Pet Category Trends 2022: Supplements, Ingredients, Behaviors, & Lifestyles

Executive Summary

As part of our annual report on U.S. pet supplement trends and consumer insights, MarketPlace surveyed pet parents, including a subset of pet supplement shoppers, regarding their awareness, attitudes, and behaviors related to the category. This report presents several findings from this study, along with implications for pet nutrition ingredient companies, manufacturers, and CPG brands.

Methodology

In June 2022, MarketPlace surveyed an online panel of 737 U.S. adults aged 18 years or older who reported owning at least one dog, cat, or horse (hereafter, referred to as “average” or “general” audience). Panelists were further screened to the 282 respondents (hereafter referred to as “pet supplement shoppers” or “supplement” audience) who reported purchasing pet supplements in the past 12 months, making pet product purchase decisions, having primary or shared responsibility for their pet, and having a positive relationship with their pet.

Certain data are compared to findings from MarketPlace’s 2021 pet category consumer insights study, which applied similar screening criteria to identify pet parents and pet supplement shoppers. Survey samples for both studies were provided by Dynata. Responses were tabulated and are reported here in the aggregate, except where otherwise noted. Due to rounding, tables may display % that vary slightly from the numbers shown.

Findings from this study were presented at the 2022 Annual Conference of the National Animal Supplement Council.

Key Findings

SUPPLEMENTATION AND HUMAN-PET RELATIONSHIPS

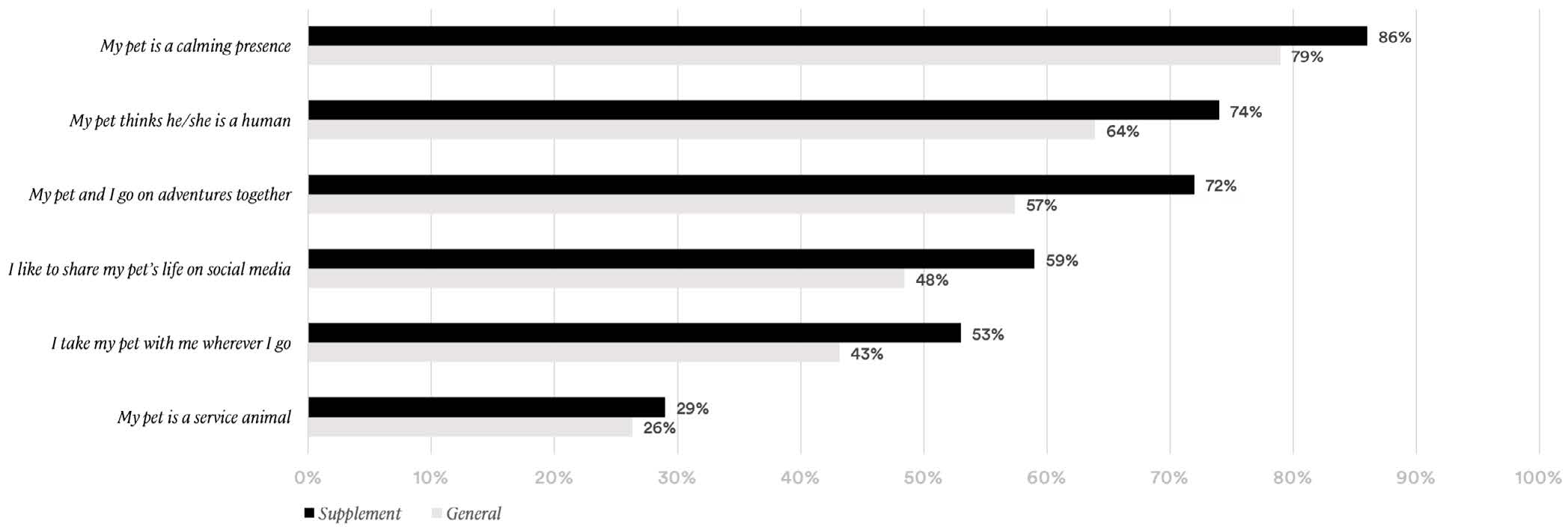

- The pet supplement audience is much more likely to say they go on adventures with their pet or that they share their pet’s life on social media compared to the general pet parent audience

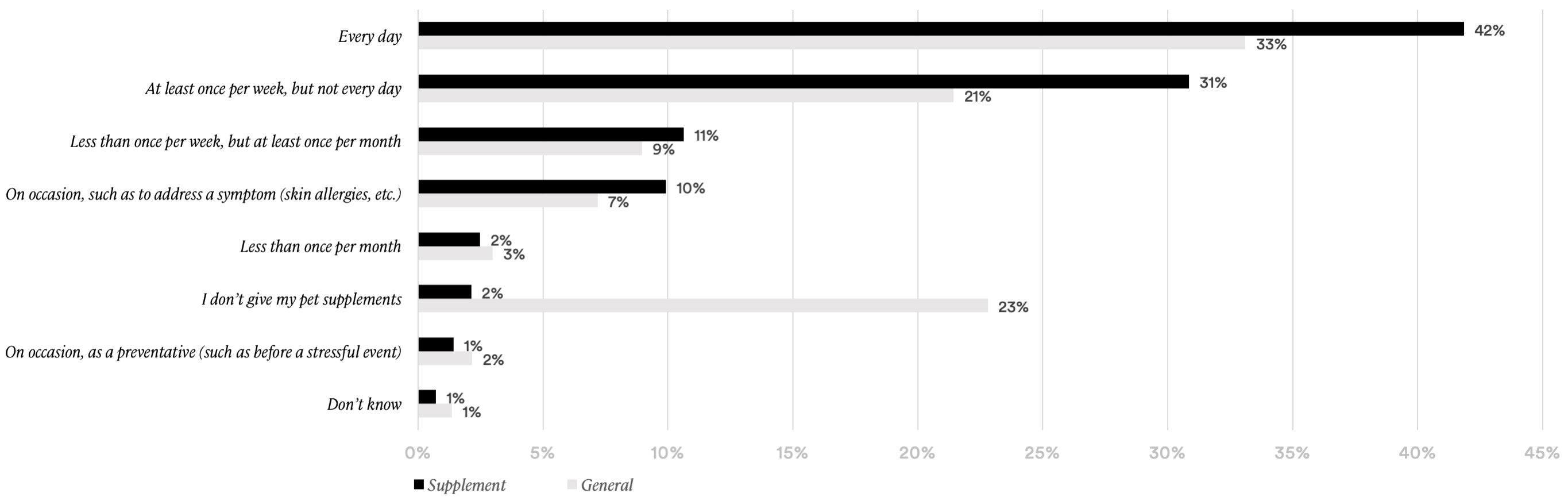

- About three-out-of-five pet supplement consumers give their pet supplements every day

PET SUPPLEMENT CLAIMS AND PURCHASE DRIVERS

- Pet supplement audience is more likely than the general pet parent to say they would seek a specific benefit first when purchasing a pet supplement

- The pet supplement audience is more likely than average to believe organic claims are indicators of high quality food, treats, or supplements for pets

FORMAT AND INGREDIENT PREFERENCES

- Pet supplement audience is more likely than the general pet parent to believe human-grade indicates high quality in pet products

- Nearly half of the pet supplement audience reports having spent more than an hour in the past 12 months researching vitamins and/or minerals

- The pet supplement audience is much more likely than the average pet parent to have spent one hour or more researching “-biotics” (pre-, pro-, or postbiotics) or CBD in the past 12 months

NEED-STATES: BENEFITS, ATTITUDES, AND BEHAVIORS

- The pet supplement audience is somewhat more likely than average to consider purchasing a daily wellness supplement

- One-in-four pet supplement consumers said they would consider purchasing a joint health supplement

- Pet supplement audience is more likely than general pet parents to say they would consider giving their pet a calming or anxiety relief supplement for a vet visit or weather

SUSTAINABILITY, RESPONSIBILITY, AND TRANSPARENCY

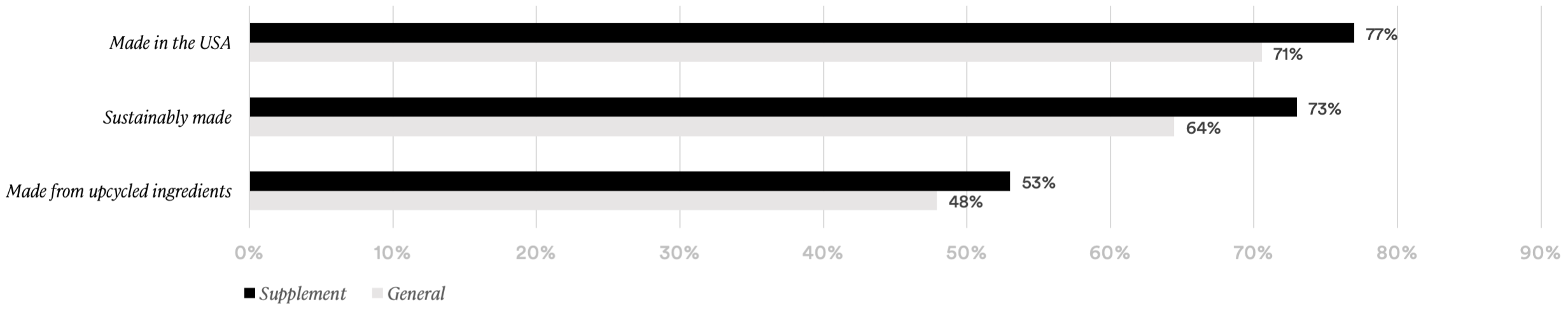

- “Made in the USA” and “sustainably made” are more likely to resonate with the pet supplement audience than the general pet audience

- The pet supplement audience is more likely than average to prefer products in packaging that is: made from only natural materials, sustainable, recyclable, made without plastic, compostable, or reusable

- The pet supplement audience is much more likely than average to perceive human-grade pet supplements as higher quality than those that aren’t human-grade

INFORMATION SOURCES AND MEDIA USAGE

- “Veterinarian” is the top source for information on pet health and wellness reported by both pet parents and the pet supplement audience

- Other popular information sources for pet supplement consumers include online search, friends and family, YouTube, and Facebook

SATISFACTION AND DISSATISFACTION IN PET SUPPLEMENTS

- The pet supplement audience is more likely than average to reject a pet product if they think their pet won’t eat it or might be unpleasant for their pet

- The pet supplement audience is likely to say they are satisfied with pet supplements for daily wellness, skin and coat, immunity, and joint health

SUBSCRIPTIONS AND PERSONALIZED NUTRITION

- About one-third of the pet supplement audience said they have not used a subscription service for pet nutrition (food, treats, supplements, etc.) but would consider it

- The pet supplement audience is likely to consider a subscription service for pet nutrition products if it offers free shipping or a money-back guarantee

SHOPPING BEHAVIORS AND PREFERENCES

- The pet supplement audience is more likely than average to look at reviews before a first-time purchase, regardless of whether the purchase is online or in-store

- The pet supplement audience uses a variety of shopping channels and is much more likely than the average pet parent to report shopping on Amazon.com and Chewy.com

PSYCHOGRAPHICS AND HEALTH-ORIENTED LIFESTYLES

- The pet supplement audience is more likely than the average pet parent to dedicate time to their own physical health, mental health, and spiritual health

- The pet supplement audience is more likely than the average pet parent to have heard of the microbiome and to have looked up information about the microbiome

Detailed Findings

Supplementation & Human-Pet Relationships

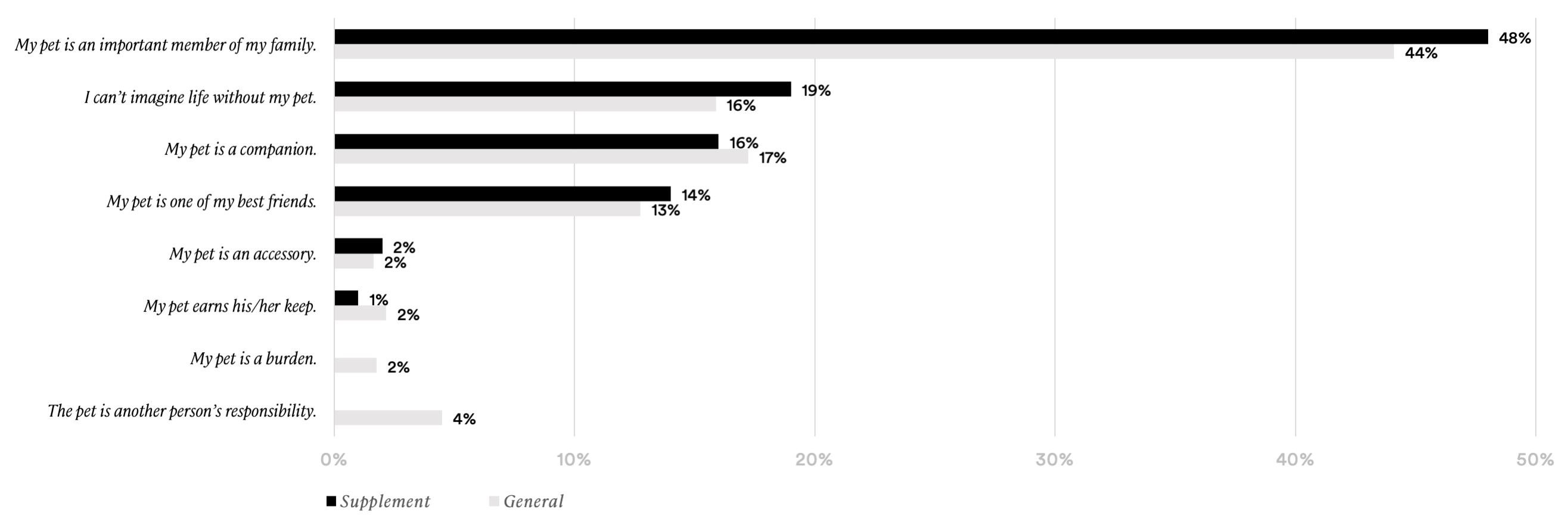

- Both the general and pet supplement audiences were most likely to describe their pet as an “important member of the family” (48%; +4%)

- The pet supplement audience is highly likely to believe their pet is a calming presence (86%; +7%) or that their pet thinks he/she is human (74%; +10%)

- The pet supplement audience is much more likely to say they go on adventures with their pet (72%; +15%) or to share their pet’s life on social media (59%; +11%)

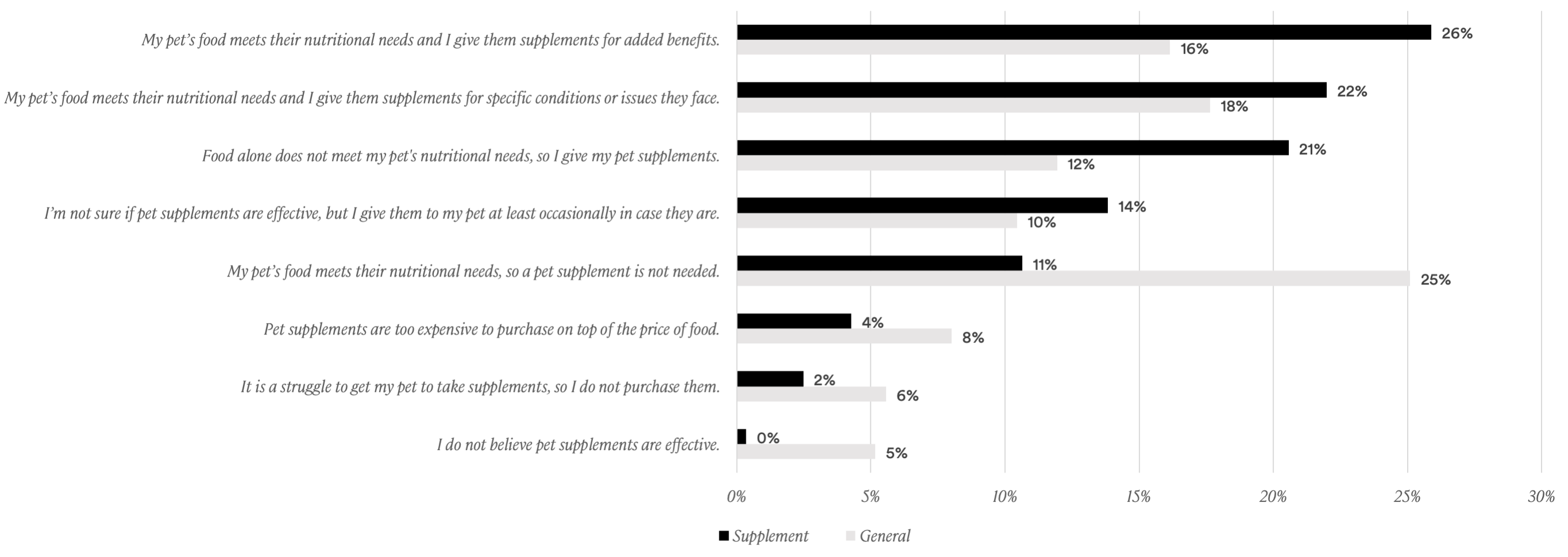

- Pet supplement audience is much more likely to give supplements because food alone does not meet nutritional needs (21%; +9%) or for added benefits (26%; +10%)

- About two-out-of-five pet supplement consumers (42%) give their pet supplements every day

