Human to Pet Nutrition: 2021 Pet Shopper Statistics

(This is part one in a series of three white papers we’re calling Human to Pet Nutrition, which covers the crossover in the preferences that pet parents have for their nutrition products and their pets’ supplements. Read part two.)

Executive Summary

To better understand U.S. consumer trends in pet supplements, MarketPlace surveyed pet parents regarding their awareness, attitudes, and behaviors related to the category. This report presents the findings of this study, along with implications for pet supplement brands.

Key Findings

- Price and a specific benefit are the first things pet parents look for in a pet supplement. Pet parents who regularly give their pet a supplement are more likely to seek a specific benefit.

- About one in five pet parents said that food meets their pets’ nutritional needs, so they give supplements for specific conditions.

- When it comes to gaining confidence in a pet supplement, pet parents indicated a strong preference for “vet recommended” and “clinically proven.”

- The most preferred delivery formats for pet supplements are soft chews, treats with health benefits, and toppers. Pet parents who regularly give their pet a supplement are more likely to prefer soft chews and toppers.

- Many pet parents favor pet supplements with ingredients used in human supplements. Six in 10 who give their pet a supplement agreed that their pets should consume only ingredients that they would themselves consume.

- Pet parents who give their pet a supplement at least once per week are much more likely than average to have purchased certain condition-specific products: skin and coat, joint health, daily wellness, digestion, and immunity.

- The top ingredients pet parents reported associating with positive health benefits are:

- Fish oil

- Probiotics

- Vitamin D

- Antioxidants

- Omegas 3 and 6

- Glucosamine

- Prebiotics

- CBD (cannabidiol)

- For pet parents who give their pets a supplement at least once per week, the top claims associated with highly effective pet nutrition products are “Veterinarian approved,” “Clinically supported,” and “Veterinarian recommended.”

- Half of pet parents who give their pets a supplement at least once per week would likely seek “natural” products with health benefits for their pet, and about one-third would seek “organic” products.

