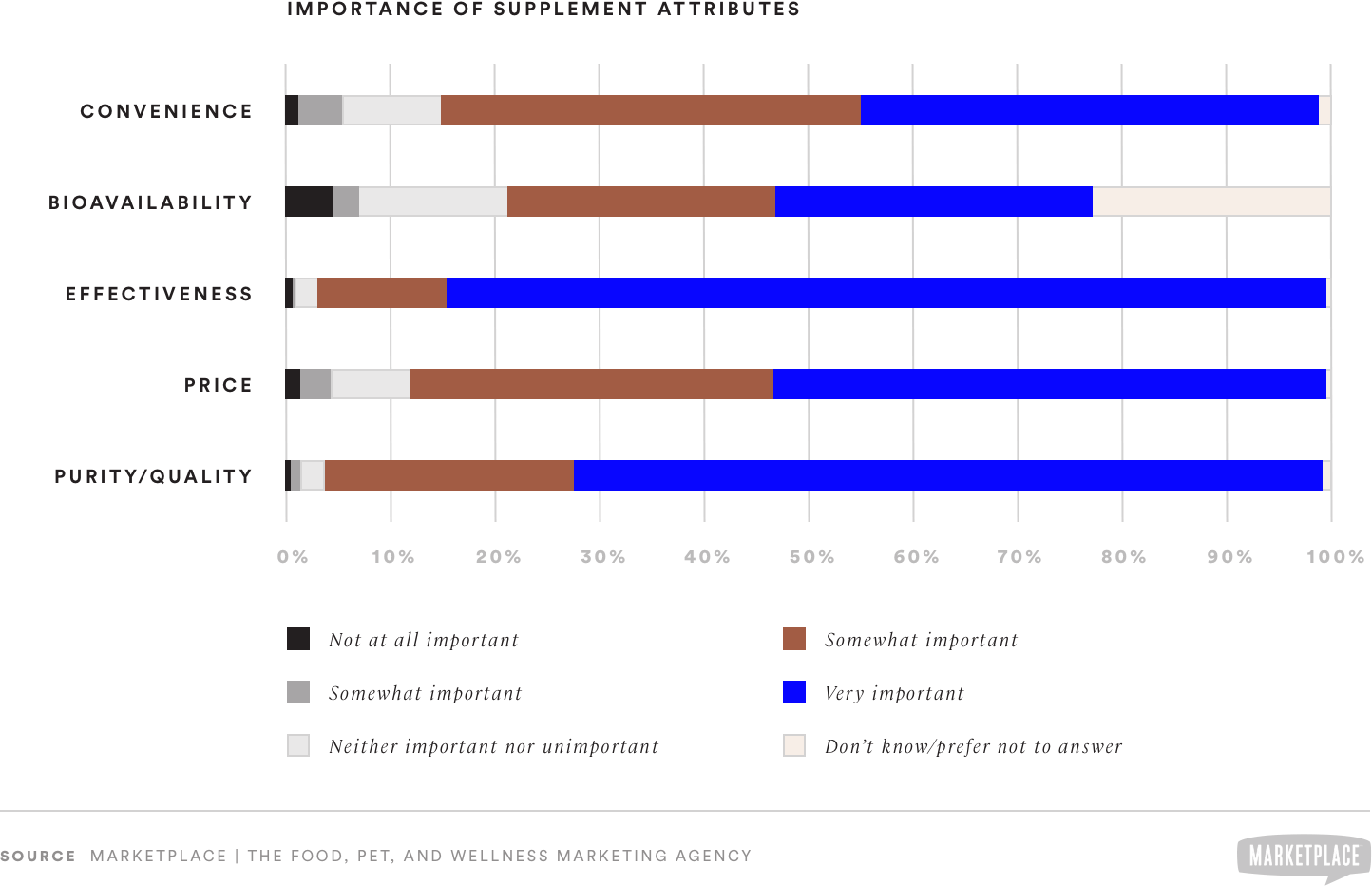

Importance of Supplement Attributes

When it comes to the attributes that matter most to supplement consumers, effectiveness and purity are the top concerns, with 84% rating effectiveness as very important and 72% rating purity as very important. Consumers are slightly less affected by convenience and price. Nonetheless, nearly 9 in 10 consumers rate these as at least somewhat important. There remains less widespread awareness of bioavailability as an attribute of supplements. However, there is a sub-segment for whom this is a key component of their decision-making.

BRAND INSIGHTS

- Clarity about effectiveness and purity of a supplement brand will have a material effect on sales.

- A significant number of consumers are unaware of bioavailability.