HUMAN-PET RELATIONSHIPS

PET SUPPLEMENT PERCEPTIONS

PET RELATIONSHIP DYNAMICS & BEHAVIORS

PET SUPPLEMENTATION FREQUENCY

Pet Supplement Claims & Purchase Drivers

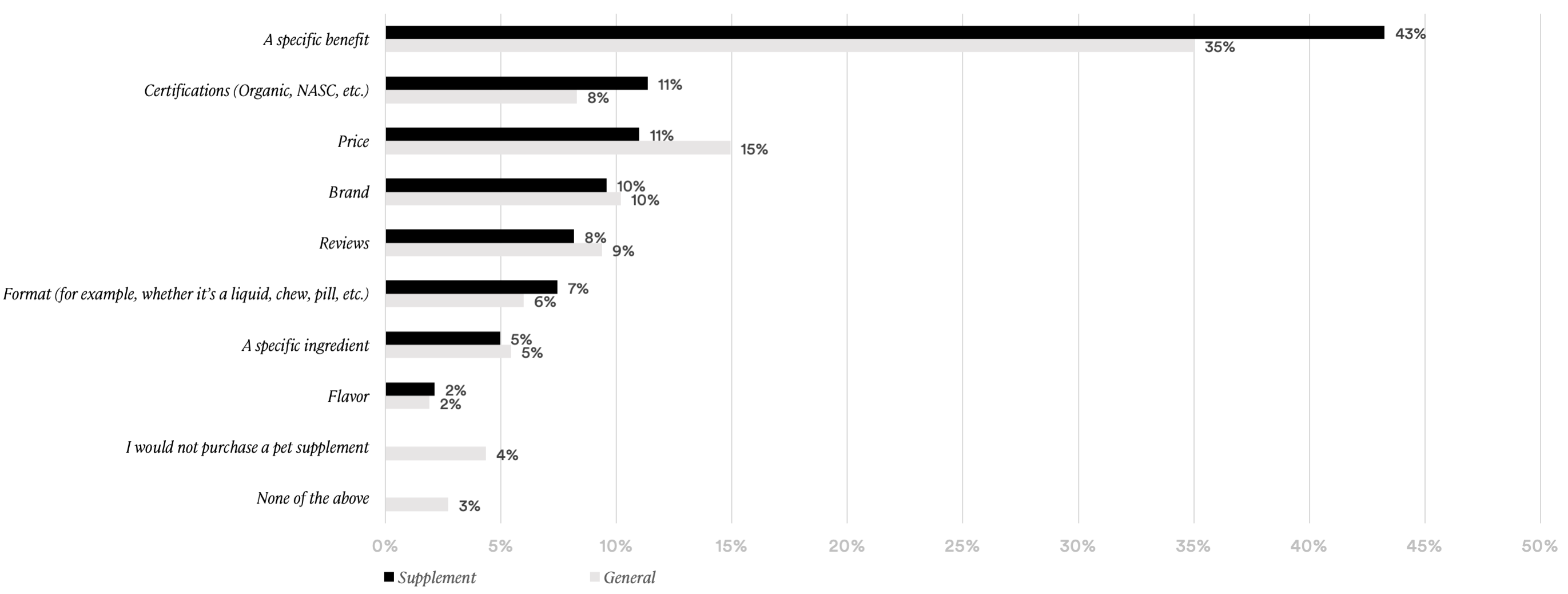

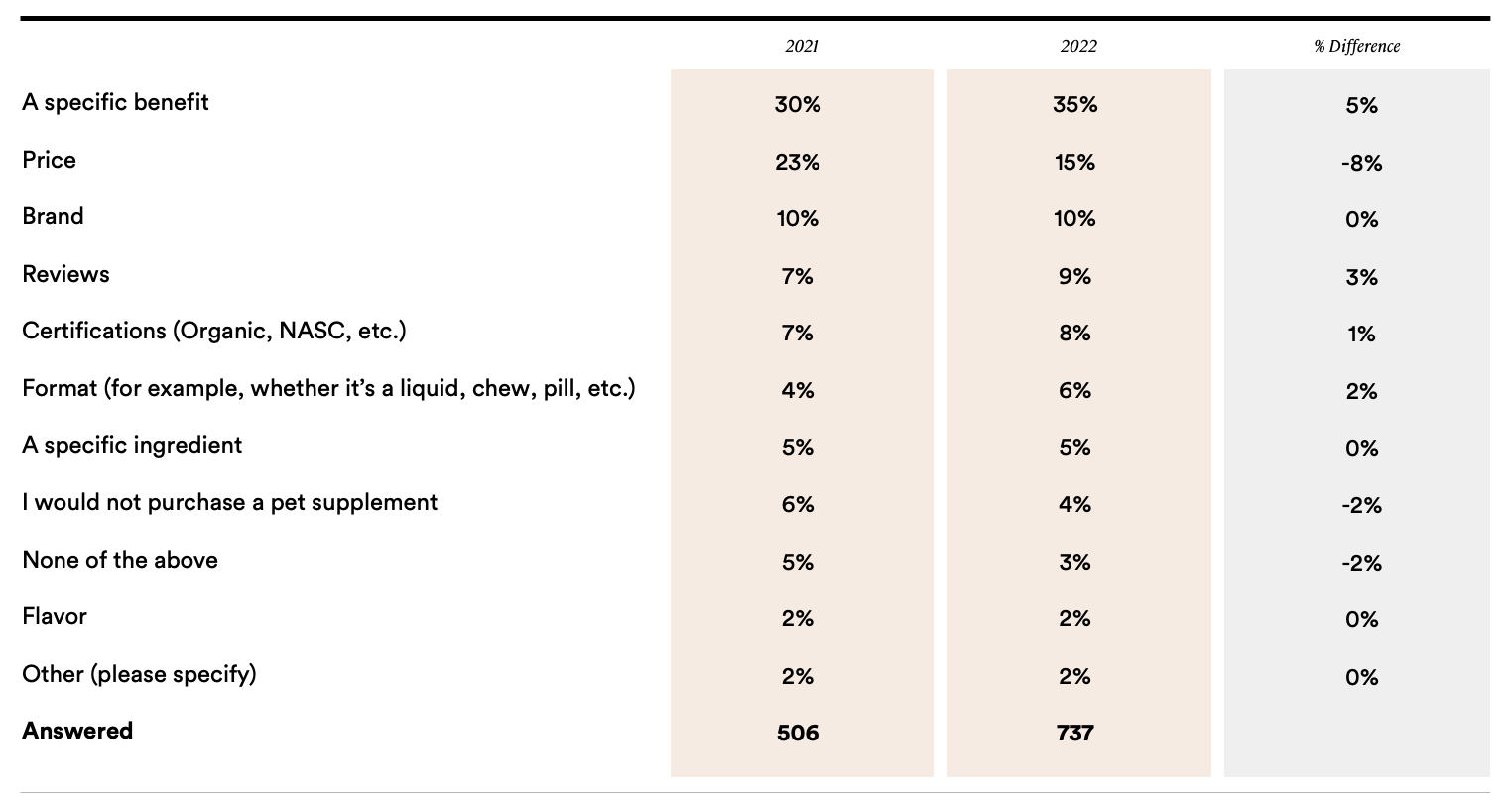

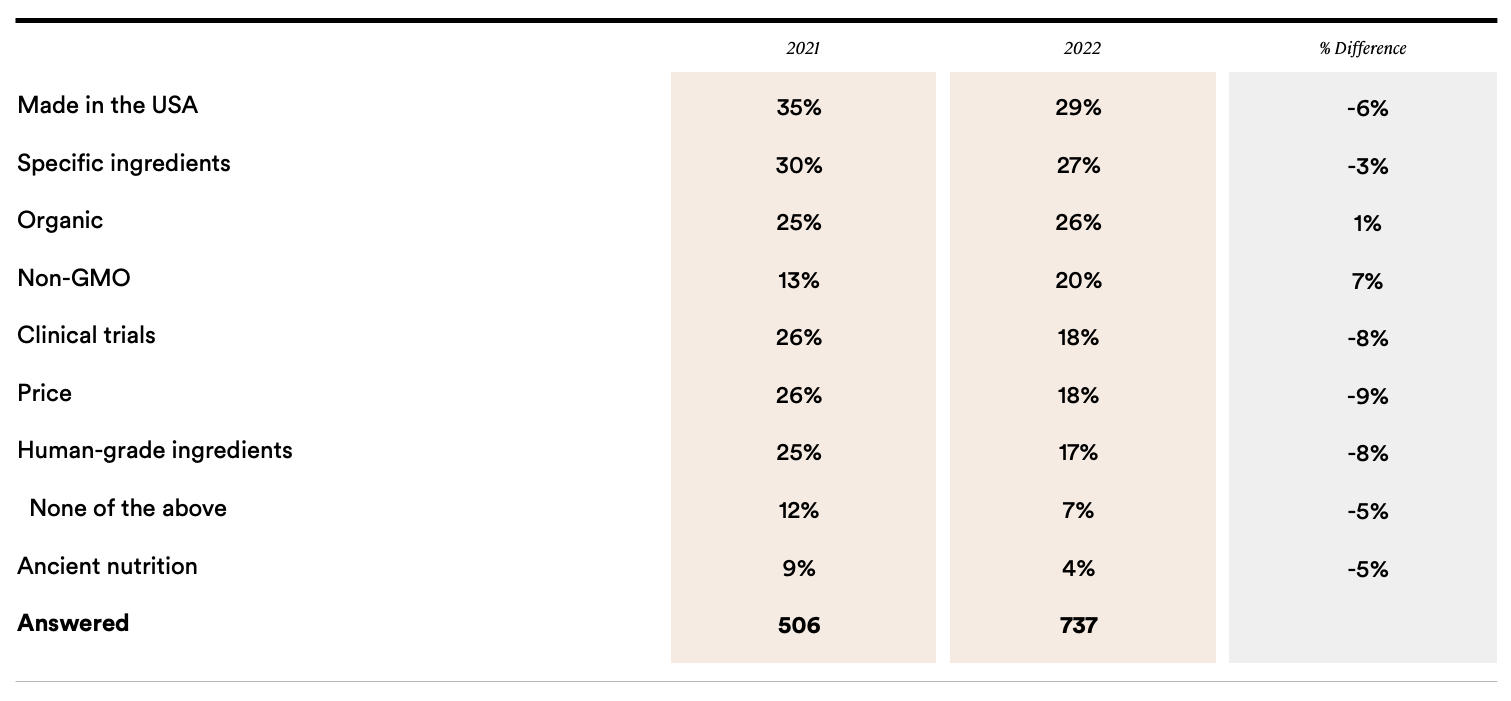

- Between 2021 and 2022, the percentage of general pet parents who said they would seek price first when purchasing a supplement declined from 23% to 15% (-8%)

- Pet supplement audience (43%) is more likely than the general pet parent (35%) to say they would seek a specific benefit first when purchasing a pet supplement

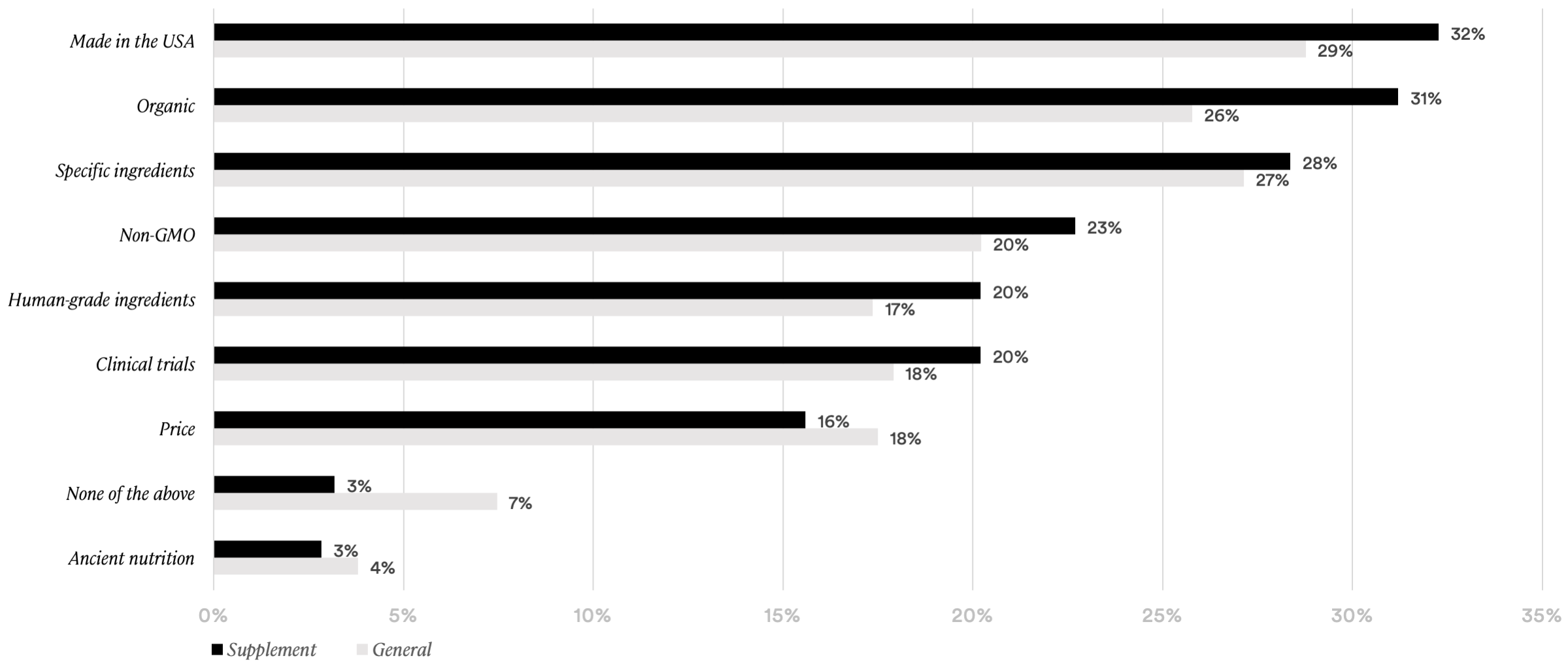

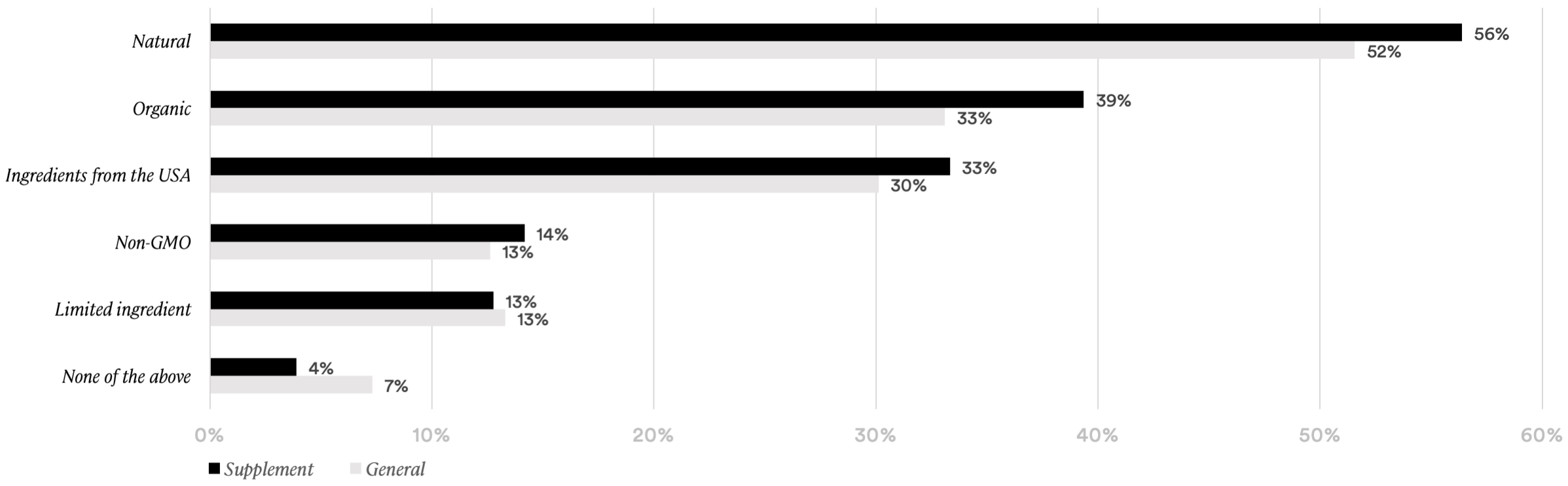

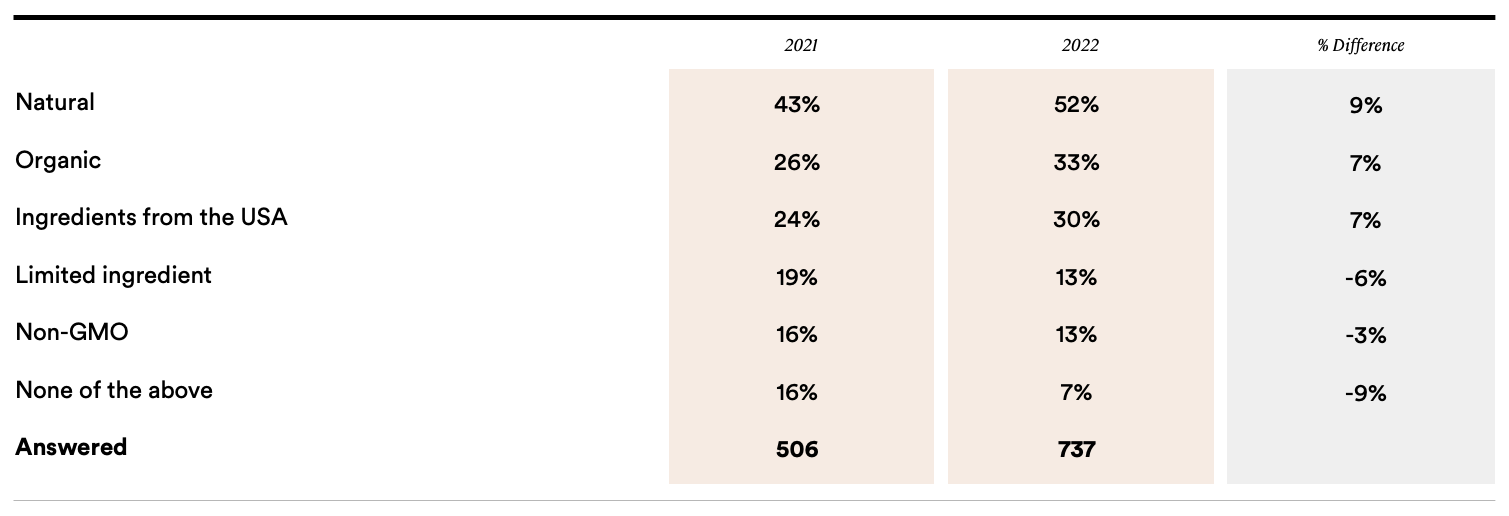

- Compared to 2021, pet parents in 2022 are more likely to seek pet products with health benefits that have claims of “natural” (52%; +9%), “organic” (33%; +7%), or “ingredients from the USA” (30%; +7%)

- The pet supplement audience is more likely than average to believe “organic” claims (31%; +5%) are indicators of high-quality food, treats, or supplements for pets

- The pet supplement audience is slightly more likely than average to believe “made in the USA” (32%; +3%), “non-GMO” (23%; +3%), and “human-grade ingredients” (20%; +3%) are indicators of high-quality food, treats, or supplements for pets

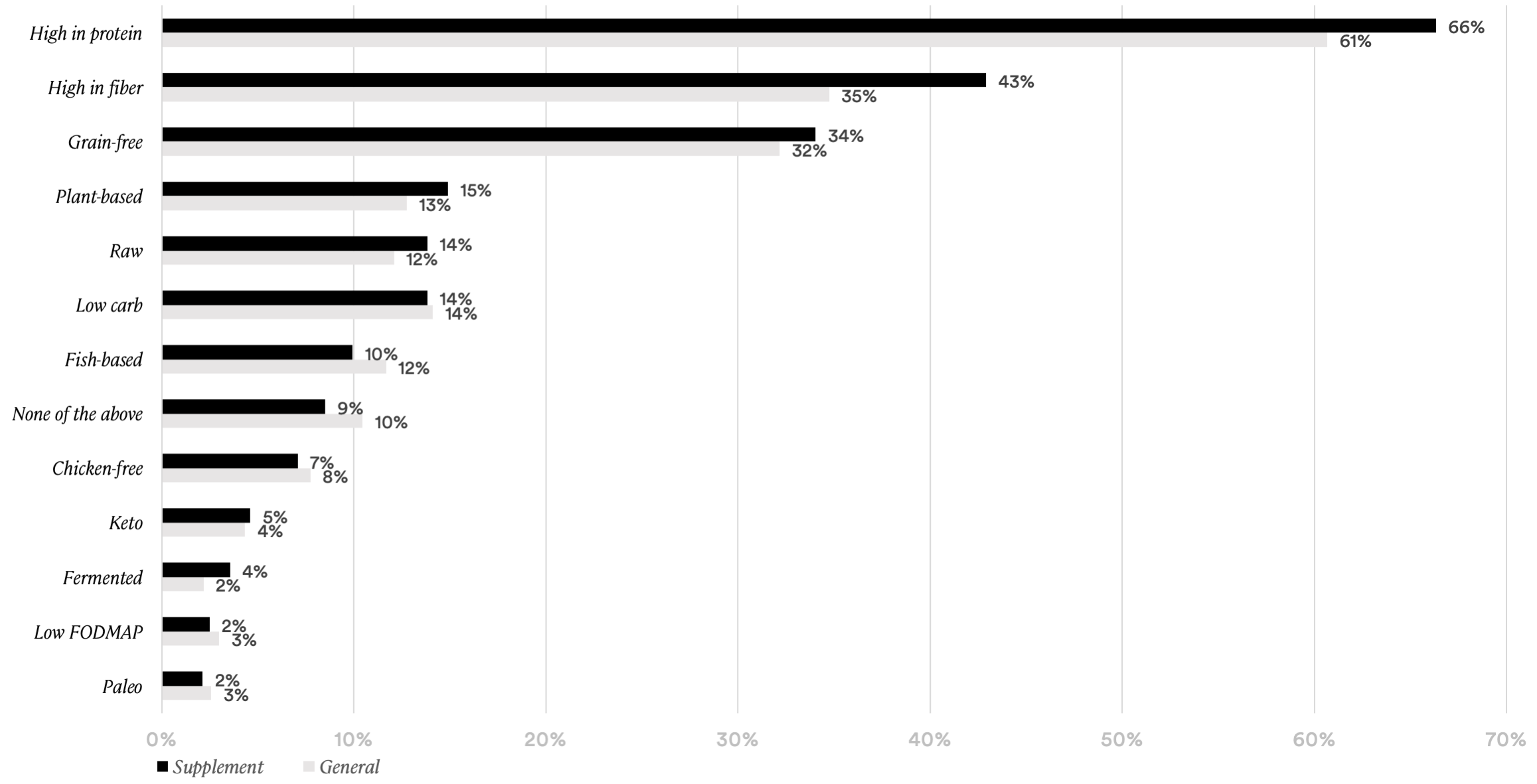

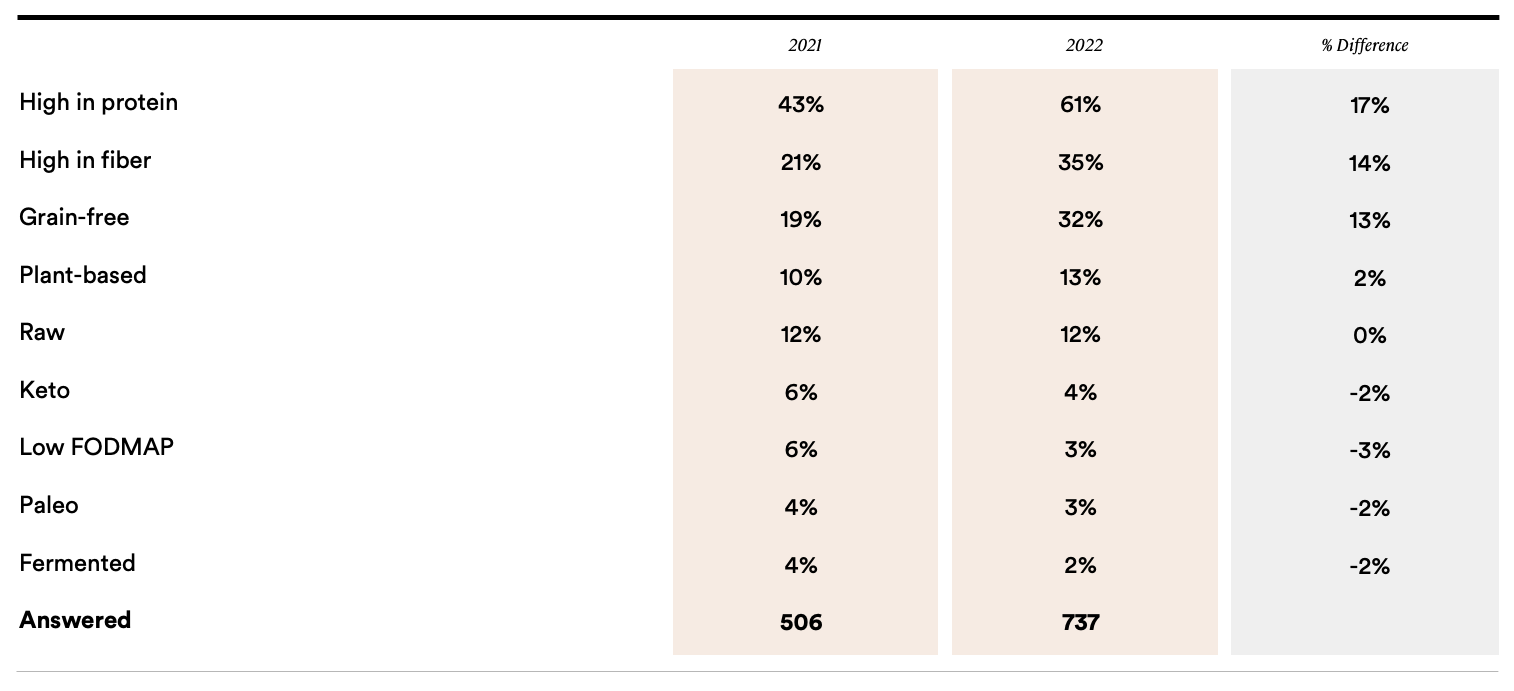

- “High in protein” (66%; +6%) and “high in fiber” (43%; +8%) claims strongly resonate with the pet supplement audience