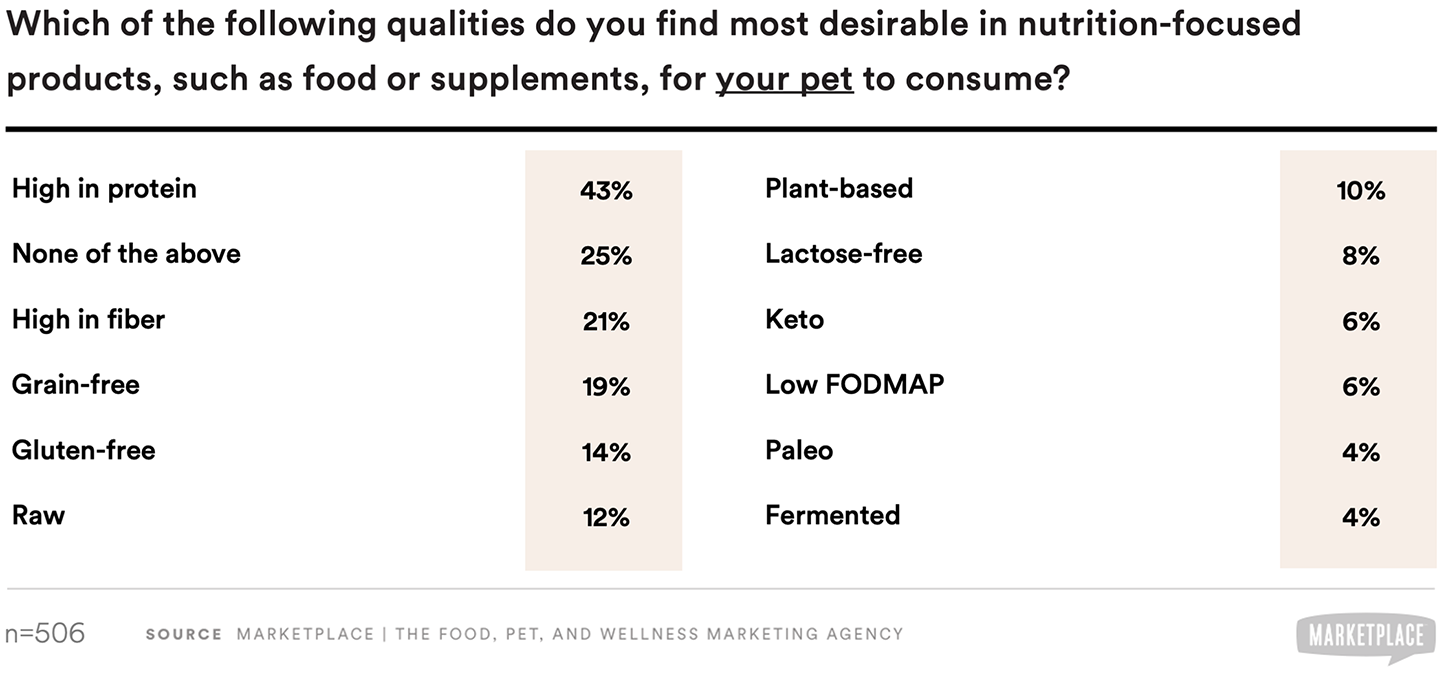

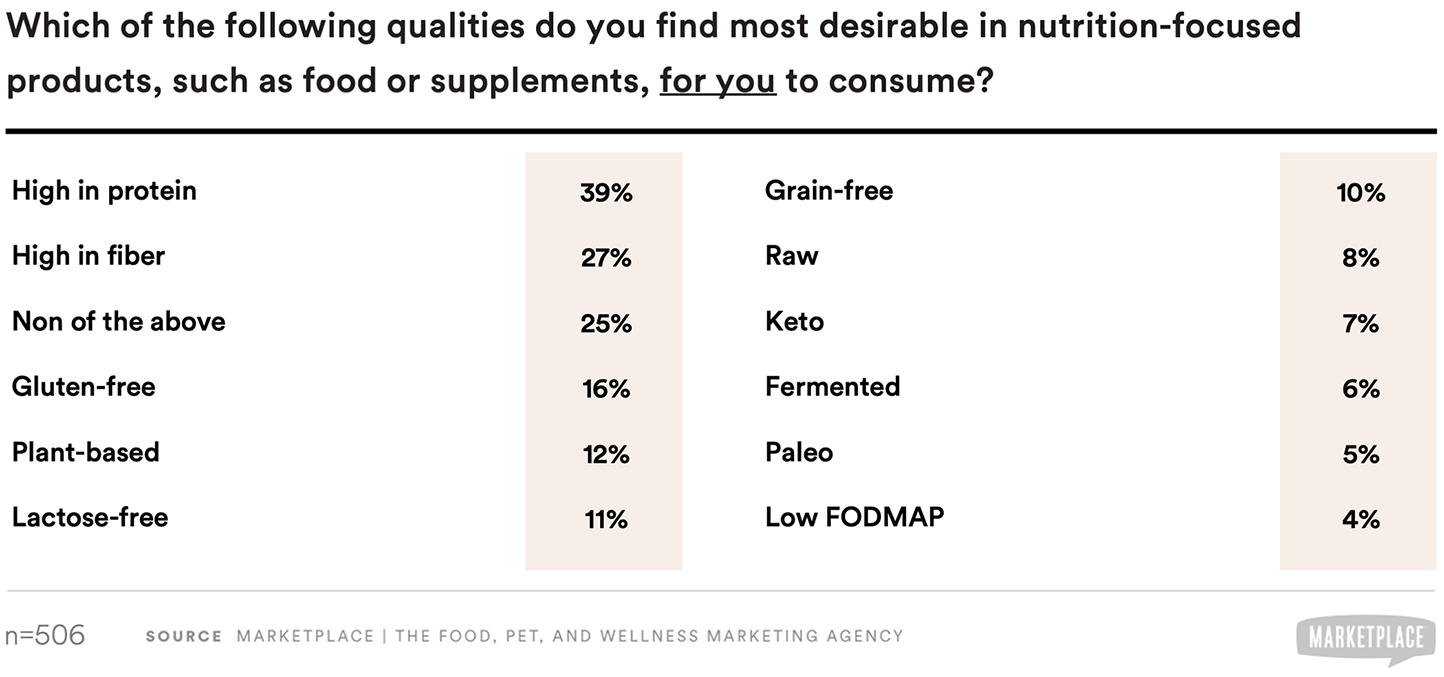

- The protein trend in human nutrition has likely influenced pet parents’ perceptions of high-protein claims in nutrition-focused food and supplements for pets. More than four in 10 pet parents indicated that high protein is desirable in these products.

- Pet parents who give their pets a supplement at least once per week are more likely than average to be aware of subscription services for their pets and to consider using one.

- Pet parents who give their pets a supplement at least once per week are more likely than average to say it is important to them that the products they buy for their pets are:

- Made in the USA

- Sustainably made

- Made from upcycled ingredients

- Manufactured from a transparent supply chain

- Ethically sourced

- Fair trade certified

- Not involved in animal testing

- Made from human grade ingredients

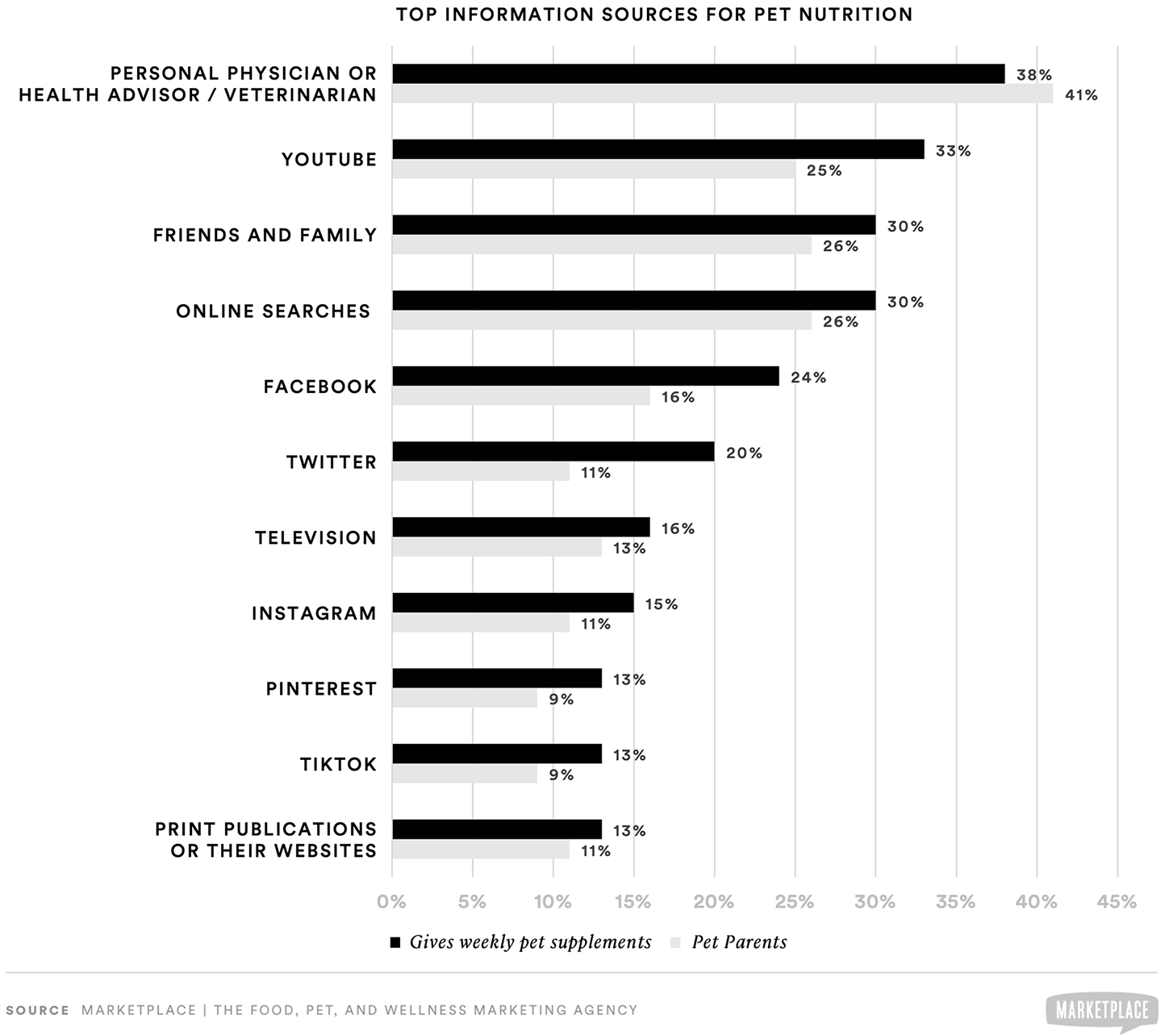

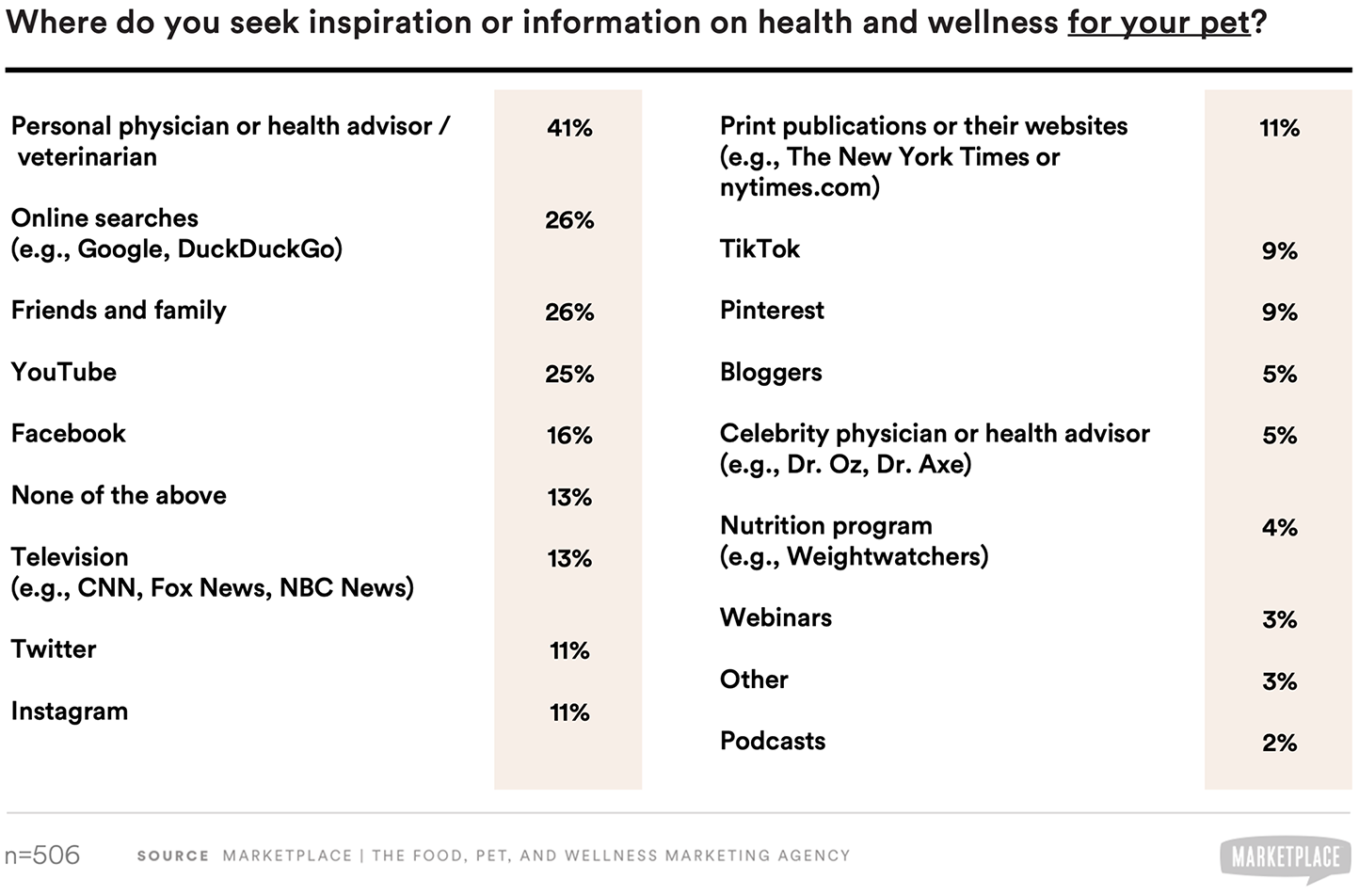

- When it comes to information sources about pet nutrition, pet parents who give their pets a supplement at least once per week tend to go to their personal vet, YouTube, friends and family, online searches, or Facebook.

Methodology

MarketPlace conducted a survey of pet parents to develop insights into consumer perceptions and behaviors regarding supplements for pets. In June 2021, MarketPlace partnered with Dynata to conduct a survey of 506 U.S. pet parents who currently have at least one dog, cat, or horse. Findings from this study were presented at the 2021 Annual Conference of the National Animal Supplement Council.

Findings

Price and Specific Benefits

Price and specific benefits are the priority considerations for pet parents looking for pet supplements