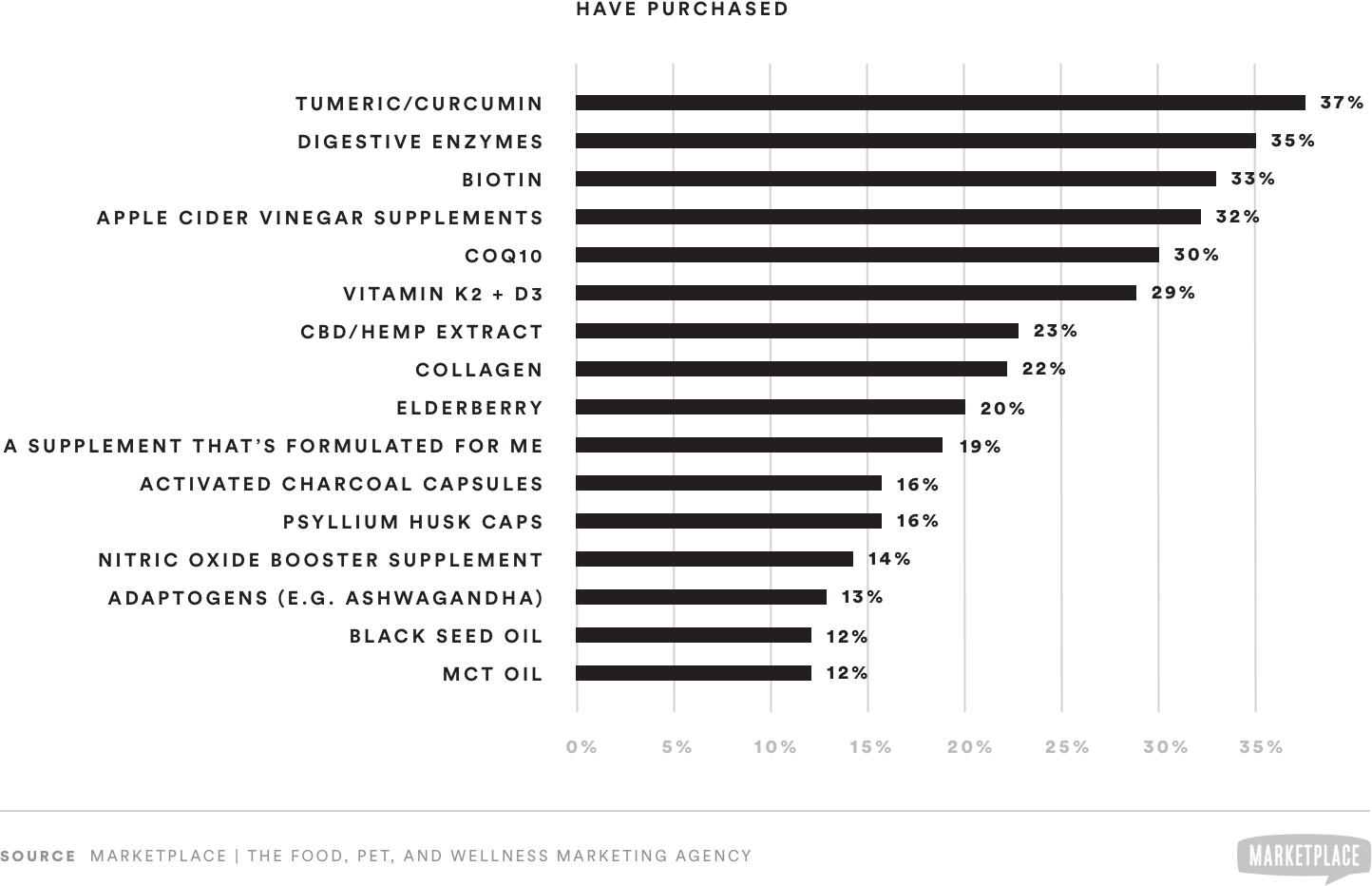

Supplement Market Purchase Behavior

There was no single supplement that had been purchased by a majority of the surveyed supplement consumers. One-third or more of respondents had purchased turmeric/curcumin (37%), digestive enzymes (35%), or biotin (33%). About 30% or more had tried apple cider vinegar supplements and CoQ10. Only 13% had tried adaptogens and 12% black seed oil or MCT oil.

BRAND INSIGHTS

- Even popular supplements like turmeric and biotin have growth opportunities via expanded awareness of their benefits.

- Education will be key to brands seeking to sell less-familiar supplements. Supplements with low levels of purchase behavior require increased awareness of the ingredient itself.

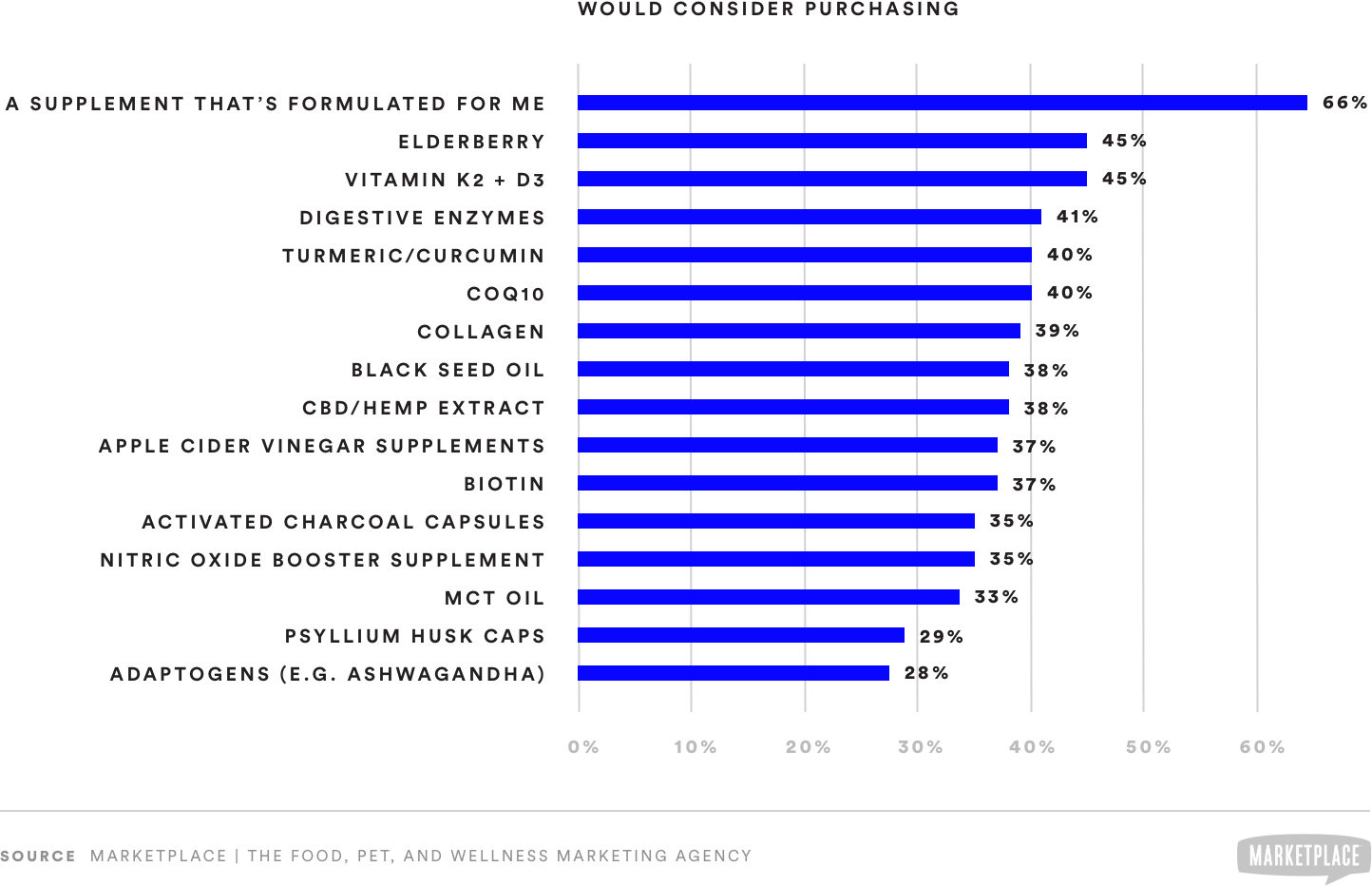

Supplement Market Purchase Consideration

Personalized supplementation is a growth opportunity for supplement brands. Two-thirds of supplement consumers (66%) said they would consider purchasing a supplement formulated specifically for them. Among specific supplements that rose to the top of the consideration set, nearly half (45%) said they would consider elderberry and Vitamin K2 + D3. The next most-considered supplements are the top two most purchased by supplement consumers: turmeric (40%) and digestive enzymes (41%).

BRAND INSIGHTS

- As medicine becomes more personalized, supplementation will follow suit. The data indicates that there is already strong demand for personalized supplement formulations.

- Just over one third of supplement users in the survey (38%) would consider trying CBD, suggesting that there is still hesitancy from consumers to try the cannabis-based ingredient.