- Compared to 2021, pet parents in 2022 are more likely to find “high in protein” (61%; +17%), “high in fiber (35%; +14%), and “grain-free” (32%; +13%) to be desirable attributes

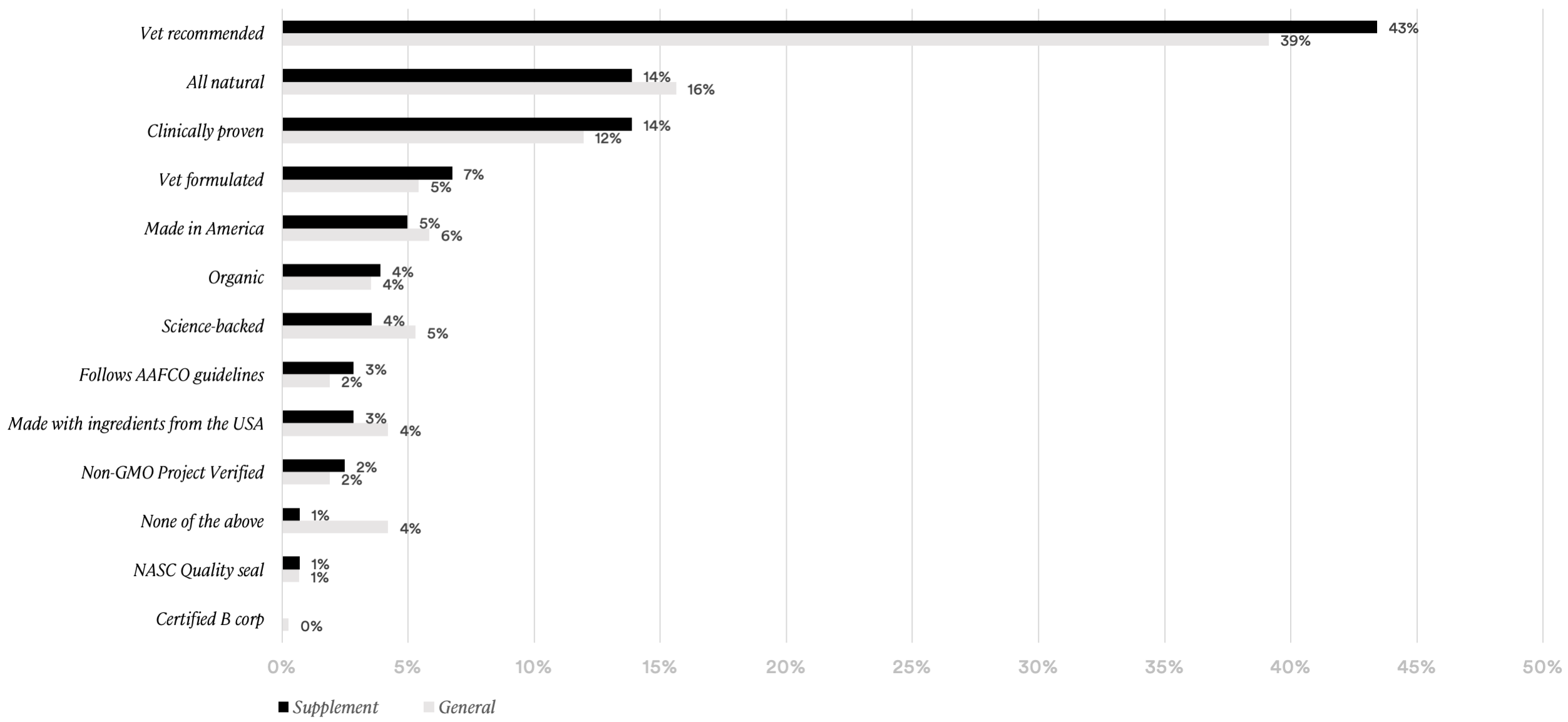

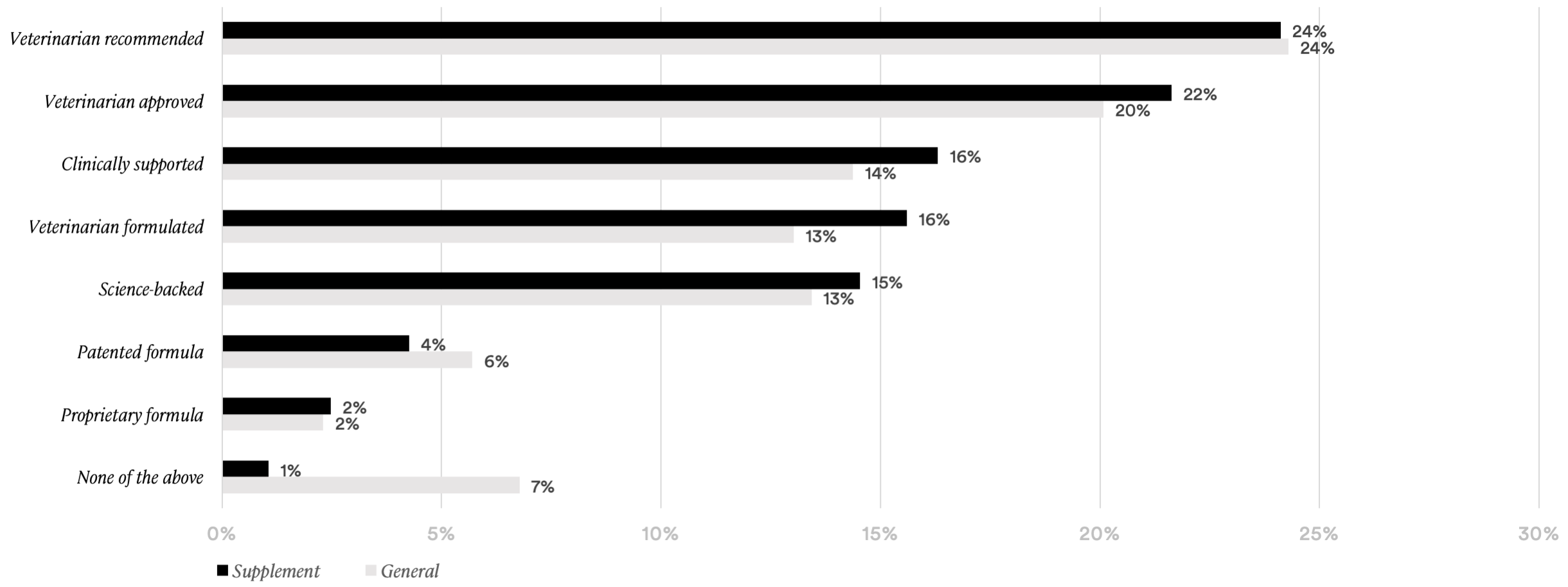

- In general, perceptions among the pet supplement audience of claims related to formulation, or veterinarian recommendation or approval, track with the average pet parent

- “Natural” claims (56%; +4%) strongly resonate with the pet supplement audience

- “Veterinarian recommended” (24%; +0%) and “veterinarian approved” (22%; +2%) claims resonate with the pet supplement audience

- The pet supplement audience is more likely than average to seek “organic” claims (39%; +6%) in a product with health benefits for their pet

PURCHASE DRIVERS

The first thing consumers look for when pet supplement shopping

YEAR-OVER-YEAR COMPARISON: GENERAL PET PARENTS

PET NUTRITION PRODUCT ATTRIBUTES THAT EVOKE CONFIDENCE

Which of the following attributes would give you the most confidence in a pet supplement you were considering for your pet? Select up to two.

PET SUPPLEMENT QUALITY INDICATORS

Which of the following are, in your opinion, the best indicators of high quality in food, treats, or supplements for pets? Select up to two.

YEAR-OVER-YEAR COMPARISON: GENERAL PET PARENTS

PERCEPTION OF EFFICACY IN PET NUTRITION

Which of the following claims would you most associate with a highly effective pet nutrition product, like a supplement food? Select only one.

PURCHASE CONSIDERATIONS FOR FUNCTIONAL PET NUTRITION

Which of the following would you be most likely to seek in a product with health benefits for your pet to consume? Select up to two.

YEAR-OVER-YEAR COMPARISON: GENERAL PET PARENTS

DIETARY DESIRES IN PET NUTRITION

Which of the following qualities do you find most desirable in nutrition-focused products such as food or supplements for your pet to consume? Select up to three.

YEAR-OVER-YEAR COMPARISON: GENERAL PET PARENTS

Format & Ingredient Preferences

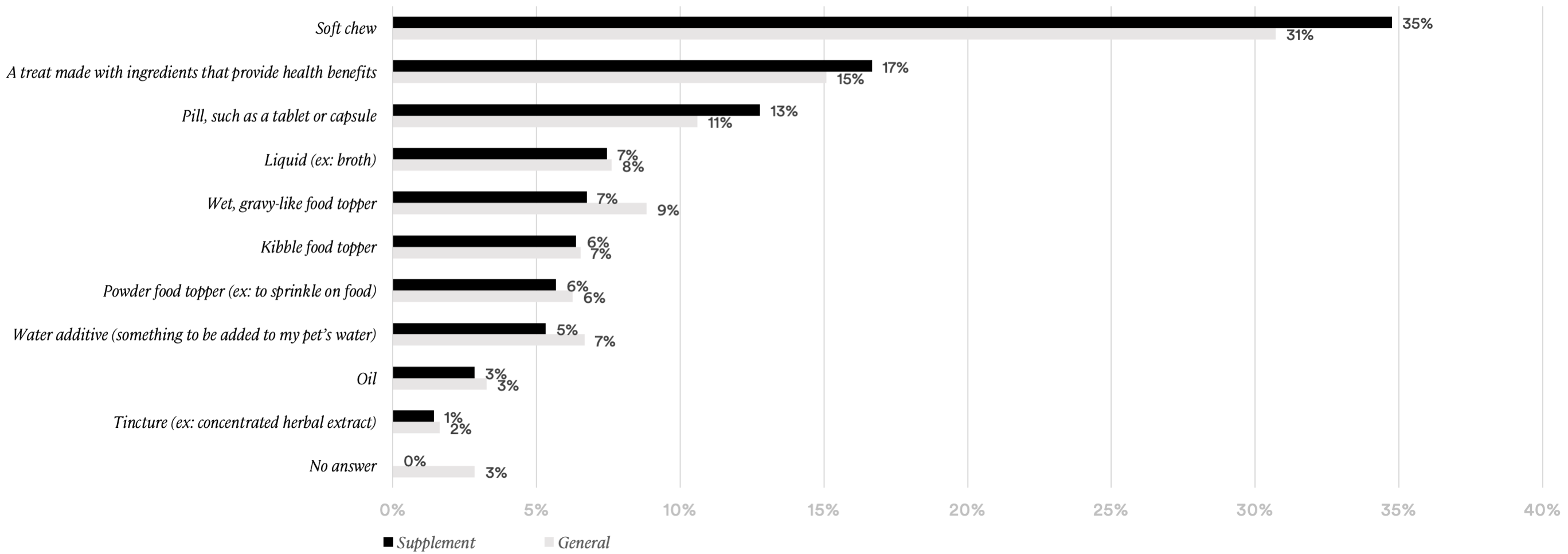

- Pet supplement audience (35%; +4%) is slightly more likely than the general pet parent to prefer a soft chew supplement format

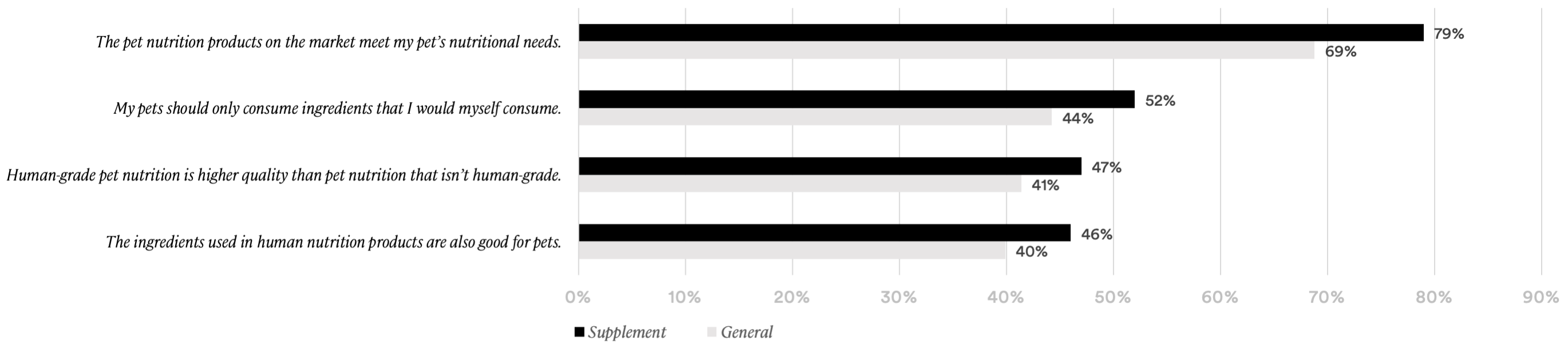

- Pet supplement audience is more likely than the general pet parent to believe human-grade pet products indicate high quality

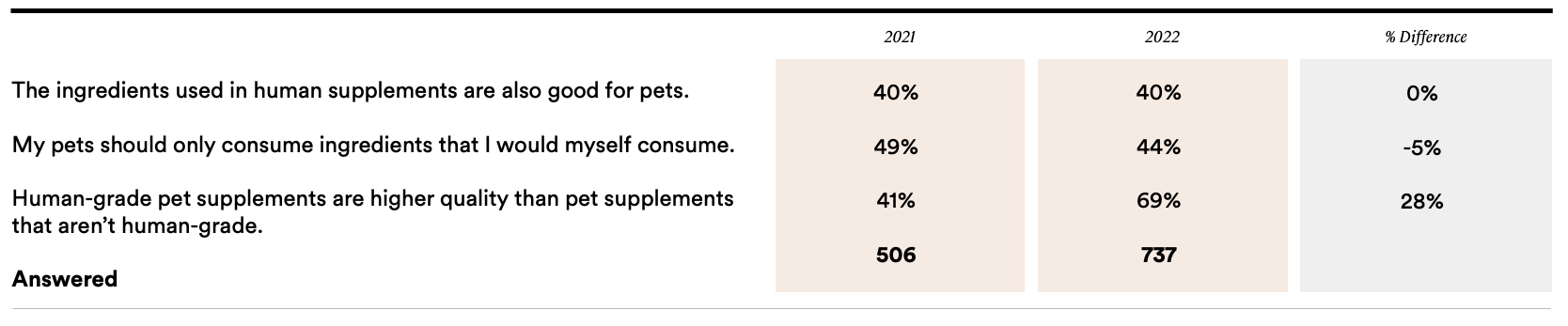

- General pet parents in 2022 are much more likely than in 2021 to agree that human-grade pet supplements are higher quality that pet supplements that are not human-grade

- Pet supplement audience (79%; +10%) is more likely than the general pet parent to agree their pet’s nutritional needs are met by products currently on the market