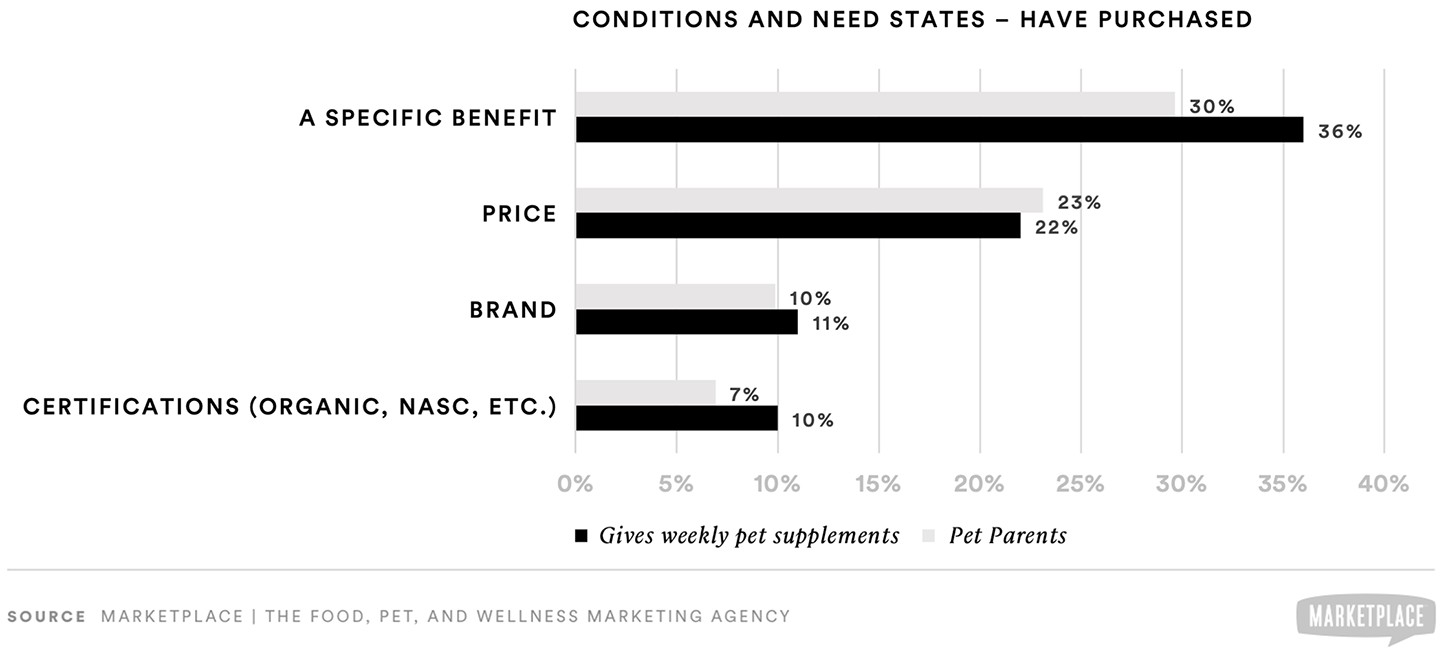

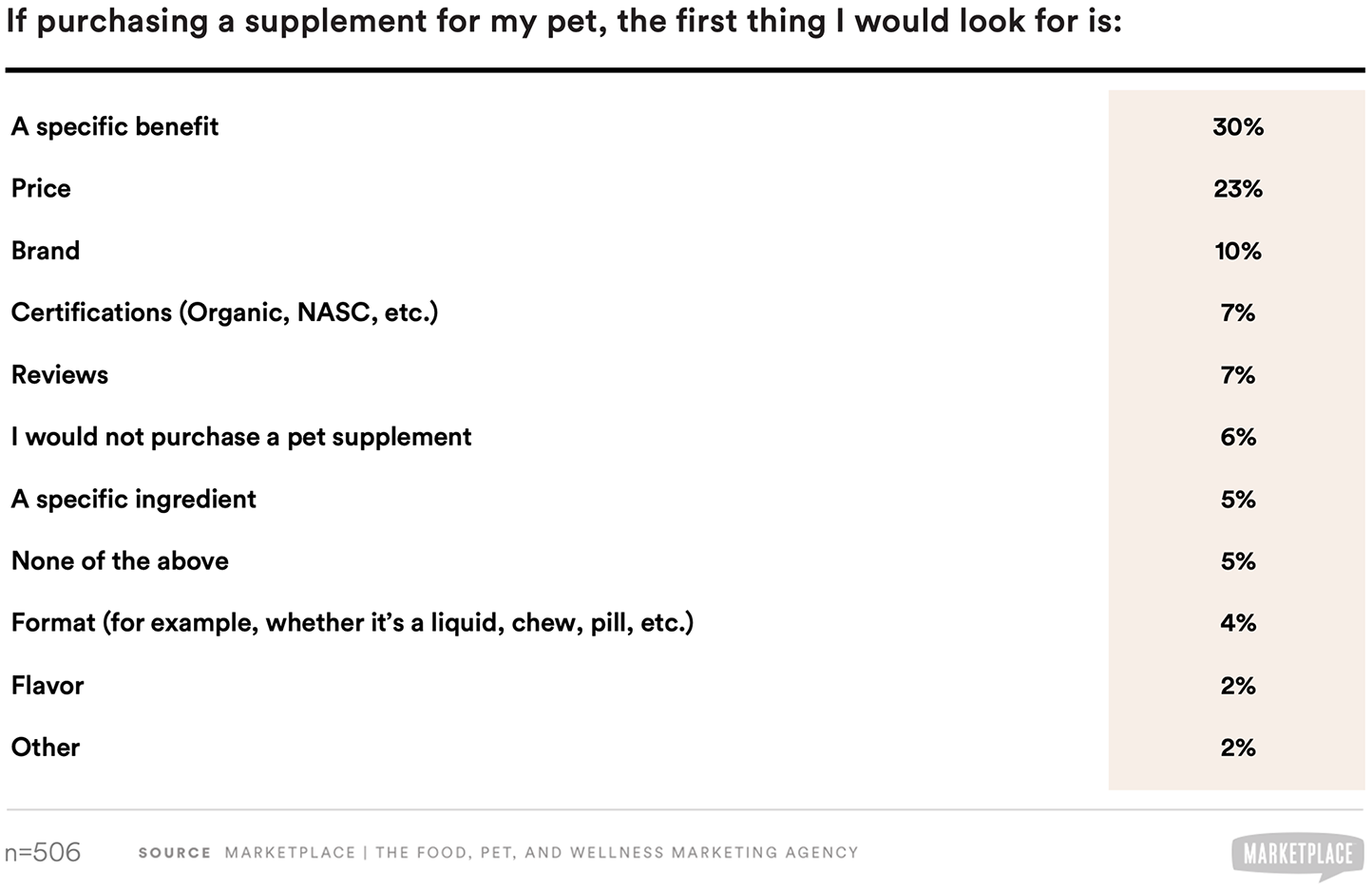

Pet parents who participated in the survey (henceforward “pet parents”) said that price (23%) and a specific benefit (30%) would be the first things they look for in a pet supplement. Pet parents who take a supplement for themselves at least once per week indicated similar priority for price (22%) and a specific benefit (32%). Additionally, pet parents who give their pet a supplement at least once per week are more likely than average to seek a specific benefit (36%).

BRAND INSIGHTS

Pet supplement brands are best served by focusing on effective delivery of specific benefits. Messaging and branding should focus on establishing efficacy. For brands with extensive product lines, analysis of pet specialty retail store scan data will help to optimize pricing. Since pricing is the first thing for which about one-fourth of pet parents look for when purchasing a pet supplement, it will be important to go to market at a price point that aligns with consumer expectations.