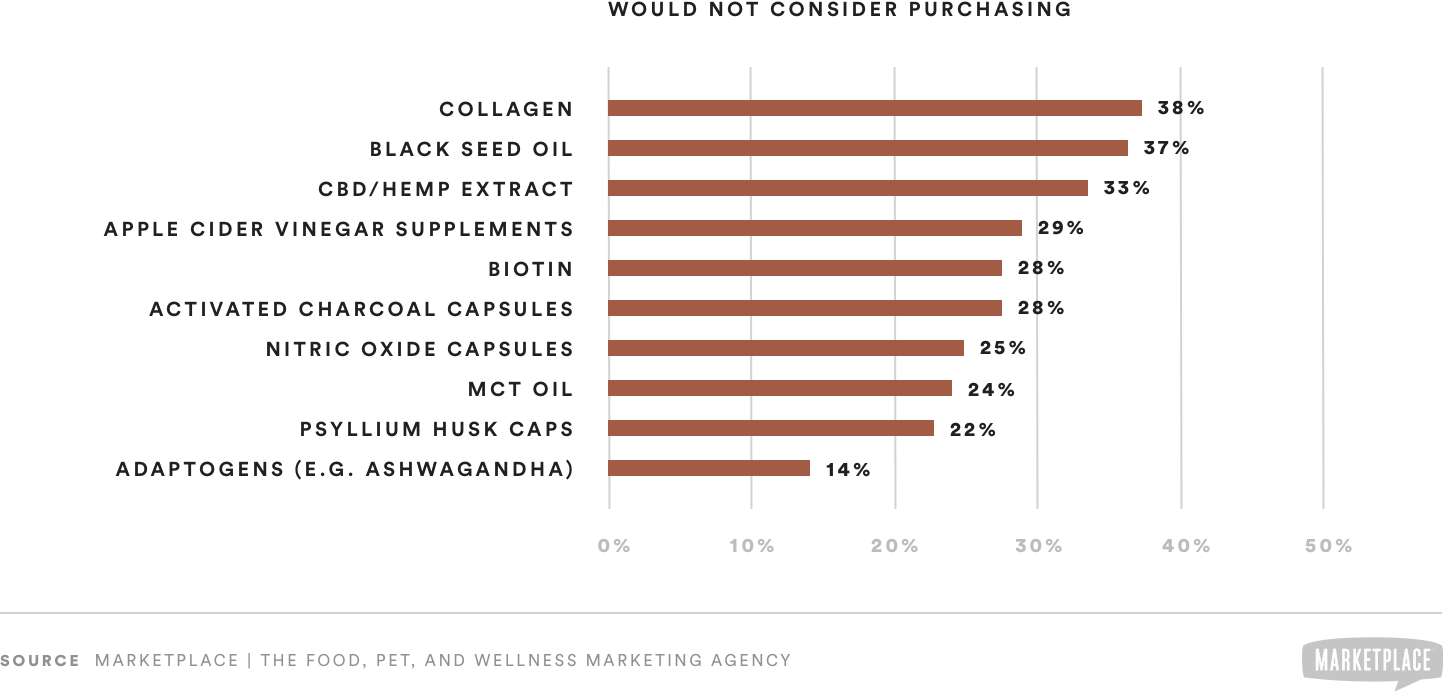

Supplement Market “Would Not Consider”

Among the supplements that respondents said they would not consider purchasing, just over half (53%) said they would not consider adaptogens. Similarly, nearly half said they would not consider purchasing psyllium husk caps (50%), MCT oil (49%), activated charcoal capsules (48%), nitric oxide booster supplements (47%), or black seed oil (46%).

BRAND INSIGHTS

- These ingredients also tended to be the least-purchased among the supplement-taking audience.

- Lack of knowledge and familiarity with these supplements are likely the drivers of lack of purchase intent or consideration.

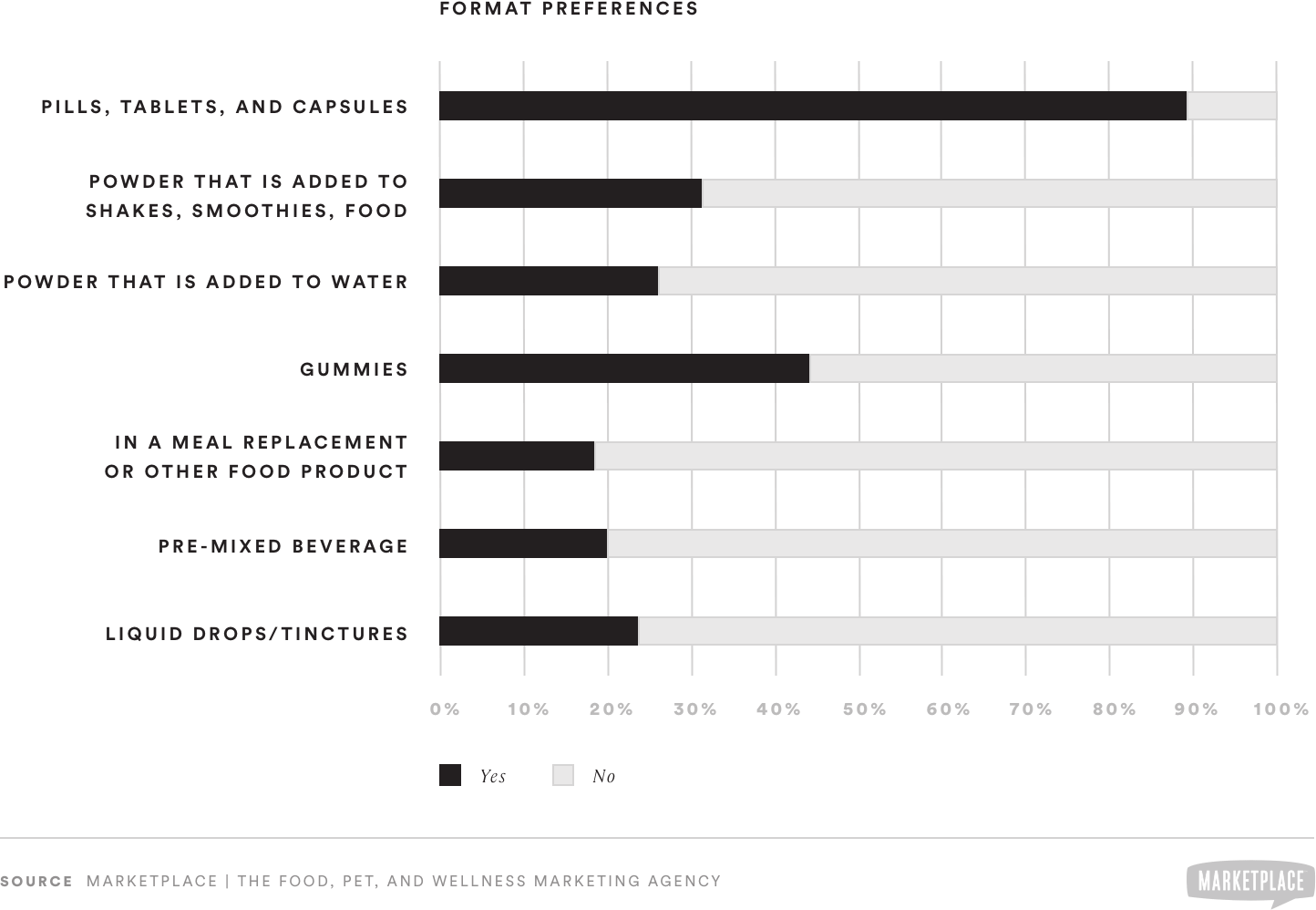

Format Preference

Supplement users were asked: “In what forms do you prefer to ingest supplements?” Nine in 10 supplement users indicated that they prefer pills and capsules. The second most-preferred format is gummies, which nearly half (45%) listed among their preferred formats. Almost one-third of supplement users (31%) said they like powders to add to shakes, smoothies, and food. While meal replacement (82% “no”) and pre-mixed beverage (80% “no”) were the least preferred, about one-in-five did list these formats among their preferences.