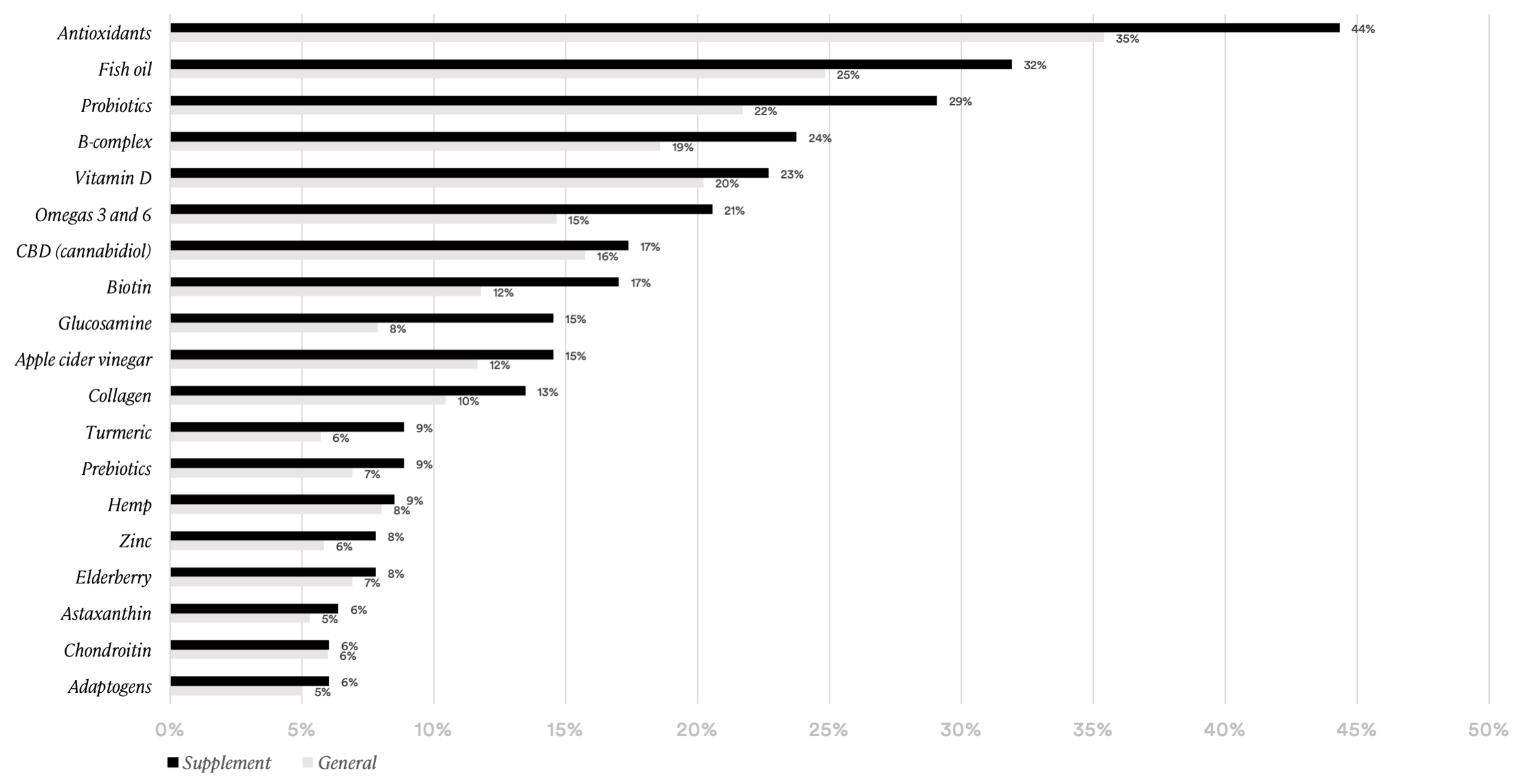

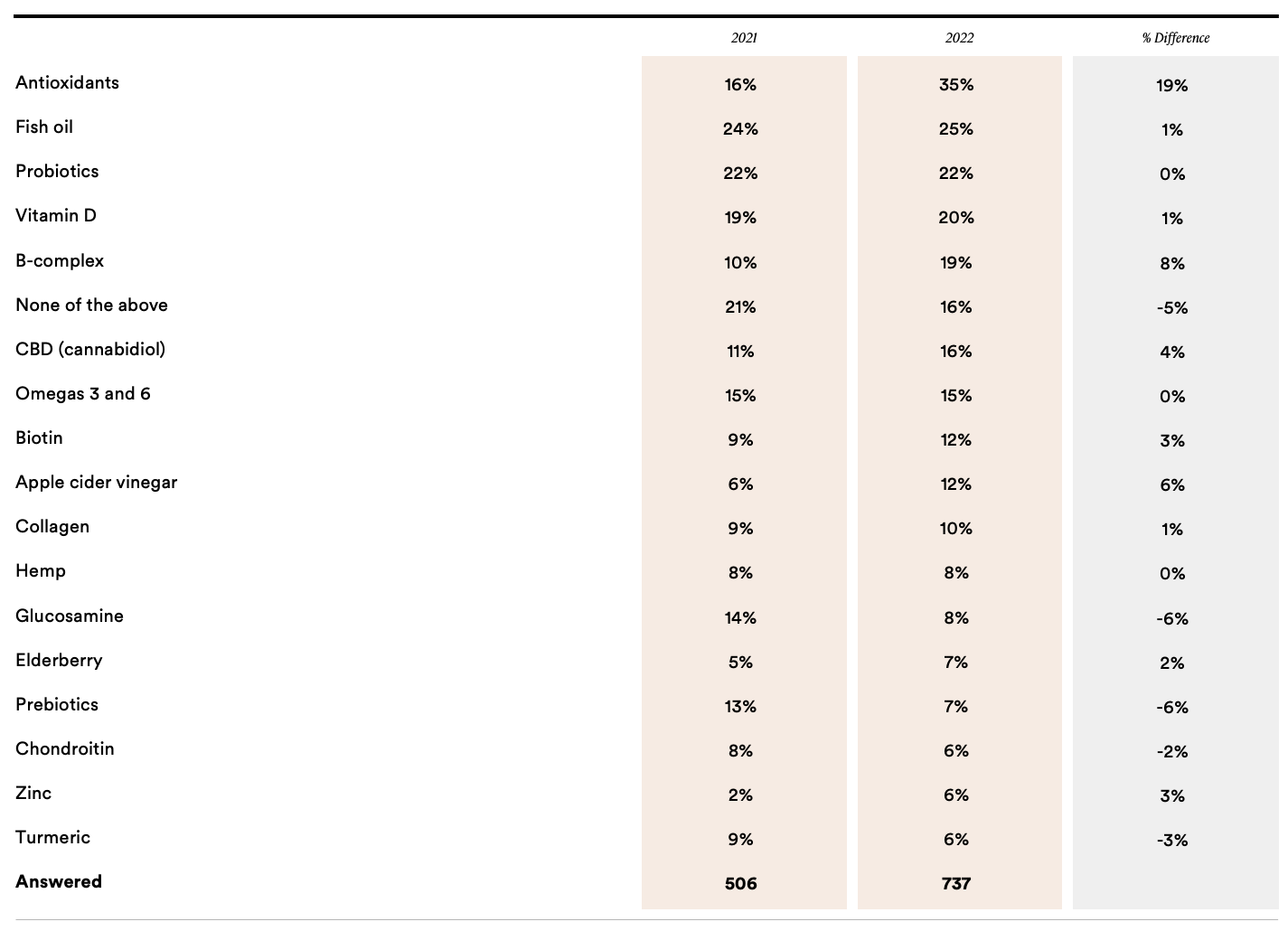

- Pet parents in 2022 are much more likely than in 2021 to report associating antioxidants with health benefits (35%; +19%)

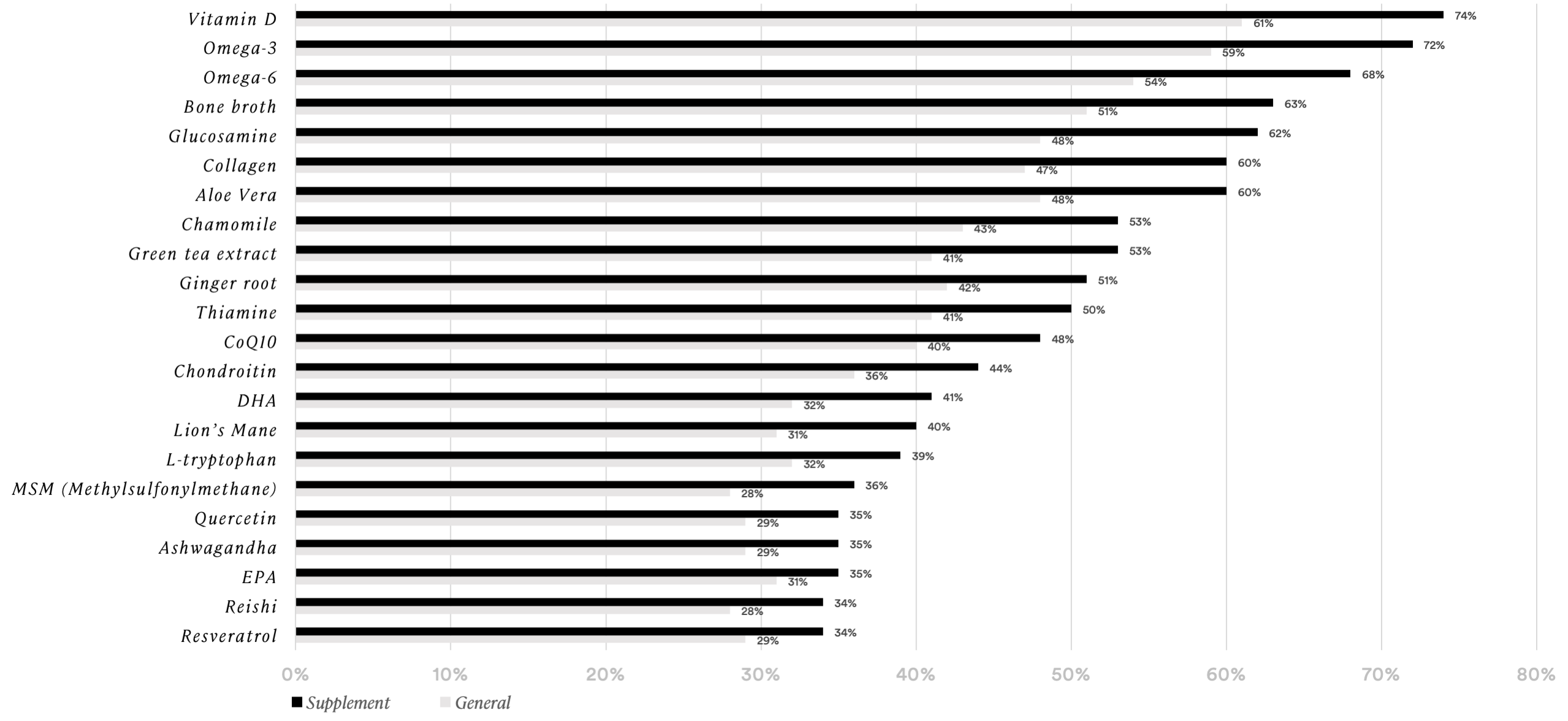

- The pet supplement audience is more likely than average to consider purchasing products made with omega-3 (72%; +13%), omega-6 (68%; +14%), bone broth (63%; +12%), glucosamine (62%; +14%), green tea extract (53%; +12%), and ginger root (51%; +9%)

- The pet supplement audience is more likely than average to consider purchasing products made with vitamin D (74%; +13%), collagen (60%; +13%), aloe vera (60%; +12%), chamomile (53%; +10%), and thiamine (50%; +9%)

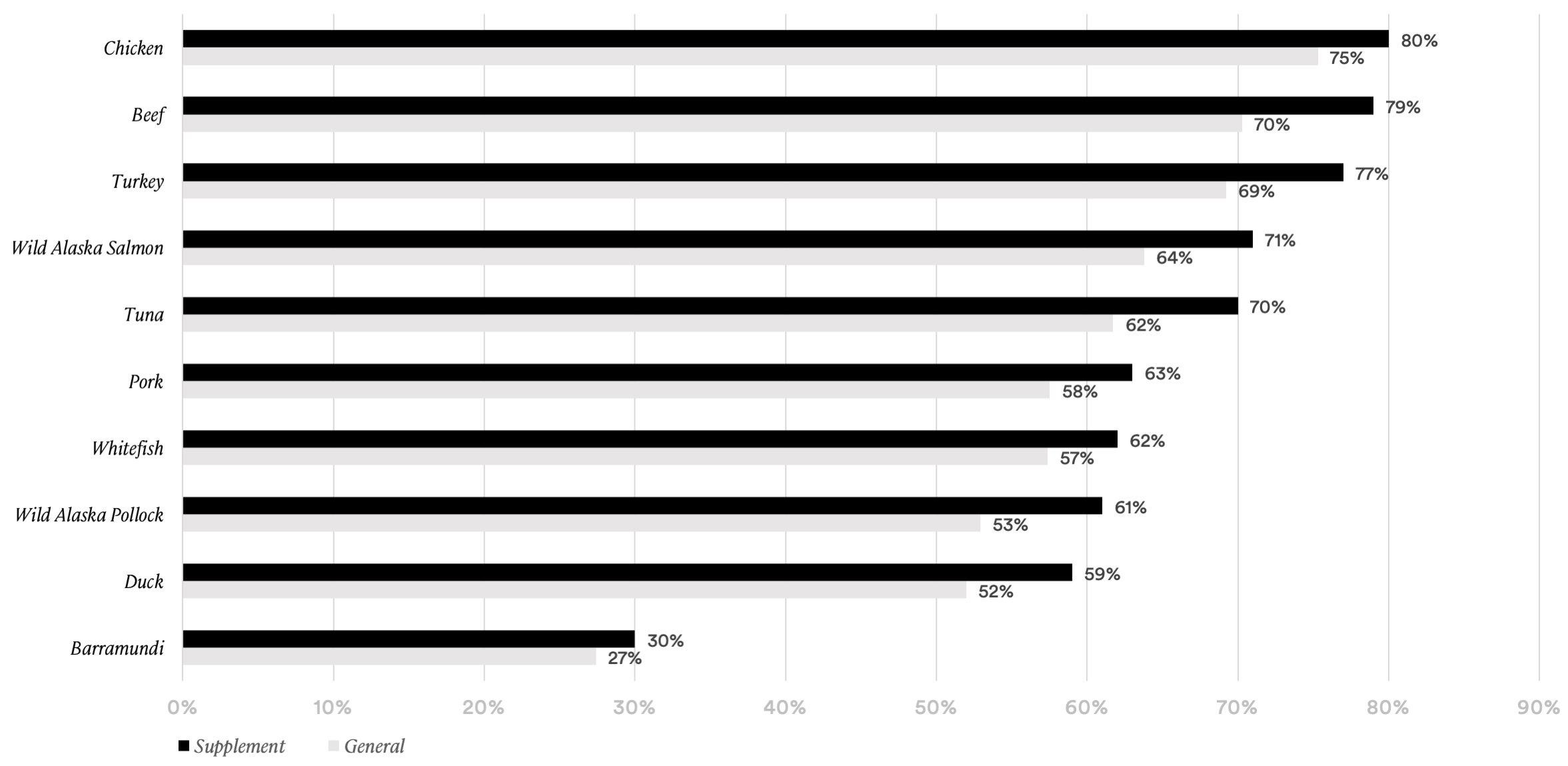

- The pet supplement audience is more likely than average to consider purchasing products made with chicken (80%; +5%), beef (79%; +9%), turkey (77%; +8%), wild Alaska salmon (71%; +7%), tuna (70%; +8%), pork (63%; +5%), whitefish (62%; +5%), wild Alaska pollock (61%; +8%), and duck (59%; +7%)

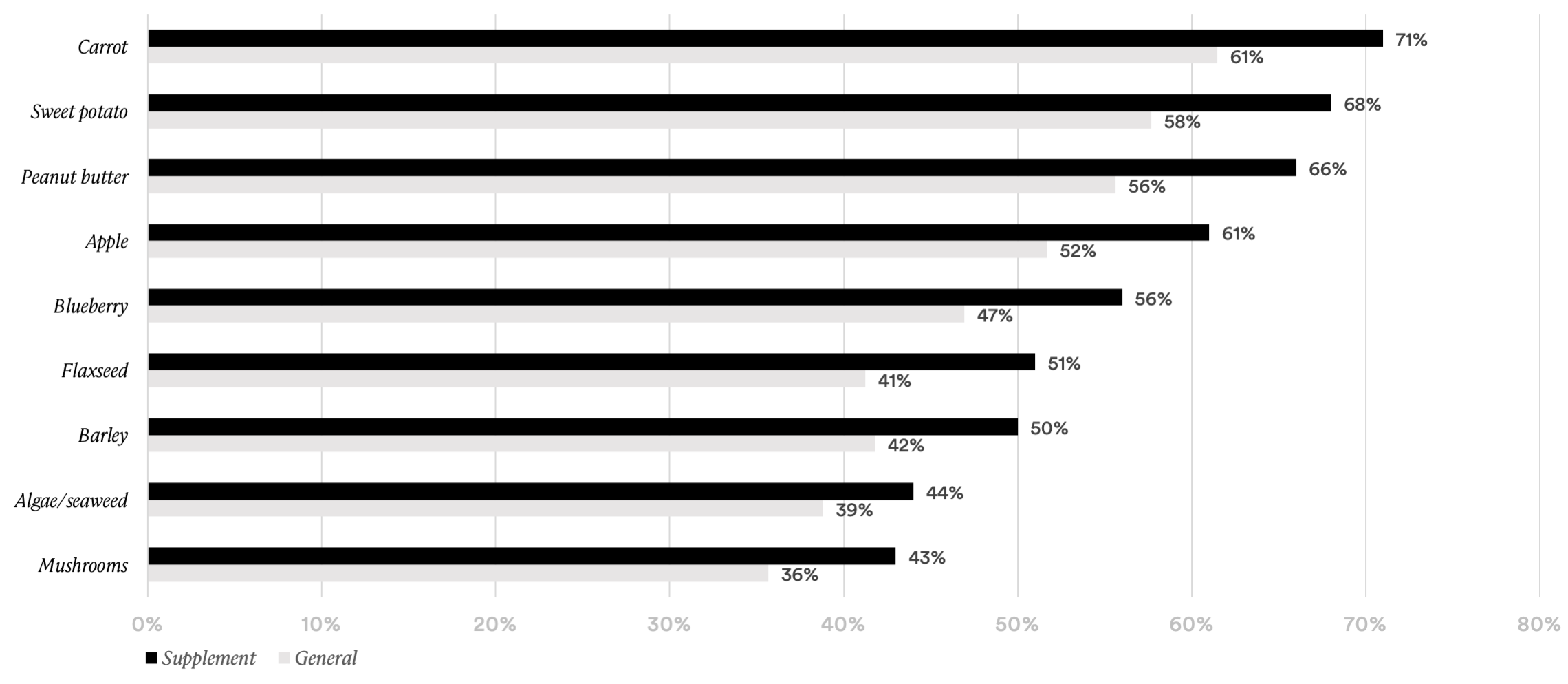

- The pet supplement audience is more likely than average to consider purchasing products made with carrot

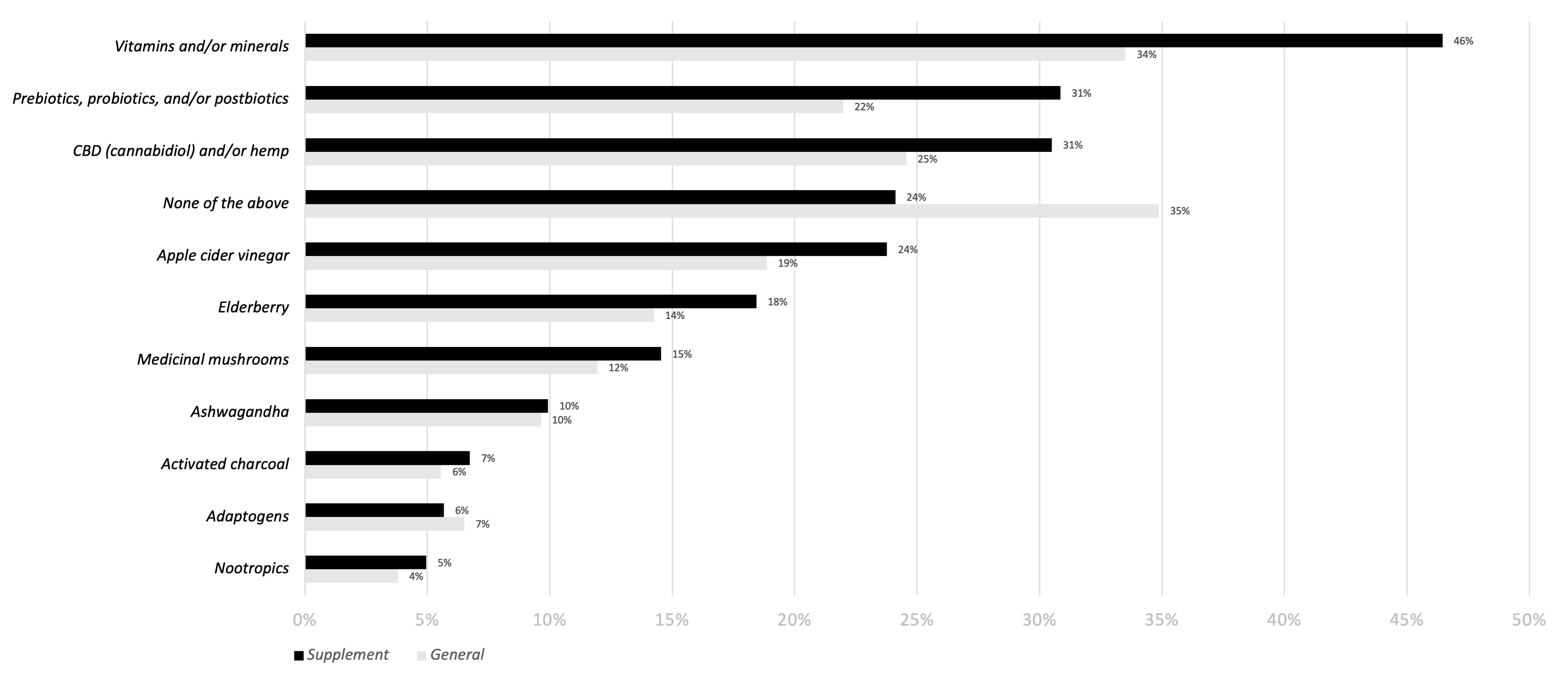

(71%; +10%), sweet potato (68%; +10%), peanut butter (66%; +10%), apple (61%; +9%), blueberry (56%; +9%), flaxseed (51%; +10%), and barley (50%; +8%) - Nearly half (46%) of the pet supplement audience reports having spent more than an hour in the past 12 months researching vitamins and/or minerals

- The pet supplement audience is much more likely than the average pet parent to have spent one hour or more in the past 12 months researching “-biotics” (pre-, pro-, or postbiotics) (31%; +9%) or CBD (31%; +6%)

PET SUPPLEMENT FORMAT PREFERENCES

If purchasing a supplement for my pet, I would most prefer the following formats. Select up to two.

PERCEPTIONS OF HUMAN-GRADE

SOMEWHAT OR STRONGLY AGREE

YEAR-OVER-YEAR COMPARISON: GENERAL PET PARENTS

INGREDIENT PERCEPTIONS

Which of the following ingredients would you be most likely to associate with positive health benefits for your pet? Select up to five.

YEAR-OVER-YEAR COMPARISON: GENERAL PET PARENTS

Association with Positive Health Benefits for Pets

FUNCTIONAL INGREDIENTS & PURCHASE CONSIDERATION

LIKELY OR VERY LIKELY TO CONSIDER

PROTEINS & PURCHASE CONSIDERATION

Read the following ingredients that could be used in products for your pet to consume. Rate each on how likely you are to consider purchasing a pet nutrition product with each of the following.

LIKELY OR VERY LIKELY TO CONSIDER

INGREDIENTS AND PURCHASE CONSIDERATIONS

Read the following ingredients that could be used in products for your pet to consume. Rate each on how likely you are to consider purchasing a pet nutrition product with each of the following.