Purchase Drivers

Nutritional Needs

Perceptions vary as to the extent to which pet food meets nutritional needs

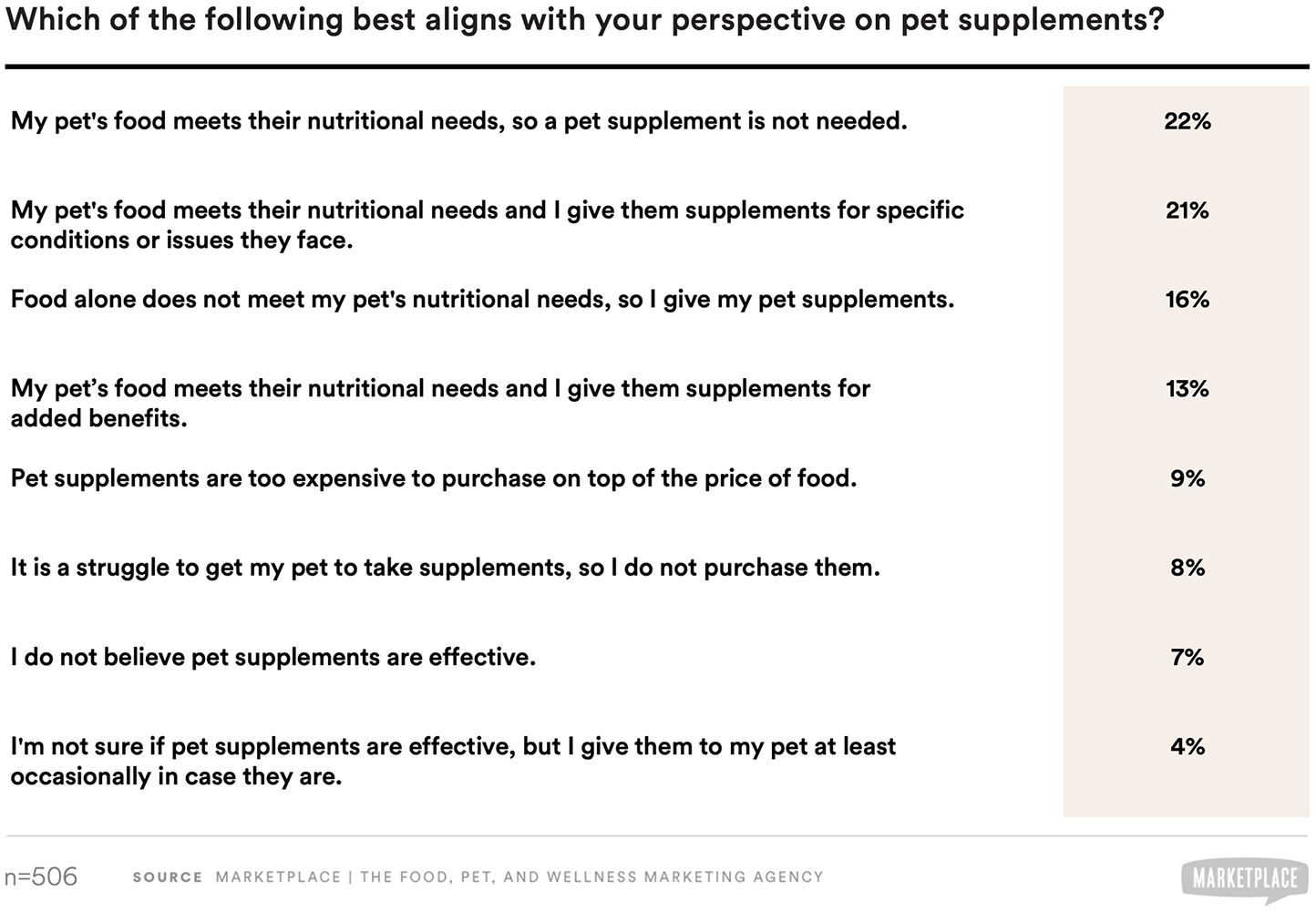

Over half of pet parents (56%) indicated that their pets’ food meets their nutritional needs. Just over one in five (22%) said the food they buy meets their pets’ needs, so they do not give them supplements. However, while 21% agreed that the food meets their pets’ nutritional needs, these pet parents said they give supplements for specific conditions. Similarly, 13% agree that the food meets their pets’ needs but give them supplements for added benefits. About 16% give supplements because they do not believe food alone has enough nutrition.

Conversely, pet parents who give their pets supplements at least once per week are much more likely to agree that:

- “My pet’s food meets their nutritional needs, and I give them supplements for specific conditions or issues they face” (29%).

- “Food alone does not meet my pet’s nutritional needs, so I give my pet supplements” (23%).

- “My pet’s food meets their nutritional needs, and I give them supplements for added benefits” (20%).

BRAND INSIGHTS

Given the variation in pet parents’ perceptions of nutritional content in pet food vis-à-vis pet supplements, supplement brands may wish to focus messaging on the specific health benefits that supplements provide and steer away from negative messaging about pet food. This way, brands may appeal to both the audience who believes pet food meets nutritional needs and those who believe it does not.