BRAND INSIGHTS

- Pill brands should consider a gummy offering.

- While brands can succeed with classic pills and capsules, there is enough demand and interest in other formats to merit diversification.

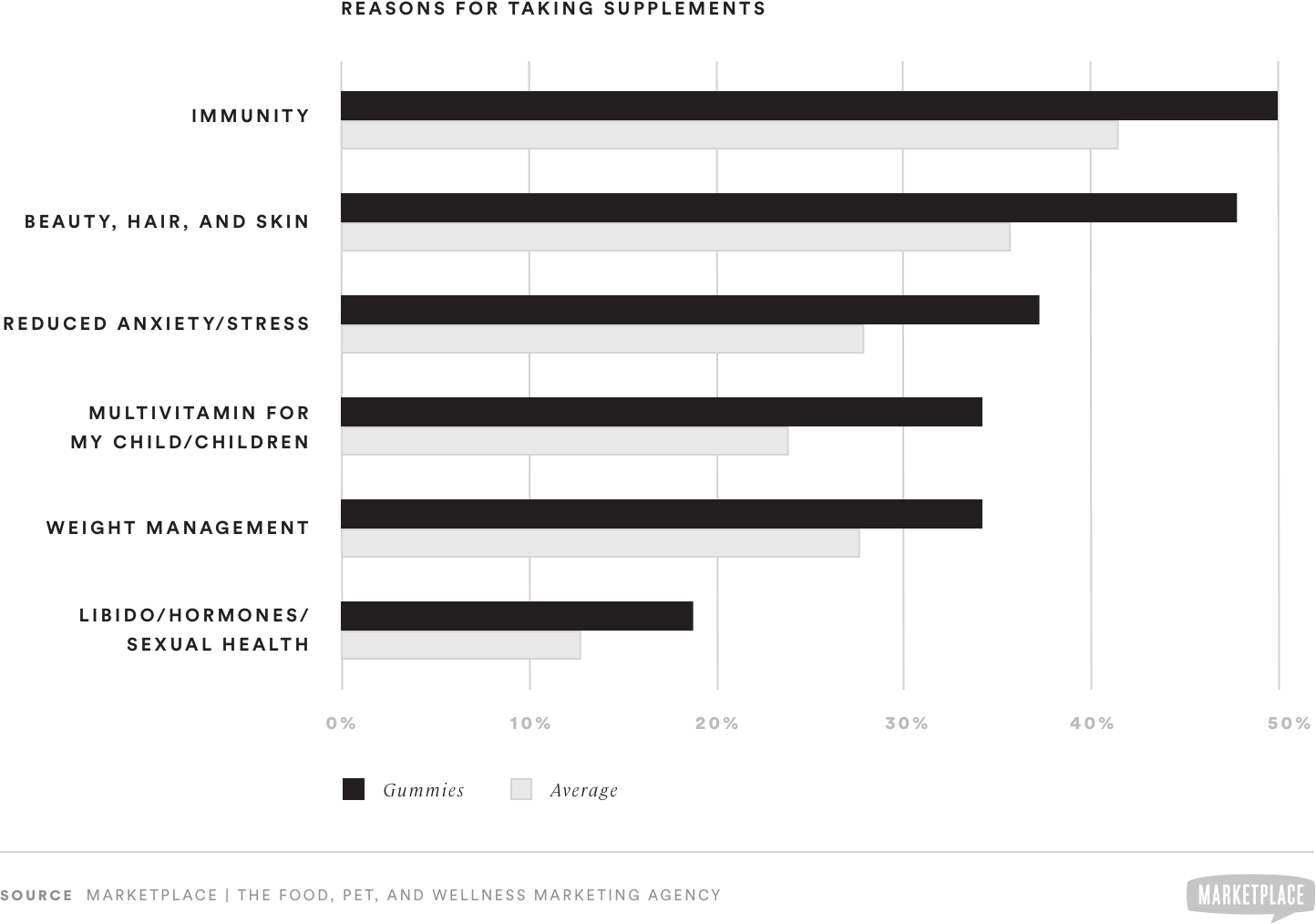

In Focus – Gummy Supplement Consumers

Overall, gummy supplement users are more informed and tend to have stronger opinions about supplements than the average supplement user. The group is, in general, more likely to have purchased or consider purchasing the ingredients asked about in the survey. Conversely, gummy users are much less likely to not consider purchasing these ingredients.

Gummy takers are more likely than the average supplement user to buy supplements for reduced anxiety (+10%), immunity (+9%), beauty (+12%), libido (6%), weight management (6%), and as a multi-vitamin for kids (+10%).