LIKELY OR VERY LIKELY TO CONSIDER

INGREDIENTS RESEARCH

Which of the following have you spent more than one hour researching in the past 12 months?

Need-States: Benefits, Attitudes, & Behaviors

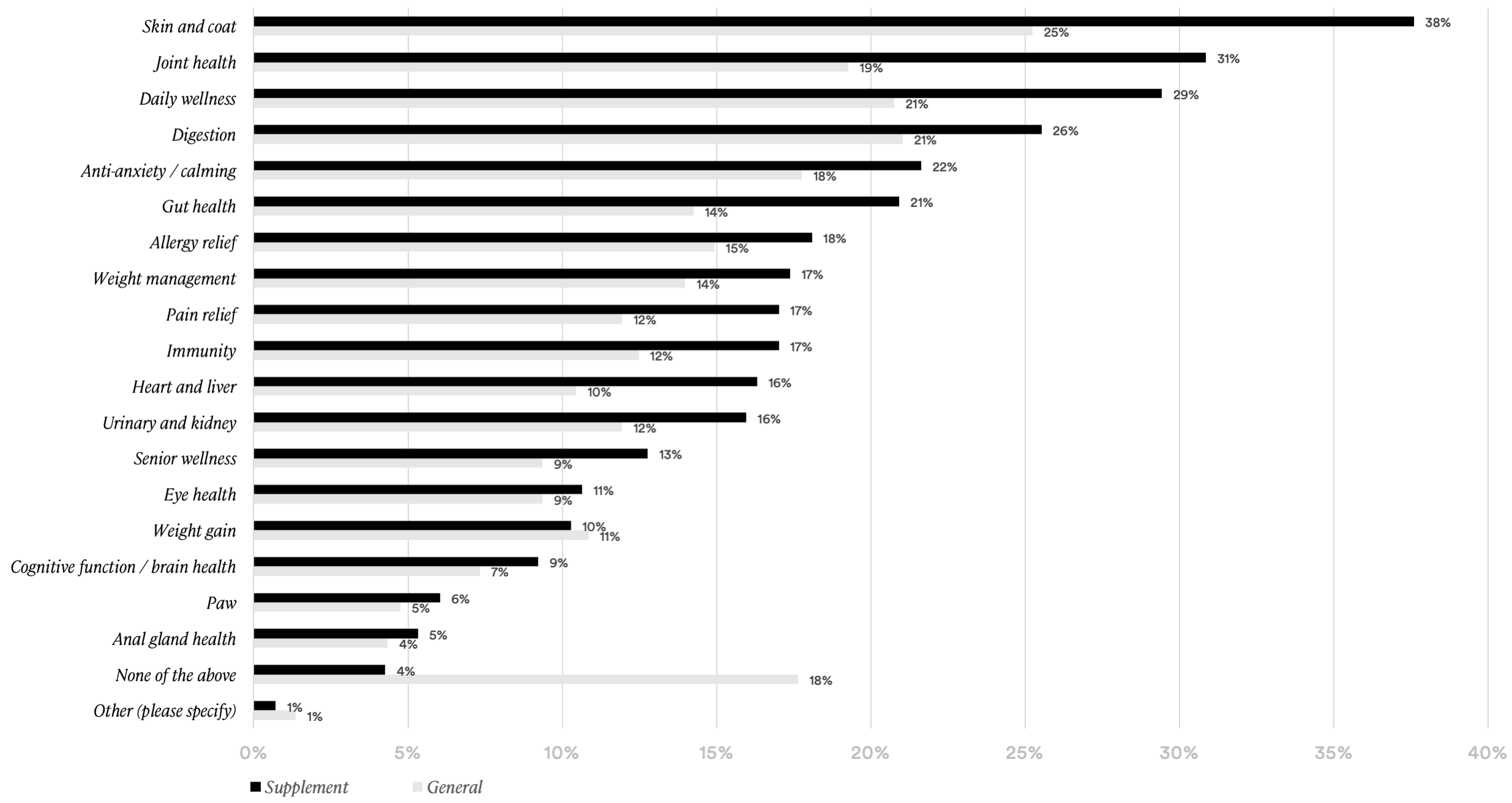

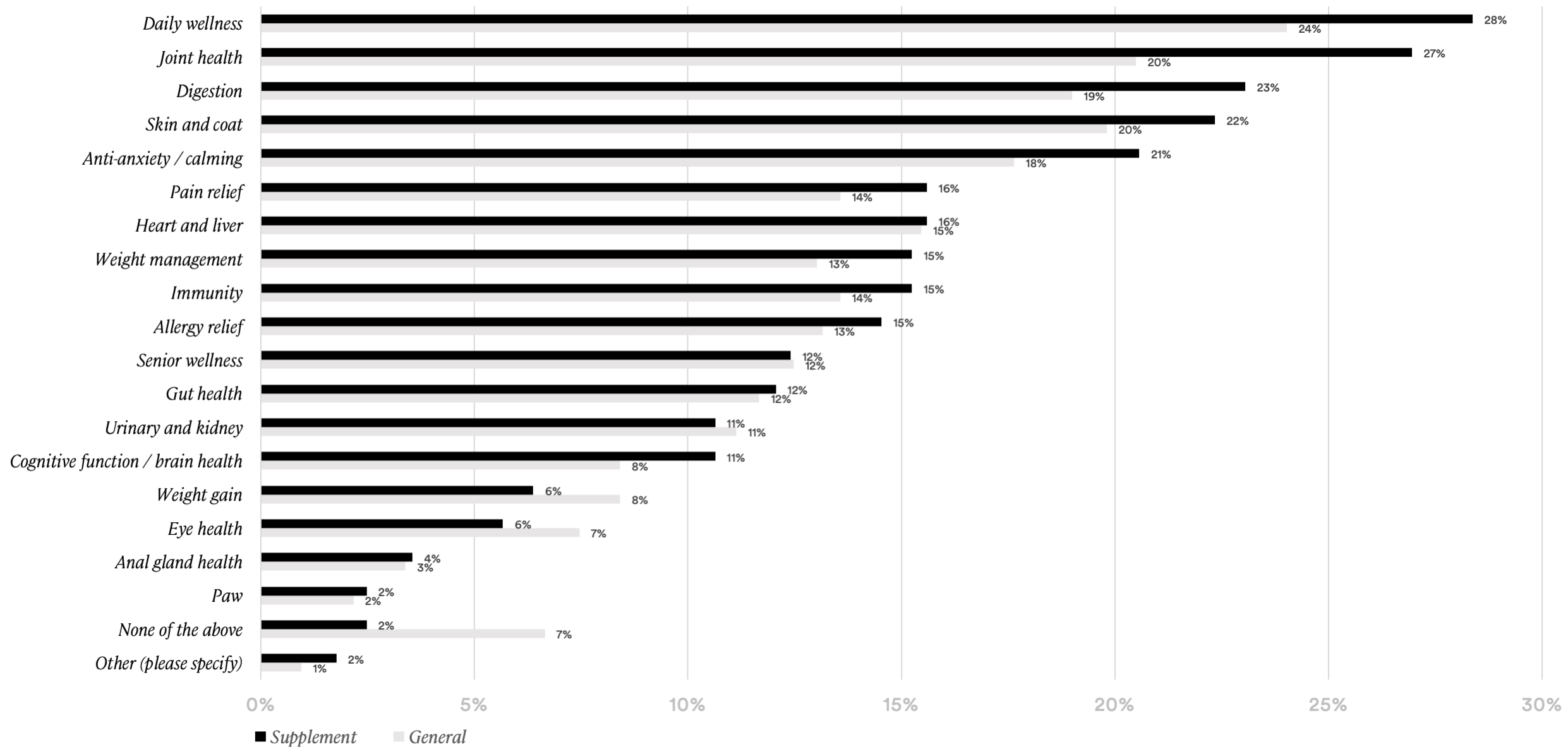

- The pet supplement audience is much more likely than the general pet parent to have purchased skin and coat (38%; +12%), joint health (31%; +12%), or daily wellness (29%; +9%)

- The pet supplement audience (28%; +4%) is somewhat more likely than average to consider purchasing a daily wellness supplement

- One-in-four (27%; +7%) pet supplement consumers said they would consider purchasing a joint health supplement

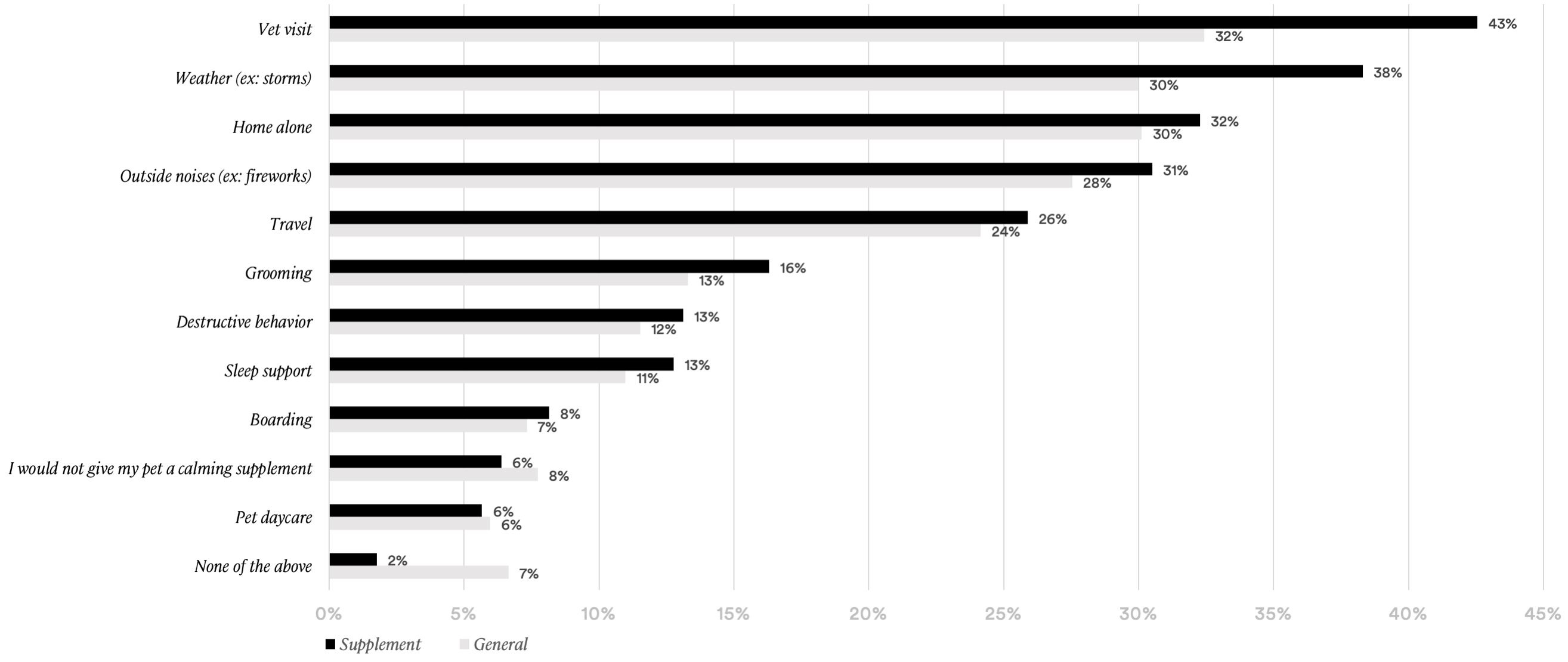

- Pet supplement audience is more likely to say they would consider giving their pet a calming or anxiety relief supplement for a vet visit (43%; +10%) or weather (38%; +8%)

PURCHASE BEHAVIOR BY NEED-STATE

Read the following list of common health conditions affecting pets. For which of the following conditions have you purchased products for your pet in the past 12 months? Select all that apply.

CONSIDERATION BY NEED-STATE

For which of the following conditions would you consider purchasing products for your pet, if it were within your budget to do so? Select up to three.

OCCASION-BASED CALMING SUPPLEMENTS

Read the following list. Select the options that describe reasons why you might consider giving your pet a calming or anxiety relief supplement. Select up to three.

Sustainability, Responsibility & Transparency

- “Made in the USA” (77%; +6%) and “sustainably made” (73%; +9%) are more likely than average to resonate with the pet supplement audience

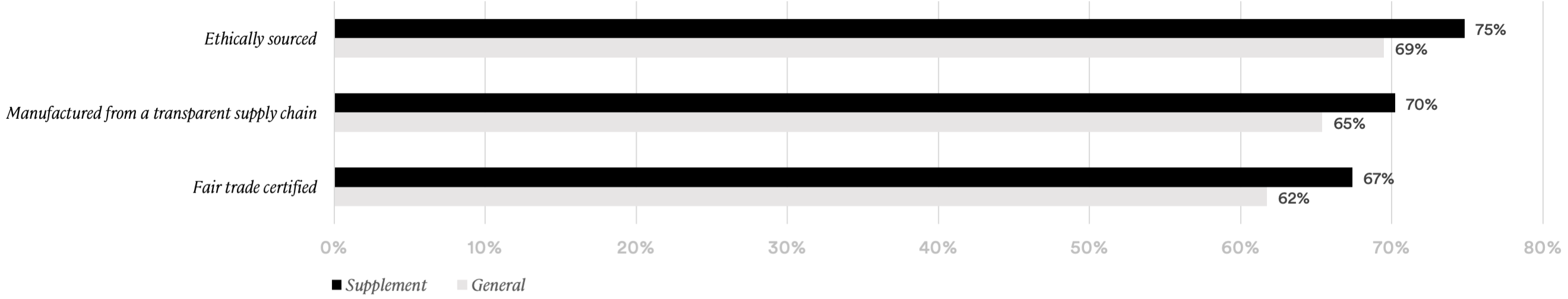

- “Ethically sourced” (75%; +5%), “manufactured from a transparent supply chain” (70%; +5%), and “fair trade certified” (67%; +5%) are more likely than average to be important to the pet supplement audience

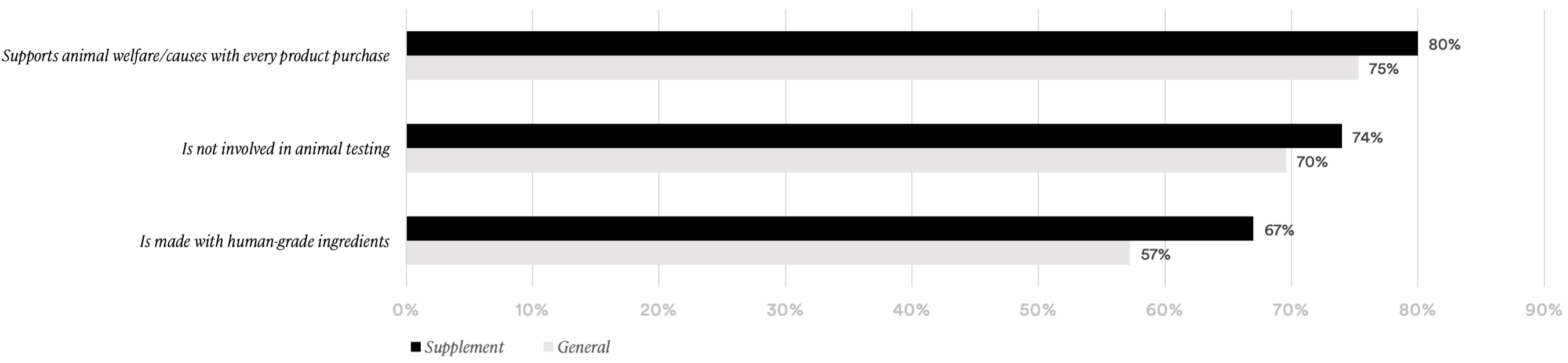

- The pet supplement audience is more likely than average to show preference for products that support animal welfare causes (80%; +5%)

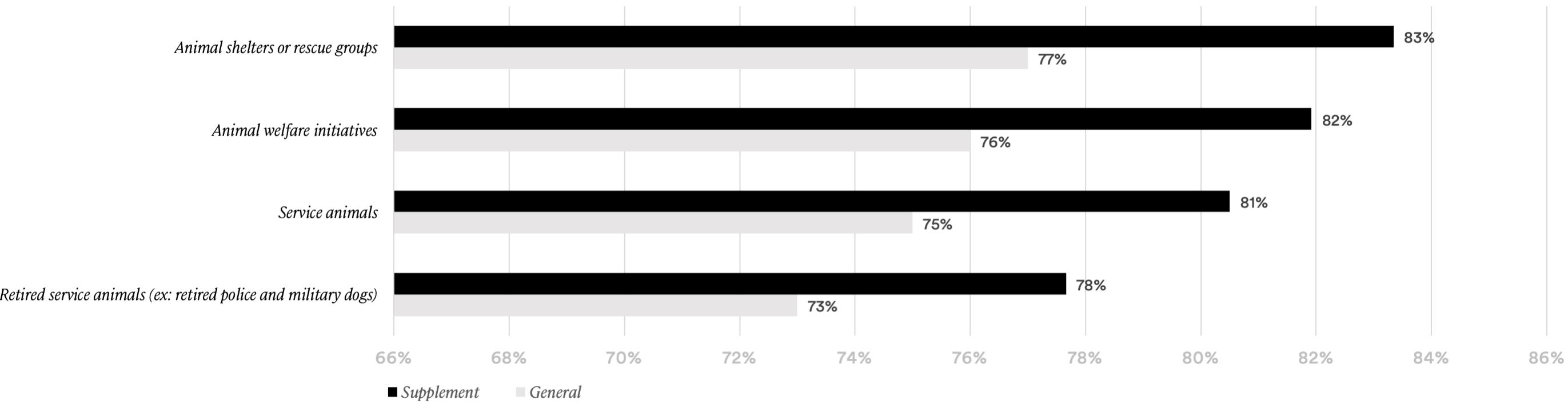

- The pet supplement audience is more likely than average to prefer products that support animal shelters or rescue groups (83%; +6%), animal welfare initiatives (82%; +6%), service animals (81%; +6%), or retired service animals (78%; +5%)

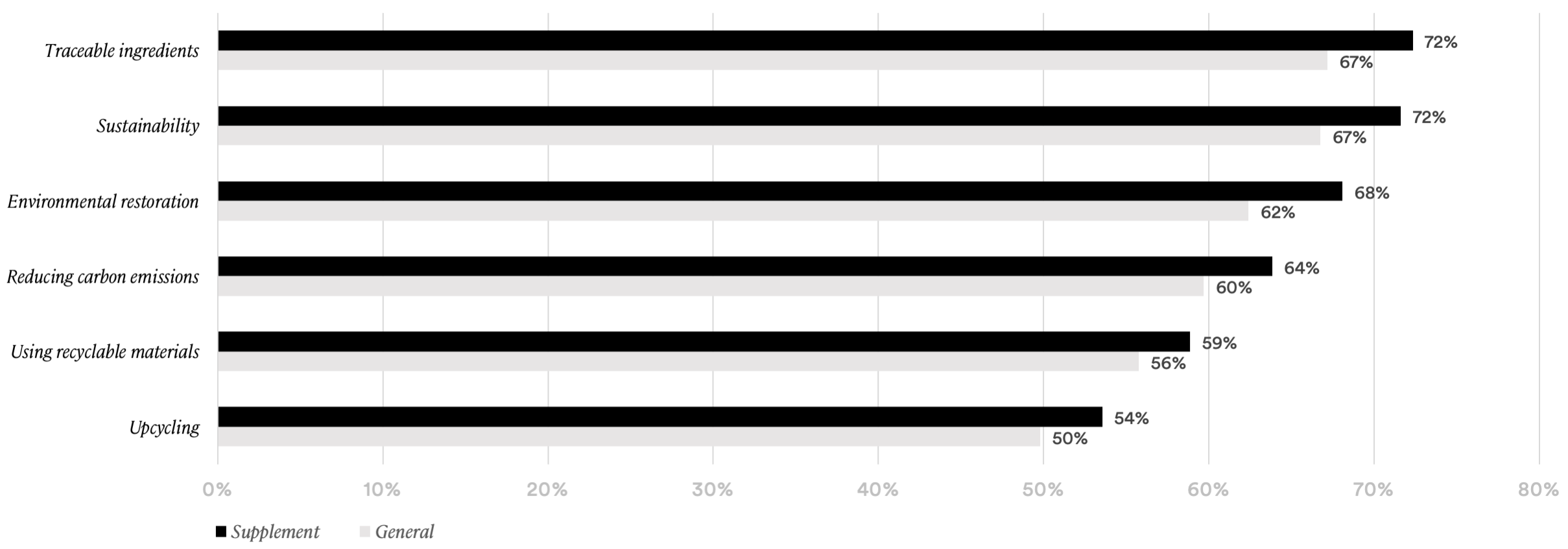

- The pet supplement audience is more likely than average to prefer products that reflect a commitment to traceable ingredients (72%; +5%), sustainability (72%; +5%), and environmental restoration (68%; +6%)