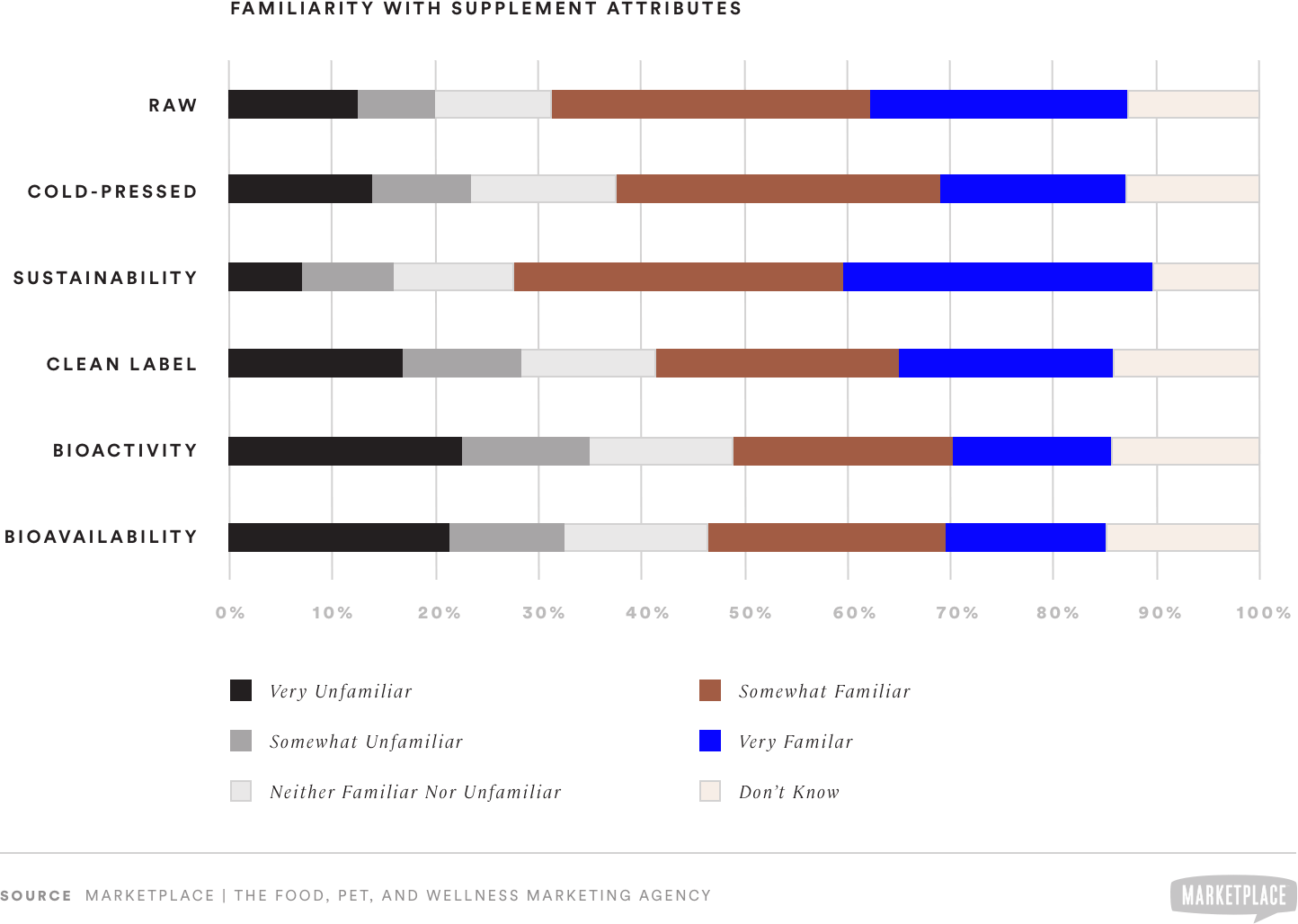

Gummy supplement users are more likely to be “very familiar” with each of the attributes tested in the survey−in particular, bioavailability (+5%), bioactivity (+5%), clean label (+5%, also +4% somewhat familiar), and sustainability (+5%).

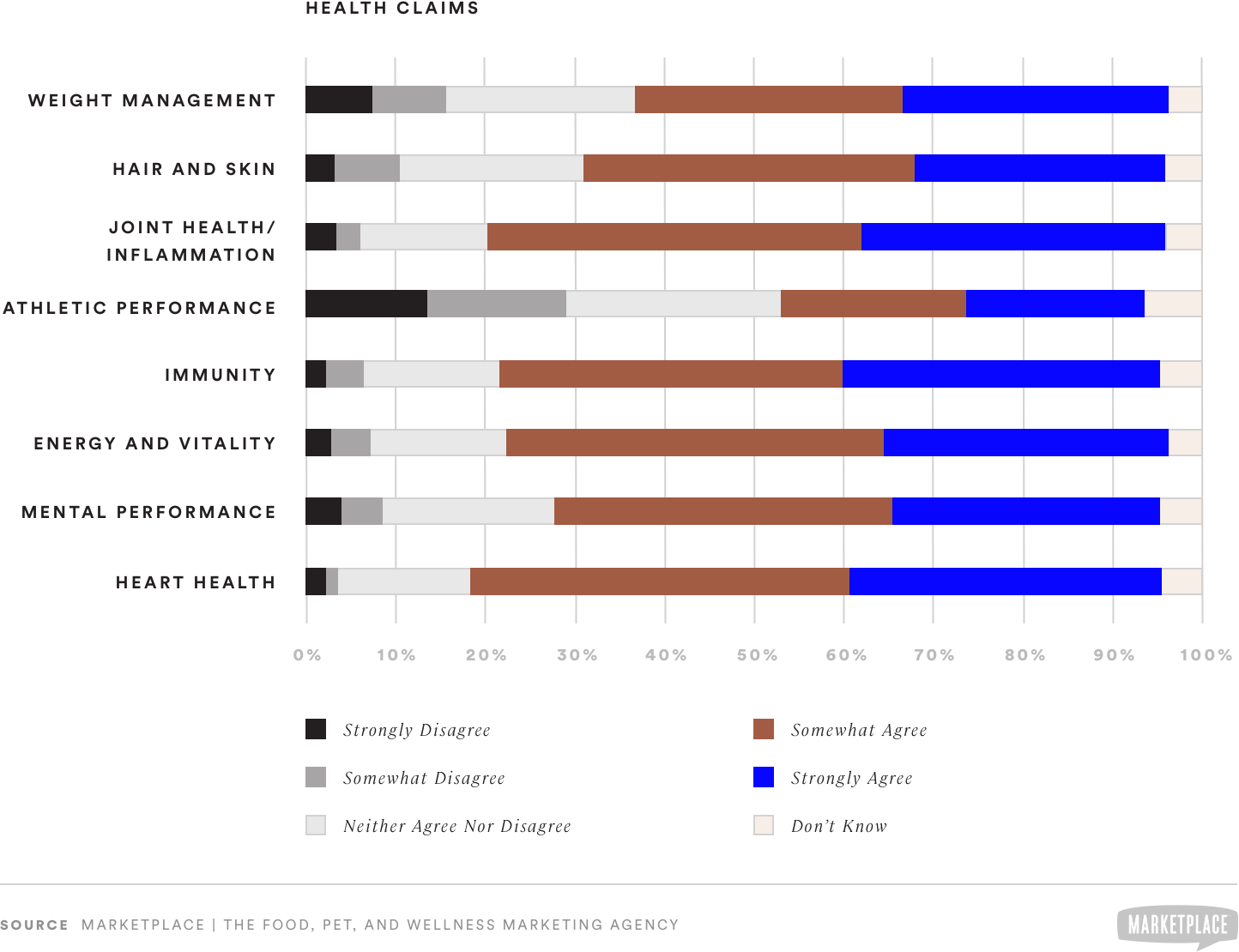

In general, gummy supplement users are more likely to strongly agree they’d consider purchasing a product if they saw package claims for the following attributes:

- Heart Health (+6%)

- Mental Performance (+8%)

- Energy and Vitality (+10%)

- Immunity (+10%)

- Athletic Performance (+9%)

- Joint Health/Inflammation (+7%)

- Hair and Skin (+8%)

- Weight Management (+8%)

- Gummy users are more likely to have purchased elderberry or collagen.

- Gummy users are more likely to consider purchasing black seed oil, vitamin K2, biotin, psyllium husks, and activated charcoal.

- Gummy users are less likely to not consider purchasing elderberry or black seed oil, biotin, nitric oxide booster, or activated charcoal.