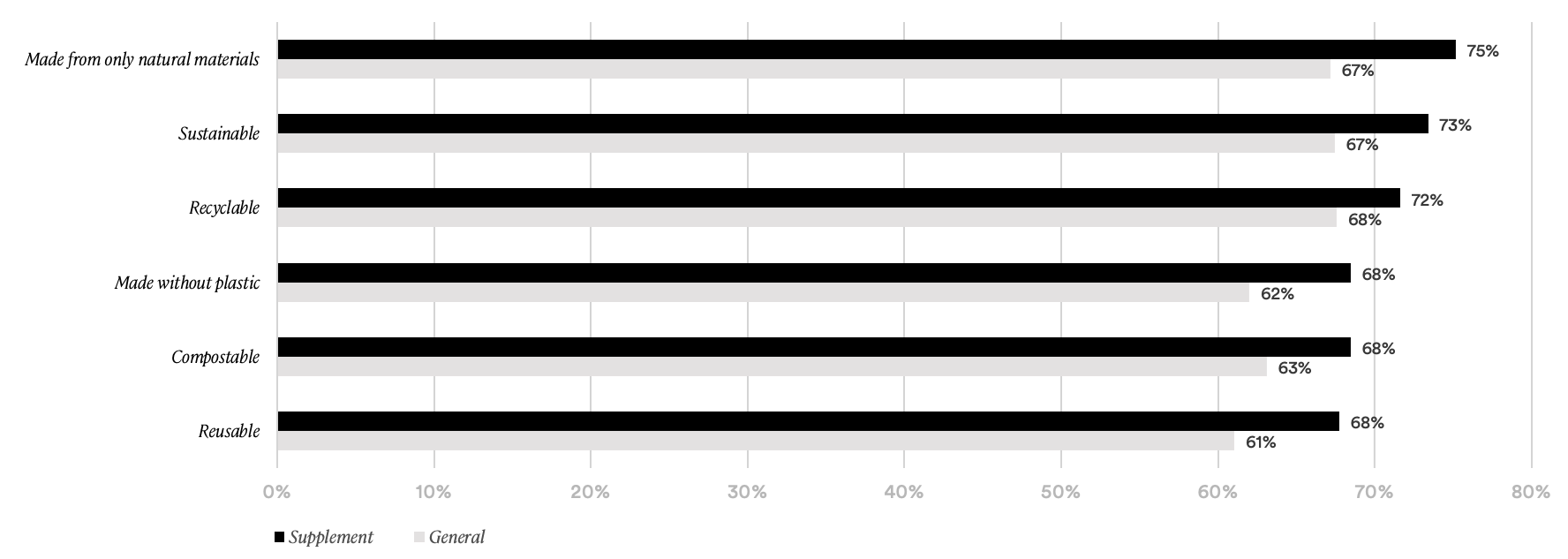

- The pet supplement audience is more likely than average to prefer products in packaging that is: made from only natural materials (75%; +8%), sustainable (73%; +6%), recyclable (72%; +4%), made without plastic (68%; +6), compostable (68%; +5%), or reusable (68%; +8%)

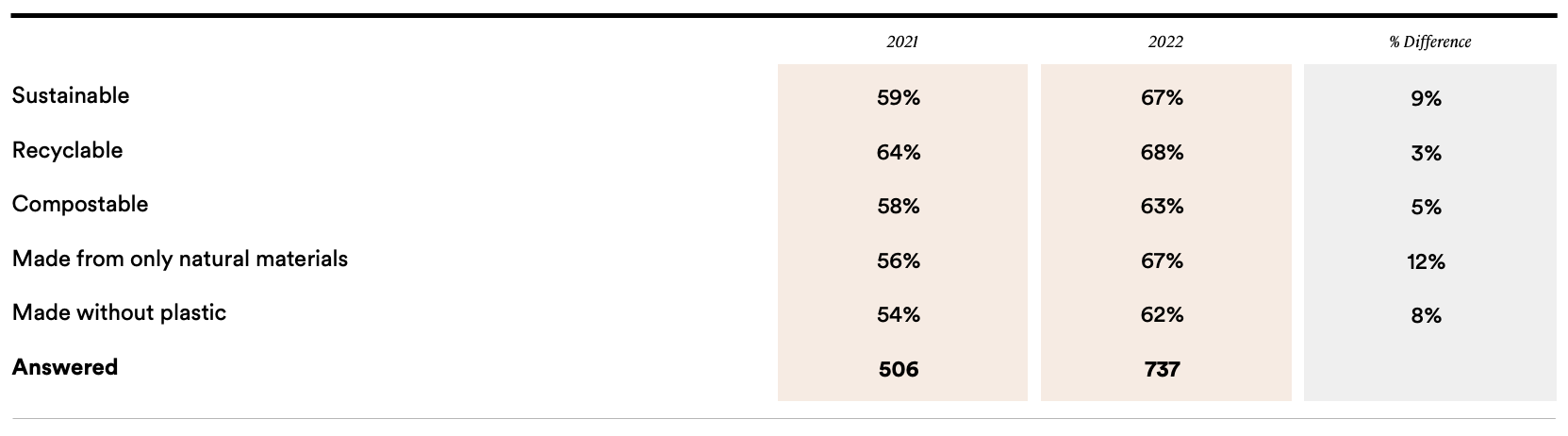

- Pet parents in 2022 are more likely than in 2021 to believe it is important to use packaging that is sustainable (67%; +9%) or made from only natural materials (67%; +12%)

IMPORTANCE OF MADE-FROM/IN/OF CLAIMS IN PET NUTRITION

Read the attributes below. For each, select the rating that best describes how important the attribute is to you when selecting pet nutrition products like food, treats, or supplements.

CLAIMS RATED AS SOMEWHAT OR VERY IMPORTANT

SOURCING & ETHICS ALIGNMENT

Read the attributes below. For each, select the rating that best describes how important the attribute is to you when selecting pet nutrition products like food, treats, or supplements.

CLAIMS RATED AS SOMEWHAT OR VERY IMPORTANT

VALUES ALIGNMENT: ANIMAL WELFARE

When making a purchase decision between two pet products that offer similar benefits and price, I am significantly more likely to buy a product or brand that _____.

SOMEWHAT OR STRONGLY AGREE WITH STATEMENT

VALUES ALIGNMENT: CAUSES

When making a purchase decision between two pet products that offer similar benefits and price, I am significantly more likely to buy a product or brand that reflects a commitment to _____.

SOMEWHAT OR STRONGLY AGREE WITH STATEMENT

VALUES ALIGNMENT: SUSTAINABILITY

When making a purchase decision between two pet products that offer similar benefits and price, I am significantly more likely to buy a product or brand that reflects a commitment to _____.

SOMEWHAT OR STRONGLY AGREE WITH STATEMENT

VALUES ALIGNMENT: PACKAGING MATERIALS

It is important to me that packaging used for the products I buy for my pet is _____.

SOMEWHAT OR STRONGLY AGREE WITH STATEMENT

YEAR-OVER-YEAR COMPARISON: GENERAL PET PARENTS

It is important to me that packaging used for the products I buy for my pet is _____.

SOMEWHAT OR STRONGLY AGREE WITH STATEMENT

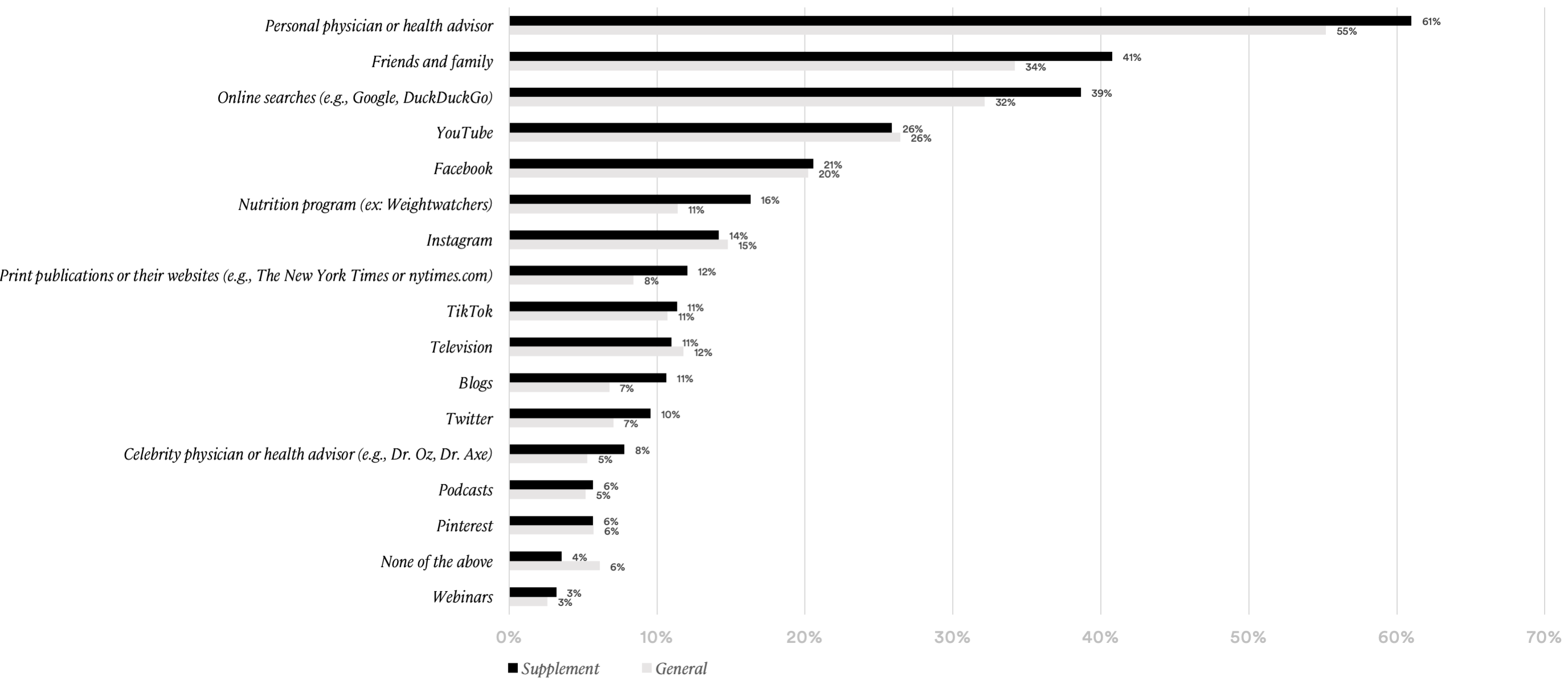

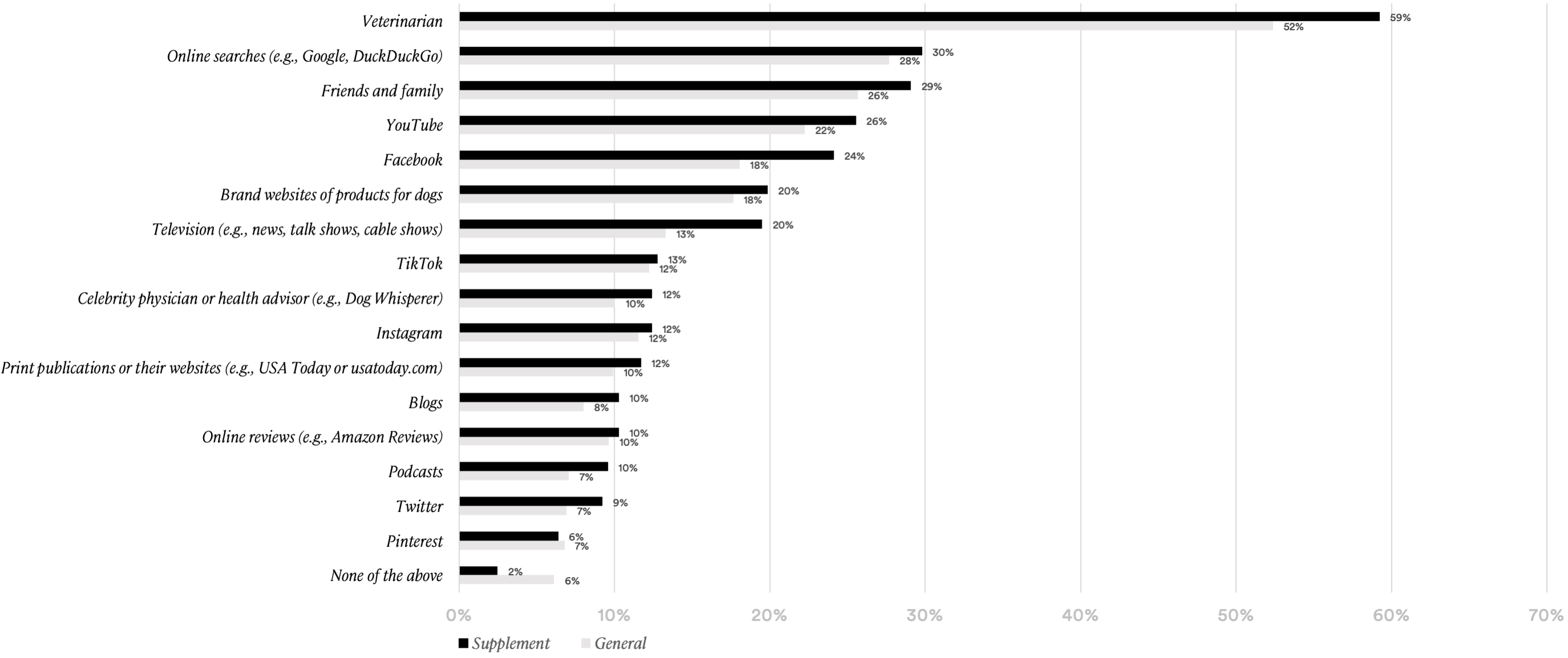

Information Sources & Media Usage

- The pet supplement audience is more likely than average to seek inspiration or information on their own personal health and wellness from their personal physician (61%; +6%)

- The pet supplement audience is more likely than average to seek inspiration or information on their pets’ health and wellness from their veterinarian (59%; +7%)

- “Veterinarian” is the top information source reported by both pet parents and the pet supplement subgroup

- Other popular sources for pet health and wellness information include online search (30%; +2%), friends and family (29%; +3%), YouTube (26%; +3%), and Facebook (24%; +6%)

HEALTH INFORMATION SOURCES (HUMAN)

Where do you seek inspiration or information on health and wellness for yourself? Select all that apply.

HEALTH INFORMATION SOURCES (PET)

Where do you seek inspiration or information on health and wellness, for your pet? Select all that apply.

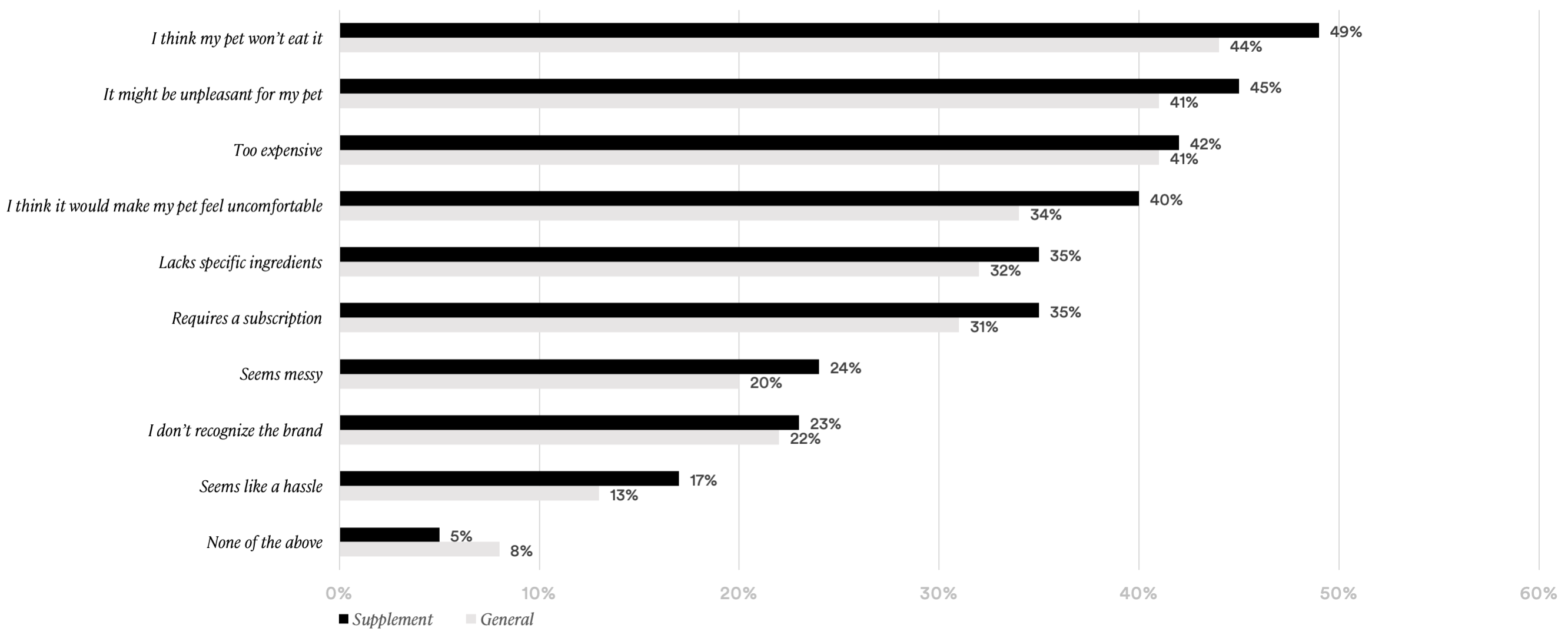

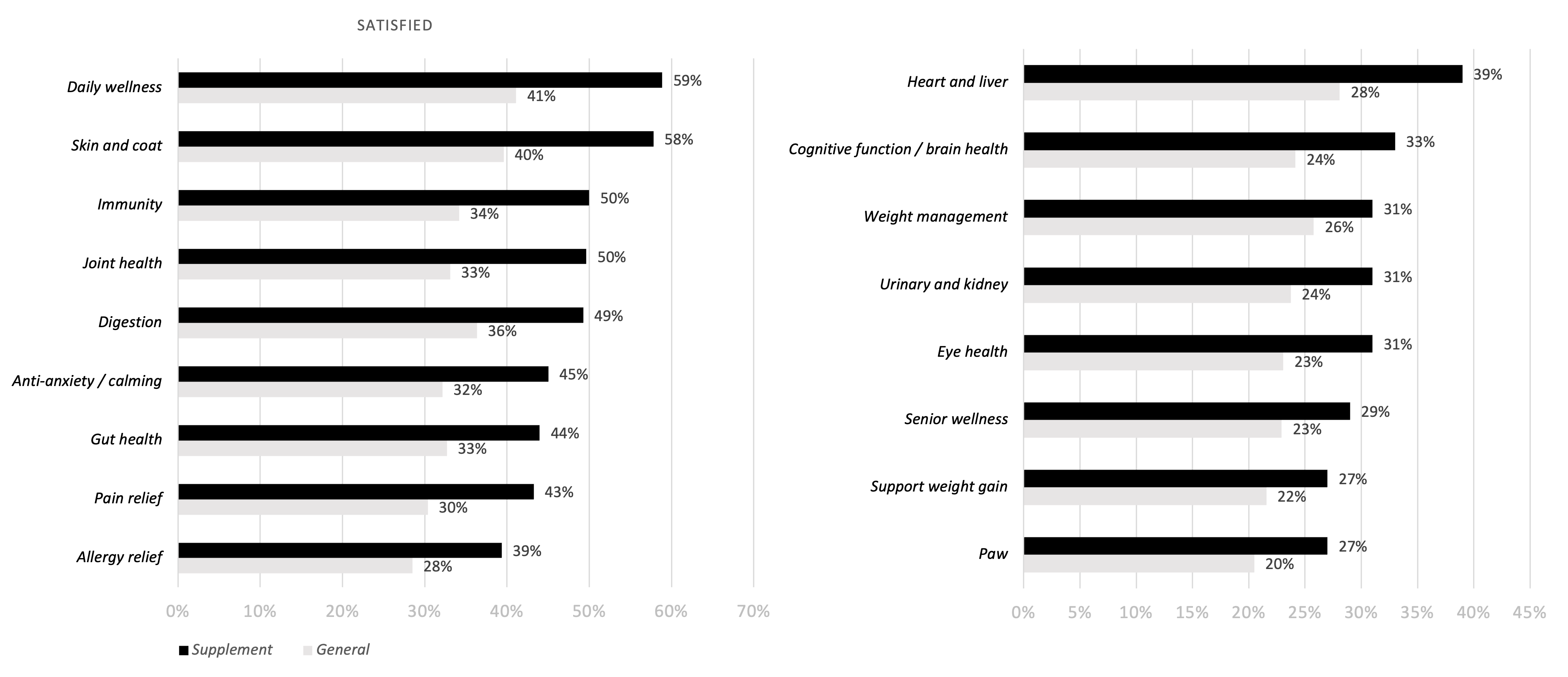

Satisfaction & Dissatisfaction in Pet Nutrition

- The pet supplement audience is more likely than average to reject a pet product if they think their pet won’t eat it (49%; +5%) or might be unpleasant for their pet (45%; +4%)

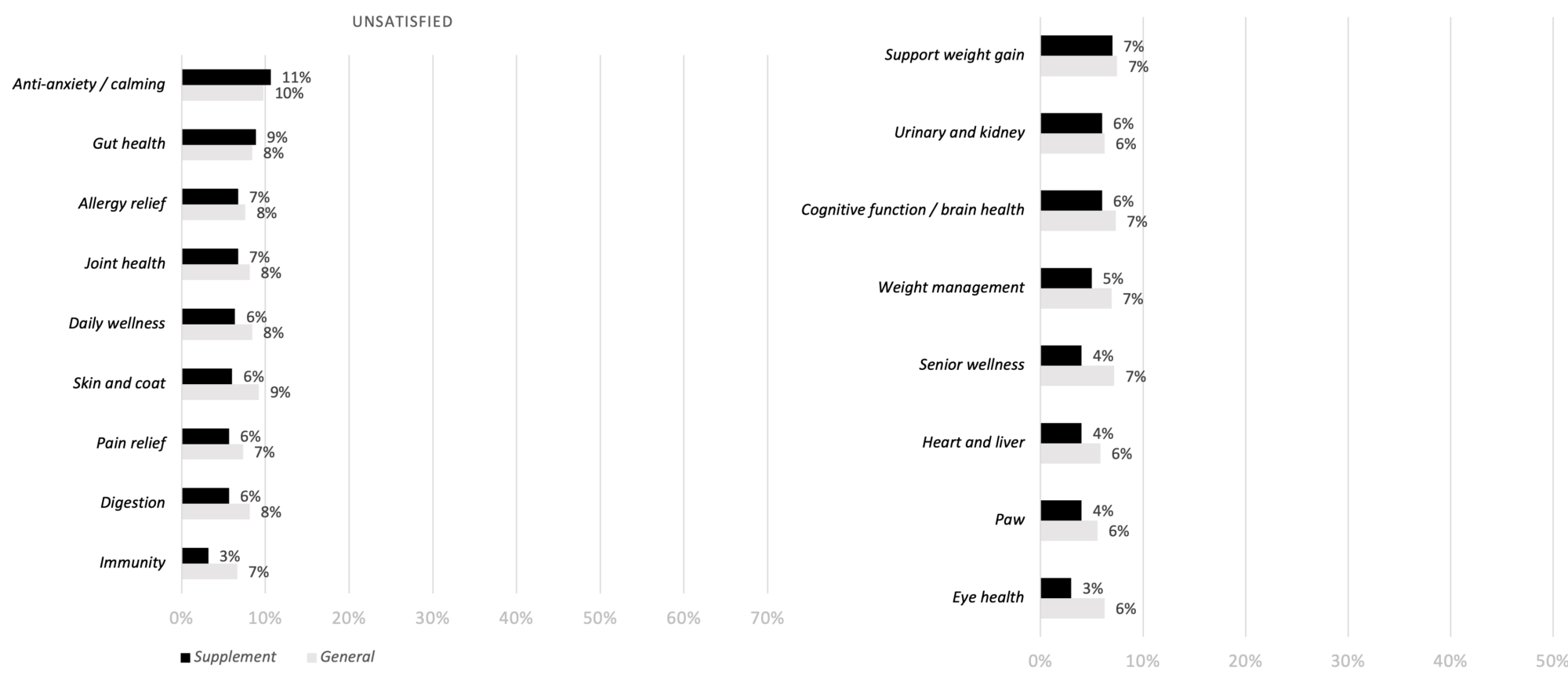

- The pet supplement audience is likely to say they are satisfied with pet nutrition products for daily wellness (59%; +18%), skin and coat (58%; +18%), immunity (50%; +16%), or joint health (50%; +16%)

- The pet supplement audience is more likely than the general pet audience to say they are satisfied with pet nutrition products for heart and liver (39%; +11%) and brain health (33%; +9%)

REASONS FOR EXCLUSION

If shopping for a product for your pet to consume, what might prompt you to REJECT a product? Select all that apply.

SATISFACTION WITH CURRENT MARKET

The following list describes types of products made to deliver specific health benefits for pets. Select the choice for each that best describes your experience with that type of product.

HAVE PURCHASED AND ARE SATISFIED WITH PRODUCT

HAVE PURCHASED AND ARE DISSATISFIED WITH PRODUCT

Subscriptions & Personalized Nutrition

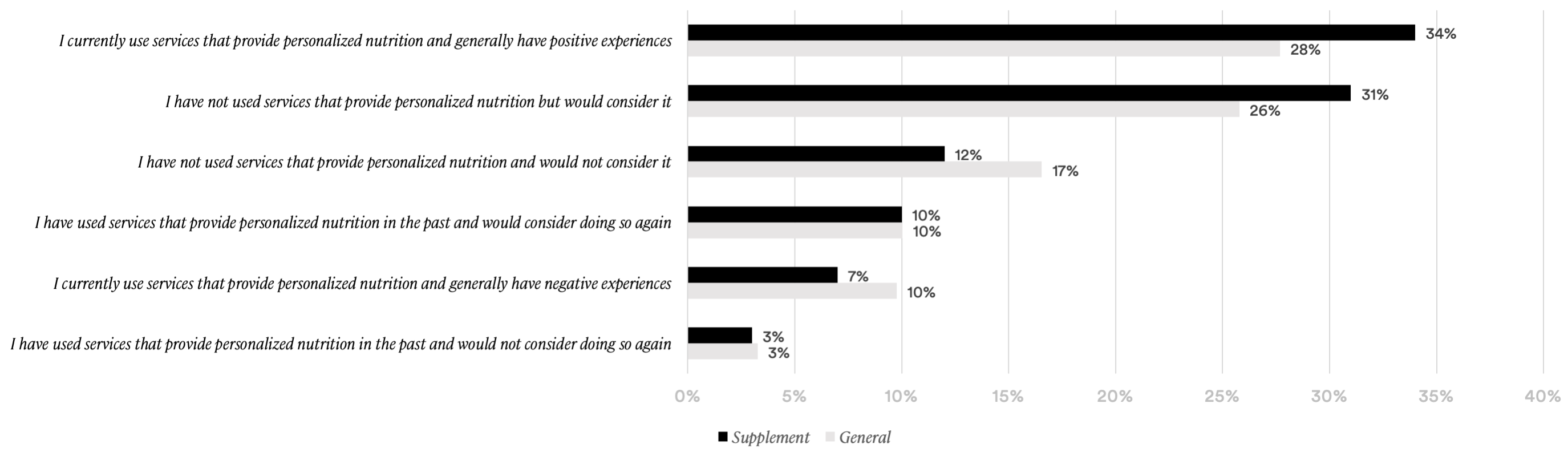

- The pet supplement audience is more likely than average to use and have a positive experience with personalized nutrition services (34%; +6%) or would consider them (31%; +5%) for themselves

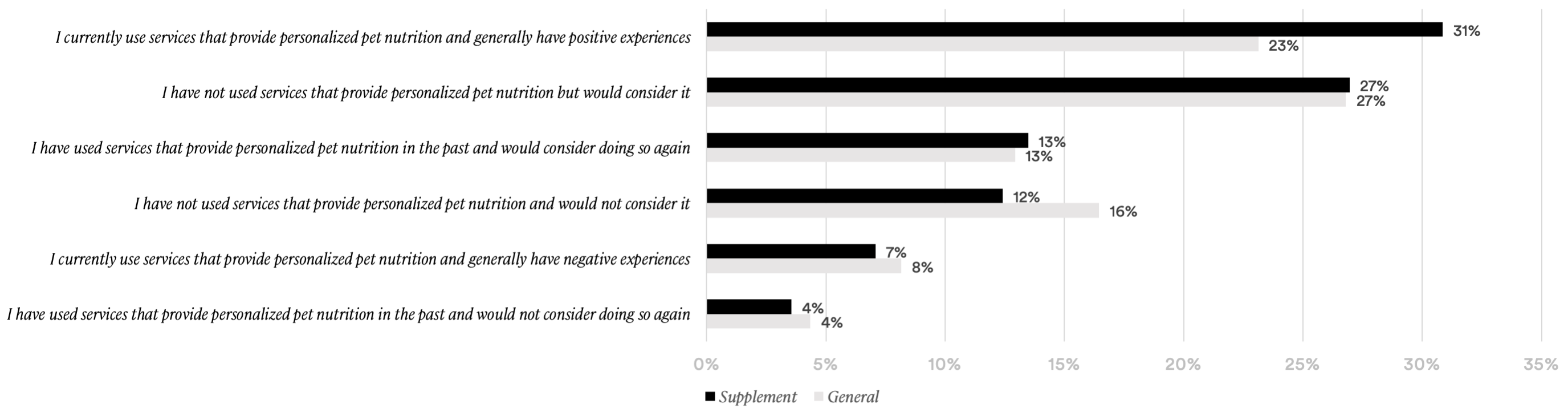

- The pet supplement audience is more likely than average to use and have a positive experience with personalized nutrition services (31%; +8%) for pets

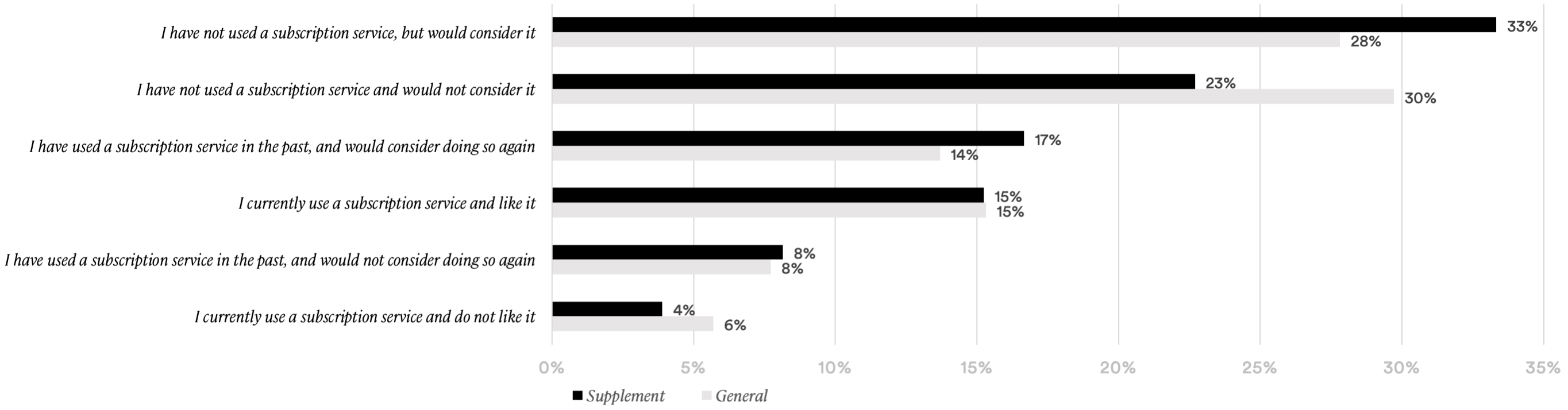

- About one-third (33%; +5%) of the pet supplement audience said they have not used a subscription service for pet nutrition but would consider it

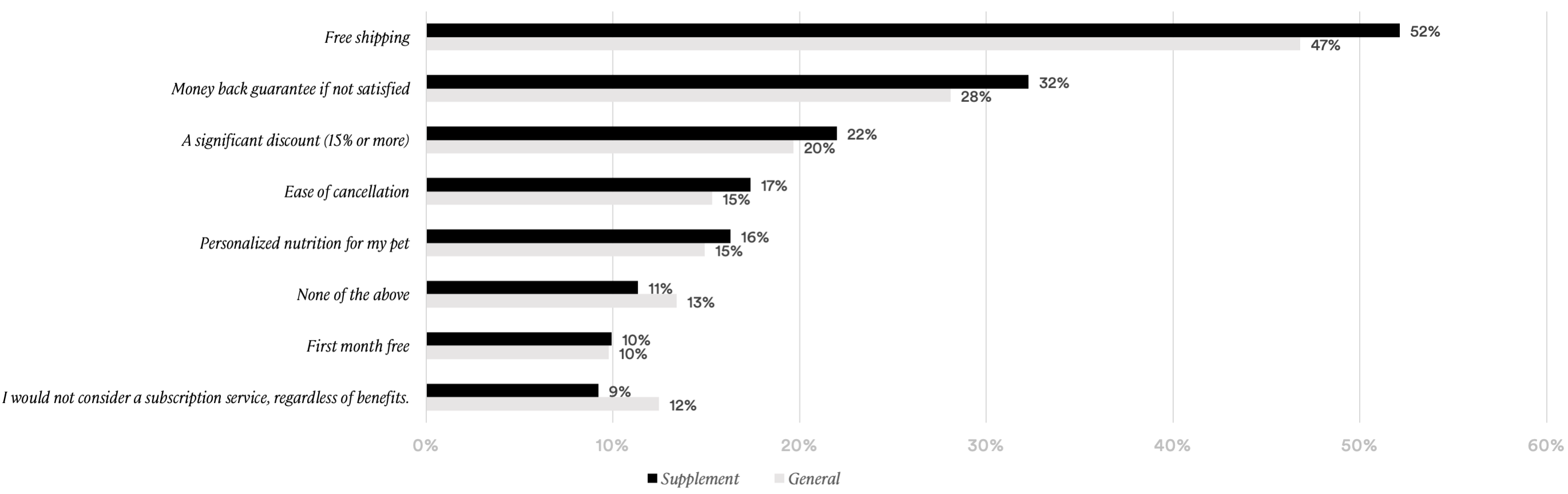

- The pet supplement audience reported they’d be most likely to consider a subscription service for pet nutrition products if it offers free shipping (52%; +5%) or a money-back guarantee (32%; +4%)

PERSONALIZED NUTRITION (HUMAN)

Which of the following options best describes your relationship to personalized nutrition services for your own nutrition?

PERSONALIZED NUTRITION (PET)

Which of the following options best describes your relationship to personalized nutrition services for your pet’s nutrition?

SUBSCRIPTIONS

Which of the following best describes your feelings about subscription services, specifically for pet nutrition products (food, treats, supplements)? Subscription services may be defined as a service or program in which you sign up for automated replenishment / recurring delivery (Subscribe & Save, etc).

SUBSCRIPTION FEATURES

Which of the following would be most likely to prompt you to consider a subscription service for pet nutrition products, such as pet food, treats, or supplements? Select up to two.

Shopping Behaviors & Preferences

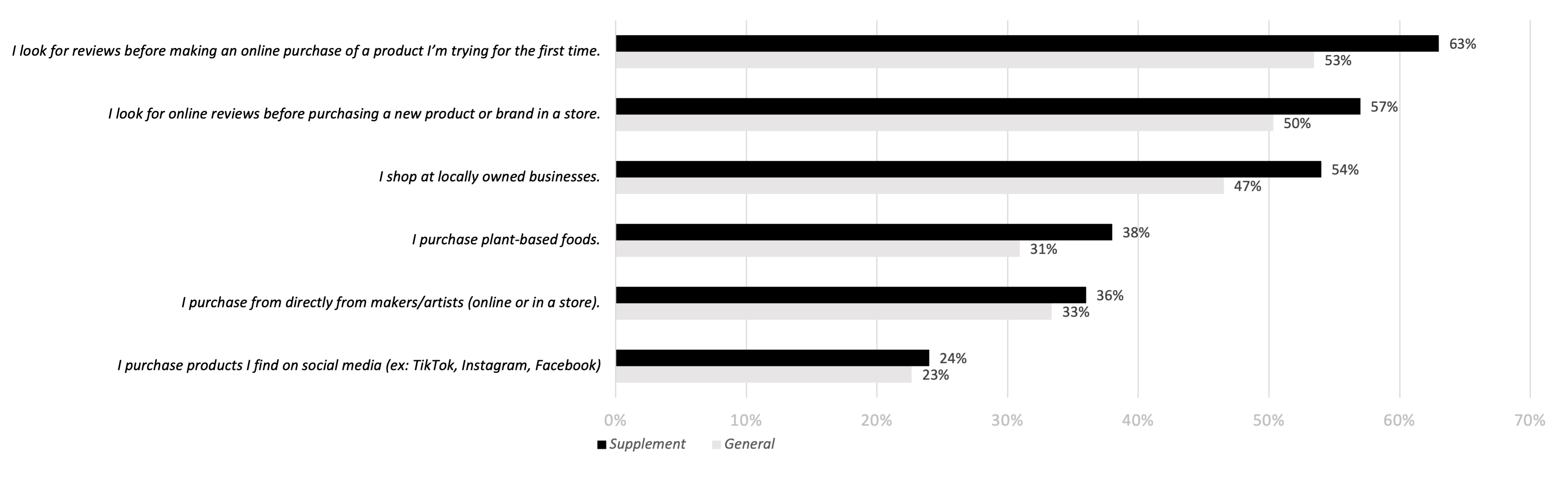

- The pet supplement audience is more likely than average to look at reviews before a first-time purchase online (63%; +10%) or in-store (57%; +7%)

- Also, the pet supplement audience is more likely than average to shop at a locally owned business (54%; +7%) or purchased plant-based foods for themselves (38%; +7%)

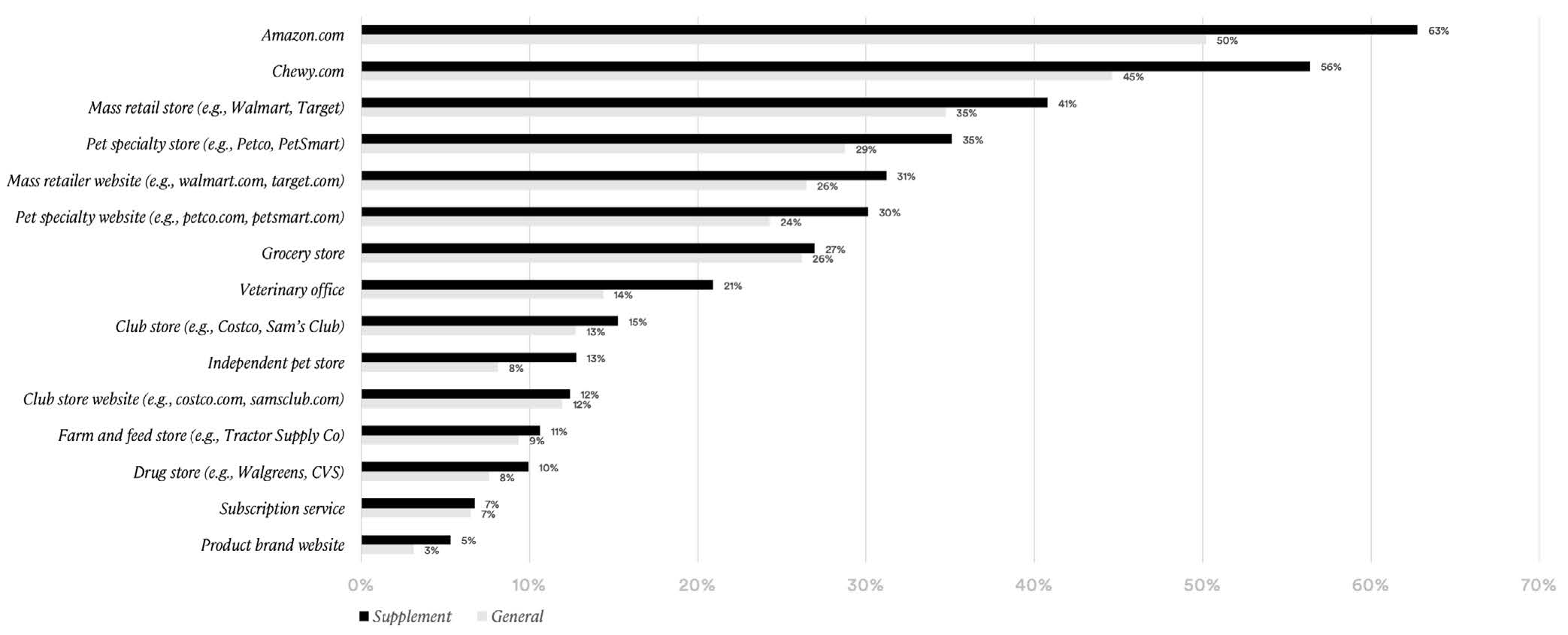

- The pet supplement audience uses a variety of shopping channels and is much more likely than the average pet parent to report shopping on Amazon.com (63%; +13%) and Chewy.com (56%; +12%)