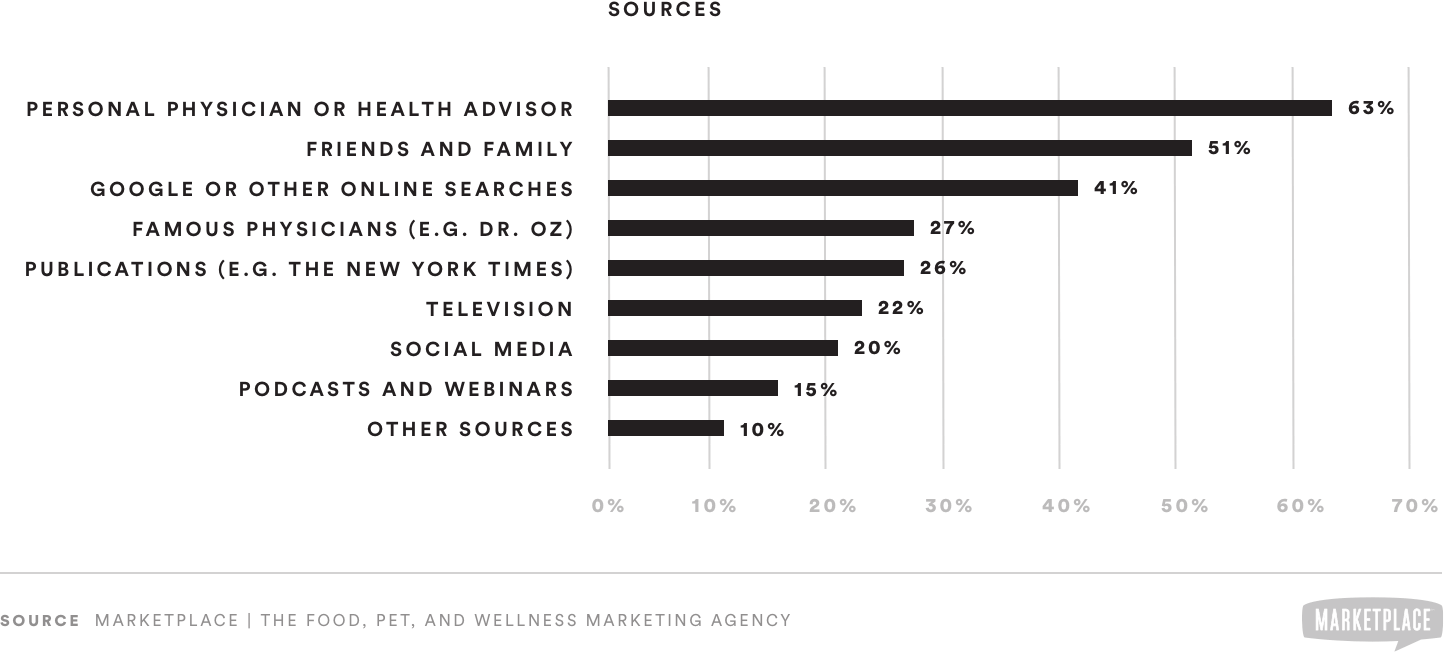

Influential Information Sources

Respondents were asked “Which of the following sources of information significantly influence your attitudes toward supplements?” Nearly two-thirds of those surveyed (63%) indicate that they trust their physician and health professionals as influential information sources. Just over half (51%) trust their family and friends. Four-in-10 (41%) use Google and other online search engines. Only 15% use podcasts and webinars; however, it should be noted that these sources have potential to be very influential for highly engaged information seekers.

BRAND INSIGHTS

- Consumers tend to trust experts the most, followed by people they know who have had personal experience with supplements.

- There is a significant population who rely heavily on online sources for information.

- While podcasts and webinars may be the least popular sources, they offer opportunities for deep engagement and should not be ignored.

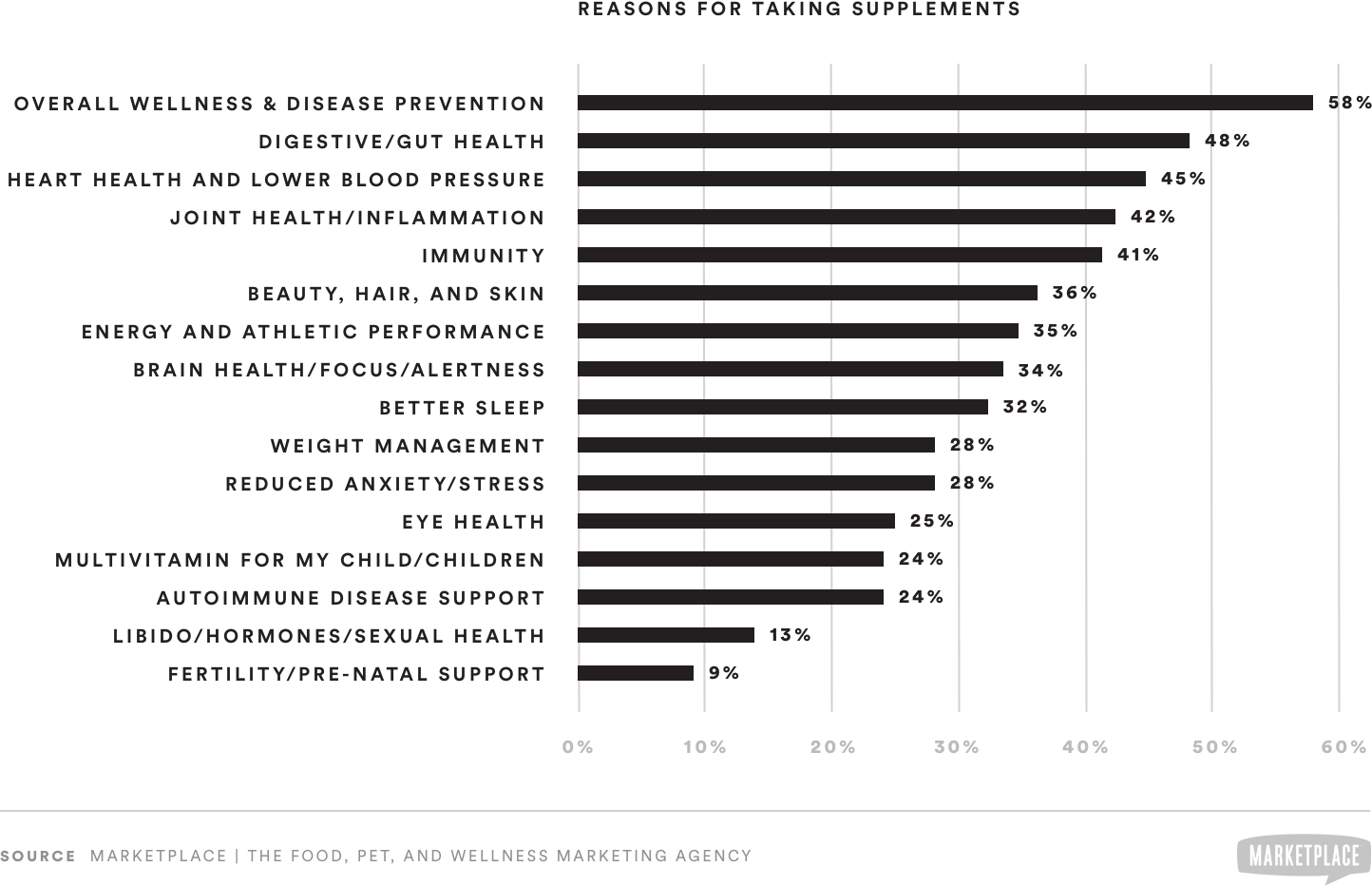

Reasons to Take Supplements

Survey respondents indicated numerous reasons for taking supplements. While there were no “catch-all” reasons for taking supplements, several stood out as the most popular. Over half of supplement users (58%) said that they take supplements to prevent disease. Nearly half (48%) use supplements to aid digestive health. Heart health (45%), joint health (42%), and immunity support (41%) are other popular reasons to take supplements. Fertility/pre-natal (9%) and libido/hormones (13%) were the least popular reasons.