- Mass retail stores (41%; +6%), pet specialty stores (35%; +6%), and pet specialty websites (30%; +6%) are also important channels for the pet supplement audience

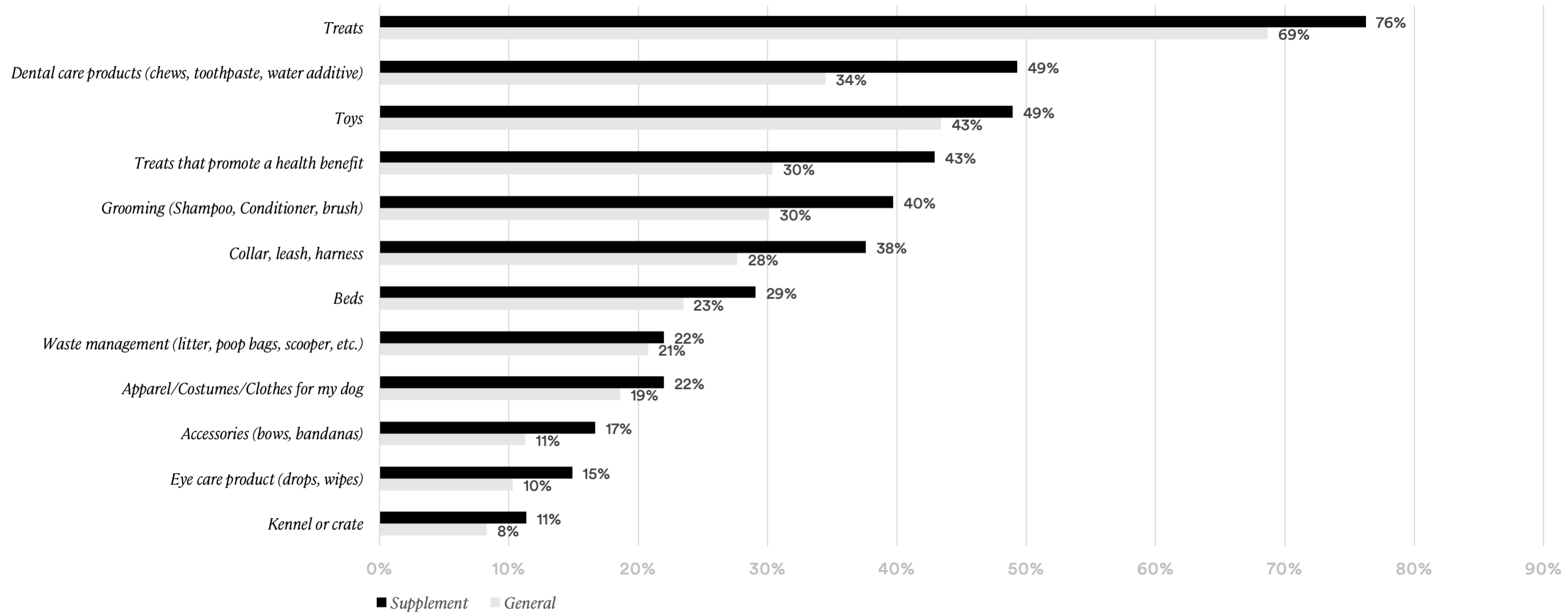

- The pet supplement audience is highly likely to have, in the past 12 months, bought treats for their pets (76%; +8%)

- They are more likely than average to have, in the past 12 months, bought dental care products (49%; +15%), toys (49%; +6%), treats that promote health (43%; +13%), grooming products (40%; +10%), or collar/leash/harness products (38%; +10%)

SHOPPING BEHAVIORS

Consider all of the purchases you’ve made in the past 12 months, including and beyond pet products. For each statement, indicate the frequency with which the statement applies.

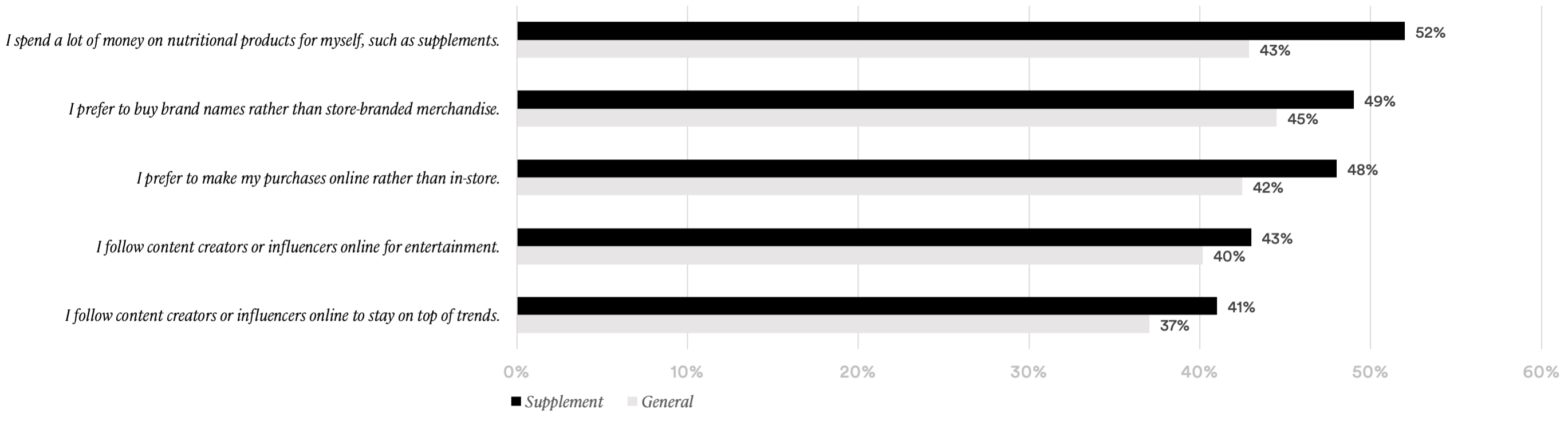

OFTEN OR SOMETIMES

SHOPPING PREFERENCES & INFLUENCERS

Read the list of statements below. For each statement, indicate the extent to which you agree or disagree.

SOMEWHAT OR STRONGLY AGREE WITH STATEMENT

PET PRODUCT RETAIL CHANNELS

From which of the following have you purchased products for your pet(s) in the past 12 months, if any? Select all that apply.

PET PRODUCT PURCHASES

Which of the following have you purchased for your pet in the past 12 months, if any? Select all that apply.

Psychographics & Health-Oriented Lifestyles

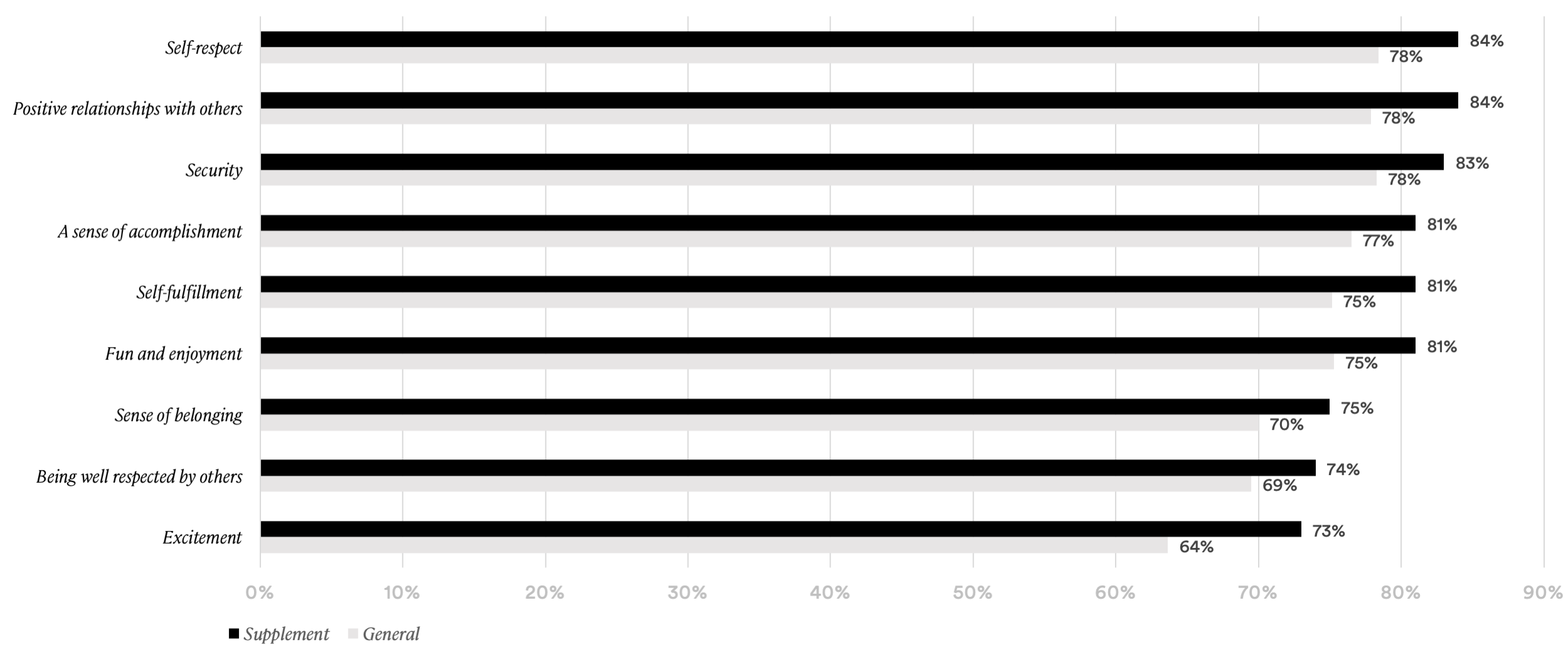

- The pet supplement audience is highly likely to place importance on self-respect (84%; +6%), positive relationships (84%; +6%), security (83%; +5%), a sense of accomplishment (81%; +6%), self-fulfillment (81%; +6%), and fun and enjoyment (81%; +6%)

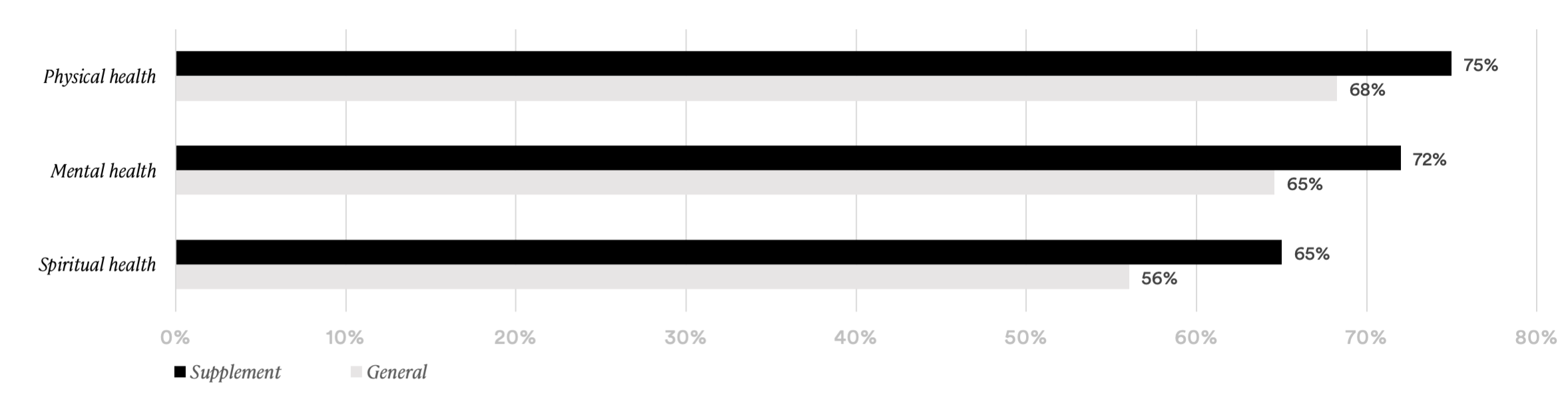

- The pet supplement audience is more likely than the average pet parent to dedicate time to physical health (75%; +7%), mental health (72%; +7%), and spiritual health (65%; +9%)

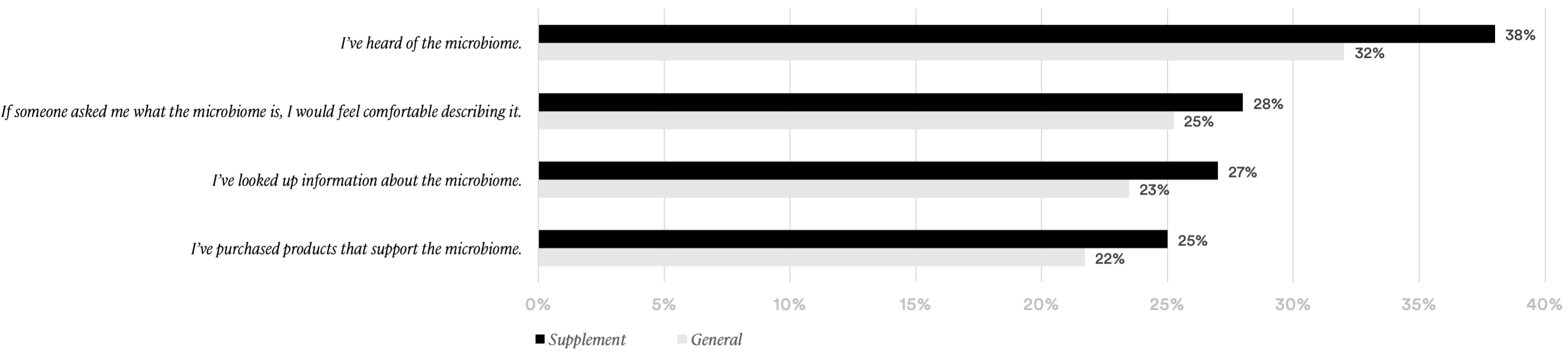

- The pet supplement audience is more likely than the general audience to have heard of the microbiome (38%; +6%) and to have looked up information about the microbiome (27%; +4%)

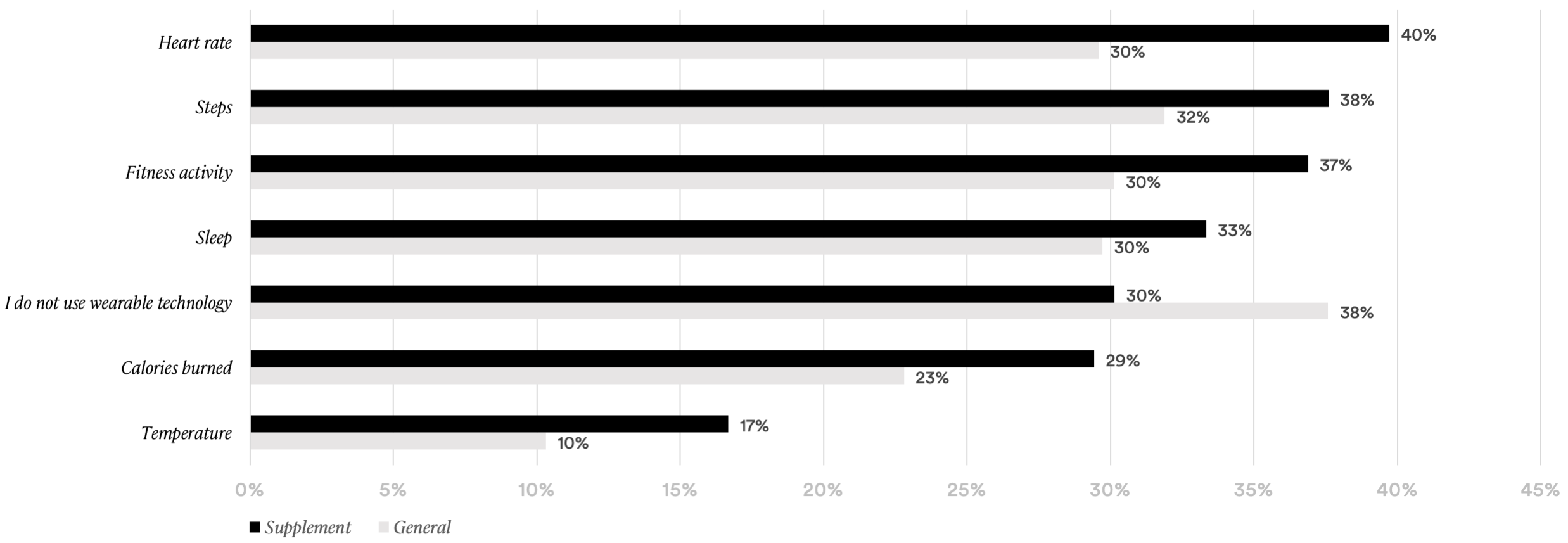

- The pet supplement audience is more likely than the average pet parent to report using wearable technology to monitor heart rate (40%; +10%), steps (38%; +6%), and fitness activity (37%; +7%)

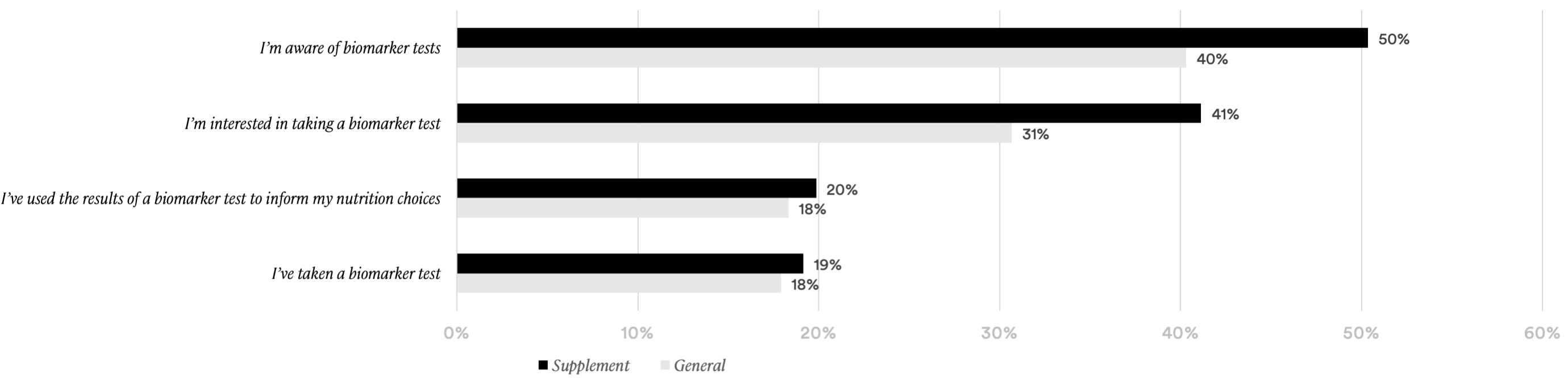

- Half of the pet supplement audience reports being aware of biomarker tests (50%; +10%)

- The pet supplement audience is more likely to be interested in taking a biomarker test themselves (41%; +10%)

PERSONAL DRIVES

People have different ideas about what is important in their lives. Read the list below and rate each item in terms of how important it is to you in your daily life. Use the scale provided.

SOMEWHAT OR VERY IMPORTANT

TIME SPENT ON PERSONAL WELLNESS

I dedicate time to participate in activities that benefit my _____.

AWARENESS OF THE MICROBIOME

The following statements are about the microbiome. Read the statements below and indicate whether each applies to you.

WEARABLE TECHNOLOGY

Which of the following, if any, do you regularly monitor through wearable technology (Fitbit, Apple Watch, Oura ring, etc.)? Select all that apply.

BIOMARKER TESTS

Read the statements below and indicate whether each applies to you.

Conclusion

Pet parents who give their pet supplements are a distinct consumer subset with preferences and priorities that differ from the general pet owner. Members of the pet supplement audience are more likely to try out functional ingredients in pet products and will dedicate time researching them. They read customer reviews and are heavy online shoppers, but they also buy pet products in brick-and-mortar.

Notably, the pet supplement audience is more likely to resonate with certain values and engage in active lifestyles. They tend to see their pet as a humanized partner, a family member with whom they take adventures and view as a calming presence. Pet supplement consumers are also more likely than general pet parents to prefer products that support animal welfare causes and values, sustainability, and prefer natural packaging.

For pet brands, the findings in this report show that pet supplement consumers are a prime target audience for products with functional ingredients and health benefits for specific need-states. By better understanding the awareness, attitudes, and behaviors of this subgroup, brands can effectively position products that speak to what matters most to pet supplement consumers.

Working With MarketPlace

Founded in 2002, MarketPlace is a strategic partner to health and wellness, pet and animal, and food and beverage brands. Through business strategy, industry focus, and marketing expertise, we help our partners grow.

If you have any questions or would like to request more information about our study, please contact us at hello@marketplacebranding.com. If you’re working to launch a supplement brand or to expand your brand offerings and distribution, we do that too—let’s talk!