BRAND INSIGHTS

- Specific conditions seem to drive supplement use; however, over half of the respondents cited general disease prevention.

- This contrast indicates that there is a split between those who have general health concerns and those who take supplements to treat specific conditions.

- Brands can take advantage by positioning products toward both general wellness and specific outcomes.

- Certain specific outcomes can be tied to general wellness: e.g., sleep, immunity, weight management.

In Focus – CBD and Supplement Consumers

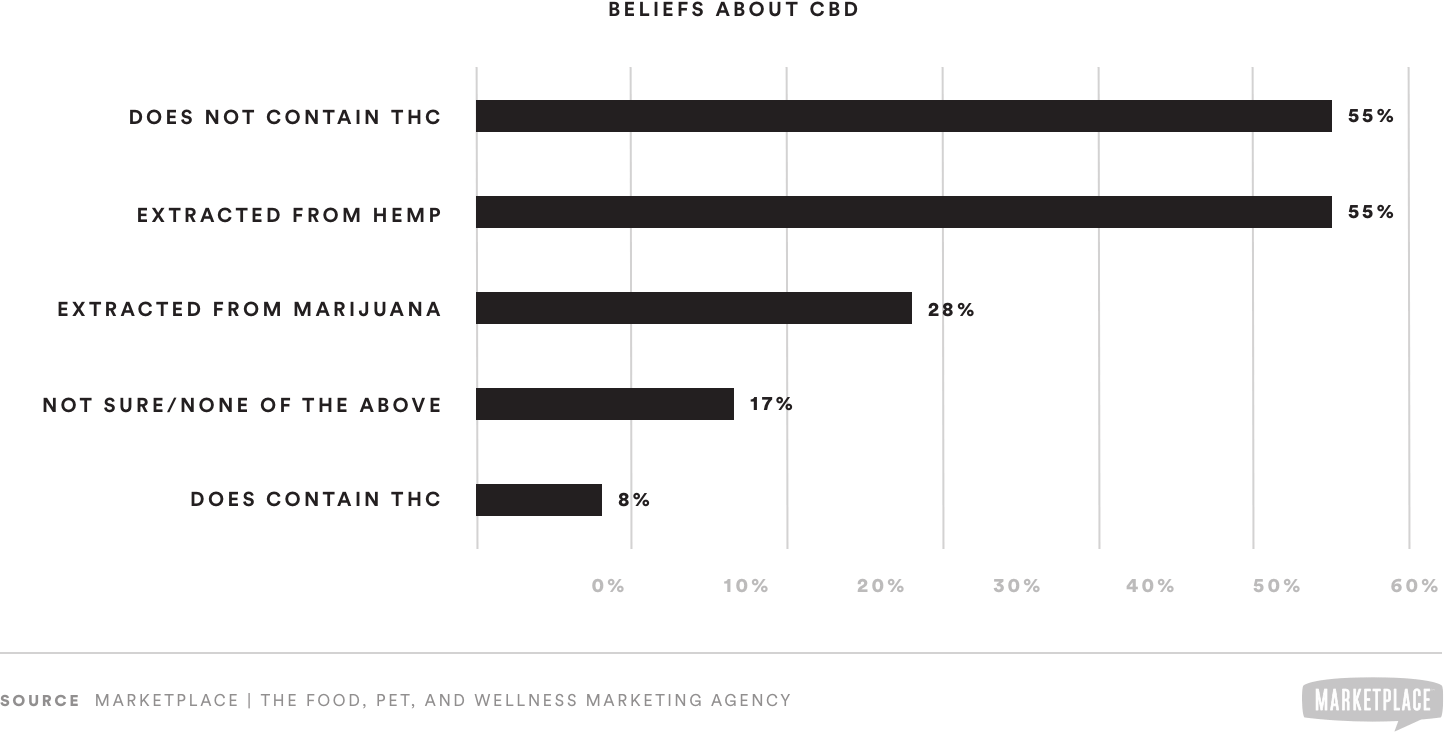

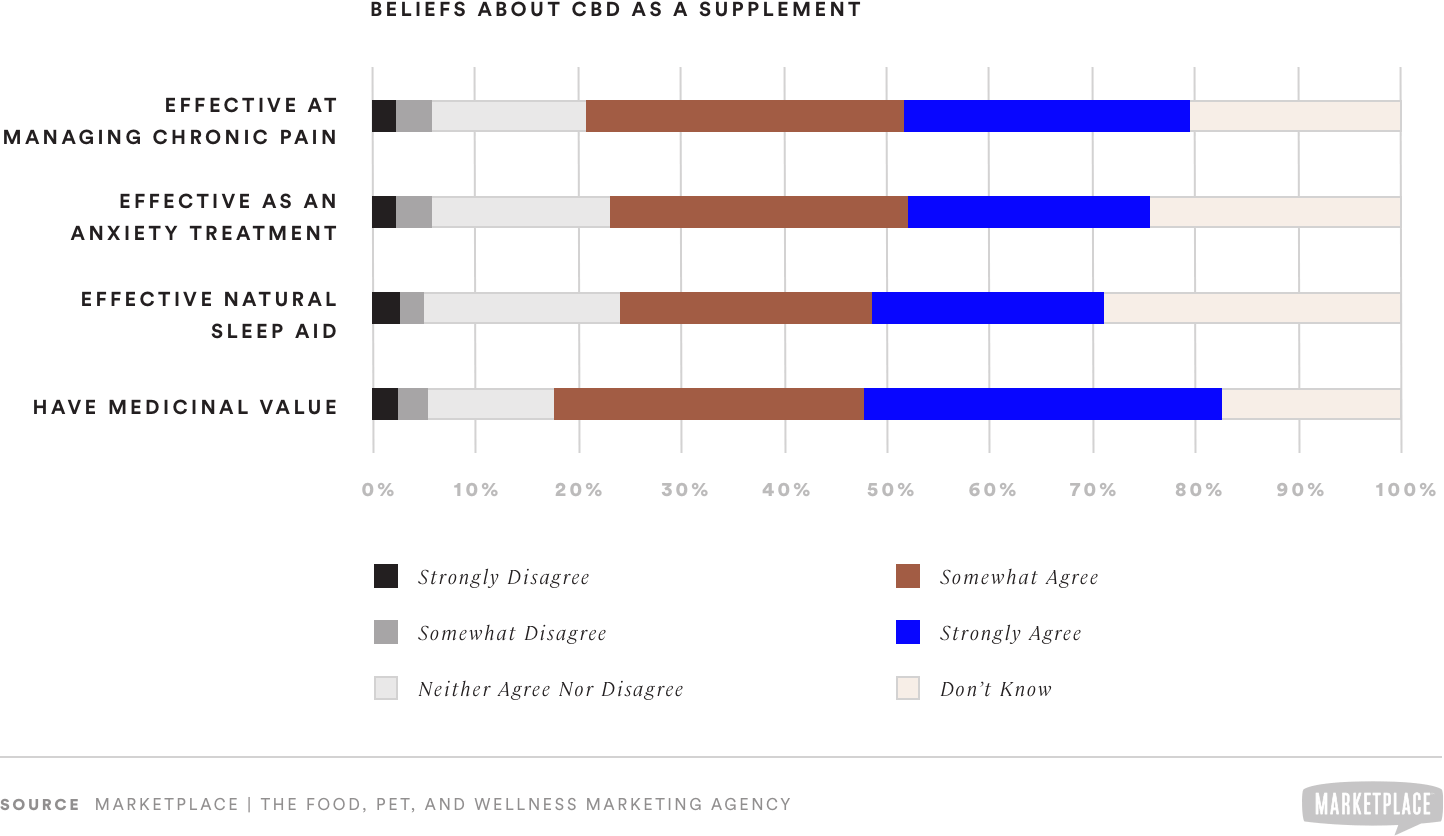

In regard to public understanding of CBD, there remains significant educational work to be done. Overall, about half of supplement users understand the difference between CBD and THC. Only 55% agree that CBD is derived from hemp. Just under half of respondents (45%) were either unsure or incorrect in whether or not CBD contains THC; 8% believe CBD contains THC, the intoxicating chemical in marijuana.

For each question regarding beliefs about CBD as a supplement, between 18% and 29% selected “don’t know.” Although there is uncertainty among many supplement users about CBD, there are broadly positive perceptions of the hemp-derived ingredient. Nearly two-thirds (64%) of supplement users believe CBD has medicinal value. Over half (59%) believe CBD is effective at managing pain, and 52% believe CBD is an effective anxiety treatment.

Survey respondents also provided open-ended comments about their opinions of CBD supplements. The sentiment expressed in these responses was mixed, with 12% expressing a negative tone about CBD, 33% positive, and 55% neutral. Positive responses tend to express a belief that CBD is effective at treating various conditions, namely pain management, sleep disorders, and anxiety. Negative responses tend to express strong skepticism about CBD’s efficacy and wariness toward its legality and its association with cannabis.

We received mixed responses about the effectiveness of the CBD supplement from those who indicated that they have used it. Below is a sample of these open-ended responses.

OPEN-ENDED COMMENTS ABOUT CBD

Supplement brands that produce condition-specific treatments can reliably market CBD to treat pain, anxiety, and sleep. However, there remains a significant number of consumers who are either skeptical or simply uninformed about its benefits. Brands that seek to integrate CBD into formulations must be careful to address misperceptions about the cannabinoid. As such, supplement makers should clearly label their products and take extra measures to educate their customers. Brands should be transparent in the claims they make. Lab testing and money-back guarantees can help to assuage the cautious consumer.

Familiarity with Supplement Attributes

Survey respondents were asked about their familiarity with several common supplement attributes. Overall, supplement users are most familiar with the terms “sustainability” (62%) and “raw” (56%). Nearly half were familiar with “cold-pressed” (49%) and “clean label” (45%) as supplement attributes. However, supplement users are less familiar with “bioactivity” (36%) and “bioavailability” (38%), indicating that there is a need for education regarding these terms.

BRAND INSIGHTS

- Brands that want to capitalize on interest in bioactivity and bioavailability will want to offer simple, easy-to-understand descriptions of the attributes.

- Sustainability, on the other hand, requires less explanation and can be appealed to directly.

On-package Health Claims

On-package appeals to condition-specific needs appear to be the most effective at encouraging purchase consideration. Most supplement users (77%) agree that they’d consider purchasing a product with heart health claims. Other highly rated on-package claims include: energy and vitality (74%), joint health/inflammation (76%), immunity (74%), mental performance (68%) and hair/skin (65%). Slightly fewer than one-third of respondents (30%) said they would not consider products with claims to athletic performance; only 42% said they would consider it.

BRAND INSIGHTS

- While athletic performance is the least popular among these attributes, 60% said they would consider products for weight management.

- Brands seeking to attract supplement users with on-package claims should make compelling, fact-based appeals to the specific conditions needing treatment.

Supplement Brand Characteristics

Purity in supplements is a high priority. Top-rated characteristics among those surveyed include non-GMO, no additives, clean label, allergen free. A majority of supplement users said they purchase supplements based on these characteristics:

- Non-GMO – 50%

- Additive free – 56%

- Nearly four-in-10 purchase for clean label (40%) or allergen-free (43%)

About one-third purchase supplements with characteristics of third-party lab testing (38%), raw (34%), bioavailability (33%), bioactivity (32%), and cold-pressed (31%).

BRAND INSIGHTS

- With only about one-third of supplement users currently purchasing for bioavailability or bioactivity, there remains a need for consumer education, since consumers also indicated elsewhere in the survey that efficacy is important to them.

Favored Brands

Respondents received a list of best-selling supplement brands. Over half of supplement users selected Nature Made (55%) as the brand about which they feel most positively. Nearly one-fourth of supplement users (23%) felt most positively about One-A-Day. Thorne (3%) and NOW (9%) received the fewest selections as most positive.

BRAND INSIGHTS

- Nature Made and One-A-Day dominate shelf space in Food, Drug, and Mass retail.

- The high visibility of these brands is a likely driver of brand preference.

- In a crowded marketplace, established brands need a multi-channel strategy to maintain share-of-mind among supplement users.

Preferred Attributes of Favored Brands

When it comes to the preferred brand selected from the list provided, supplement users said purity/quality (82%) and effectiveness (87%) were attributes they associated with those brands. Also, 60% associated taste and 80% associated potency with their preferred brands. Bioavailability was the least-associated attribute (46%).

In open-ended responses, consumers elaborated on their reasons for purchasing the brands they favor. The comments were consistent with the quantitative findings that show that quality, efficacy, and potency are key attributes that affect purchase decisions. Many respondents also brought up value as a reason for favoring a brand.

BRAND INSIGHTS

- Supplement users trust their favorite brands to deliver high quality, effective products.

- For brands to build equity with supplement users, these attributes should be in focus for communications and brand strategy.

- Bioavailability is not seen widely as a foundational brand attribute. Nonetheless, it is an attribute that matters to a significant minority of supplement users.

Online Shopping for Supplements

Regarding online shopping for supplements, consumers have mixed opinions. A sentiment analysis of open-ended responses revealed that nearly half (48%) of supplement consumers felt positively about buying supplements online. These respondents cited better prices and the presence of customer reviews as key factors. However, there is a strong preference for established and familiar brands for those who purchase online. Others are skeptical, citing a lack of trust in the quality of supplements purchased online. About 29% of respondents did not have any experience with online shopping for supplements and were neutral in tone in their comments.

BRAND INSIGHTS

- Consumers who use online channels to buy supplements are value-driven and use reviews to confirm that others have had positive experiences with the brands that they are considering.

- To overcome trust issues with online shopping, brands should ensure that labels are clearly visible, legible, and communicate product ingredients, quality, and potency.

Thank You For Reading

If you have any questions or would like to request more information about our study, please contact us at hello@marketplacebranding.com.

A VMS Industry Expert

Founded in 2002, MarketPlace is a strategic partner to health and wellness, pet and animal, and food and beverage brands. Through business strategy, industry focus, and marketing expertise, we help our partners grow

If you’re a doctor, scientist, nutritionist, entrepreneur, or work at a nutraceutical ingredient or consumer goods company and you want to launch your own supplement brand, we do that, too—let’s talk!