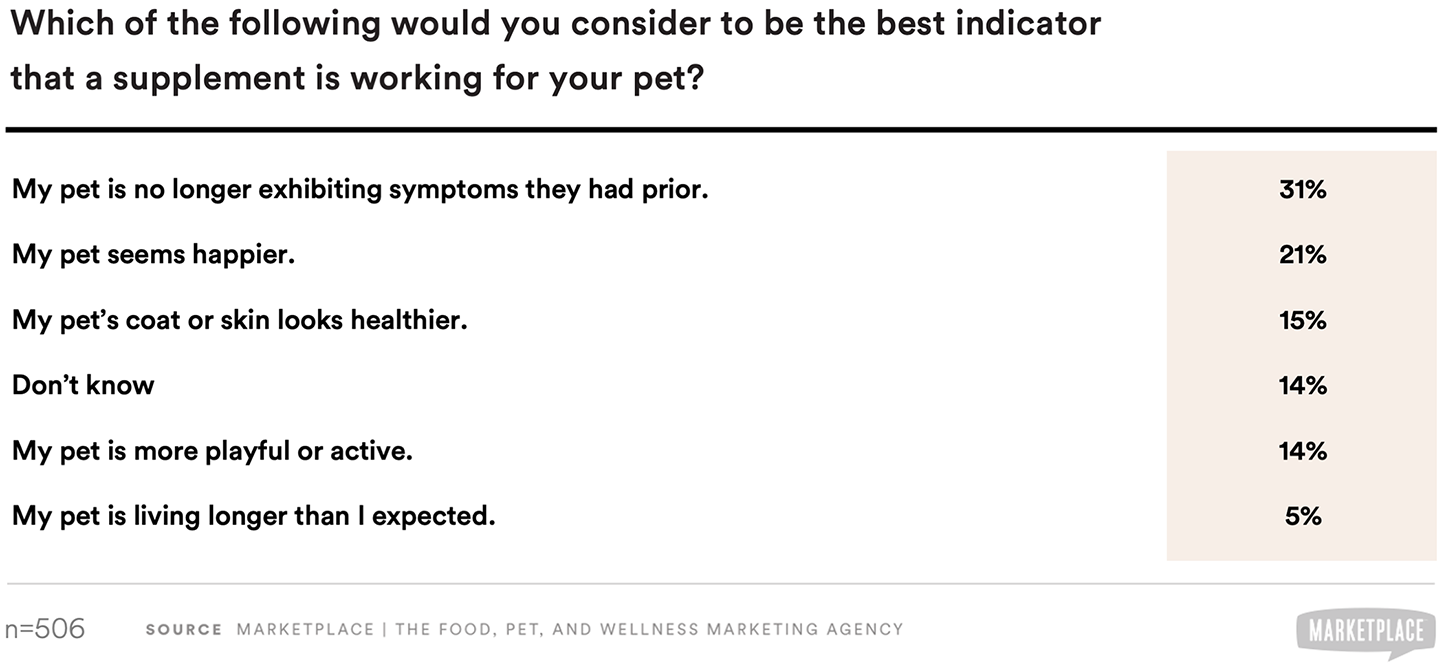

Top Indicators of Efficacy

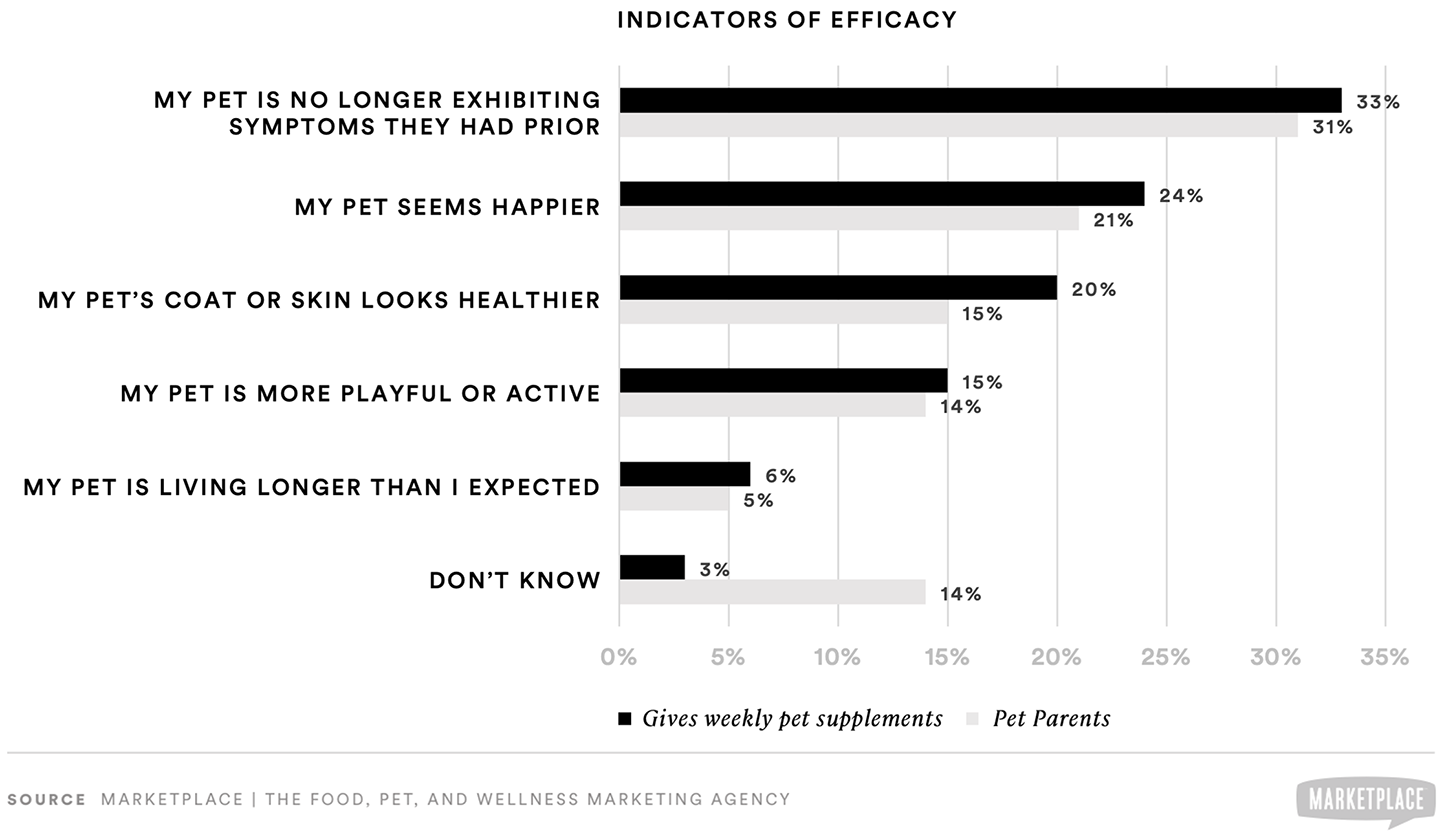

Symptom relief, perceived happiness are top indicators of efficacy

Just over half of pet parents surveyed said that the best indicator that a supplement is working is either that their pet is no longer exhibiting symptoms they had prior (31%) or that their pet seems happier (21%). Pet parents who take a supplement for themselves at least once per week indicated similarly.

Pet parents who give their pet a supplement at least once per week, on the other hand, were slightly more likely than average to agree that indicators of efficacy would be that their pet is no longer exhibiting symptoms they had prior (33%), seems happier (24%), or that their skin or coat looks healthier (20%). Very few recognized longevity as one of the best indicators of efficacy of pet supplements.

BRAND INSIGHTS

Pet supplement brands have numerous opportunities to communicate the top indicators of efficacy. Art direction and copywriting in advertising and packaging, online assets, and overall branding should communicate the possibilities of symptom abatement and happiness for pets.

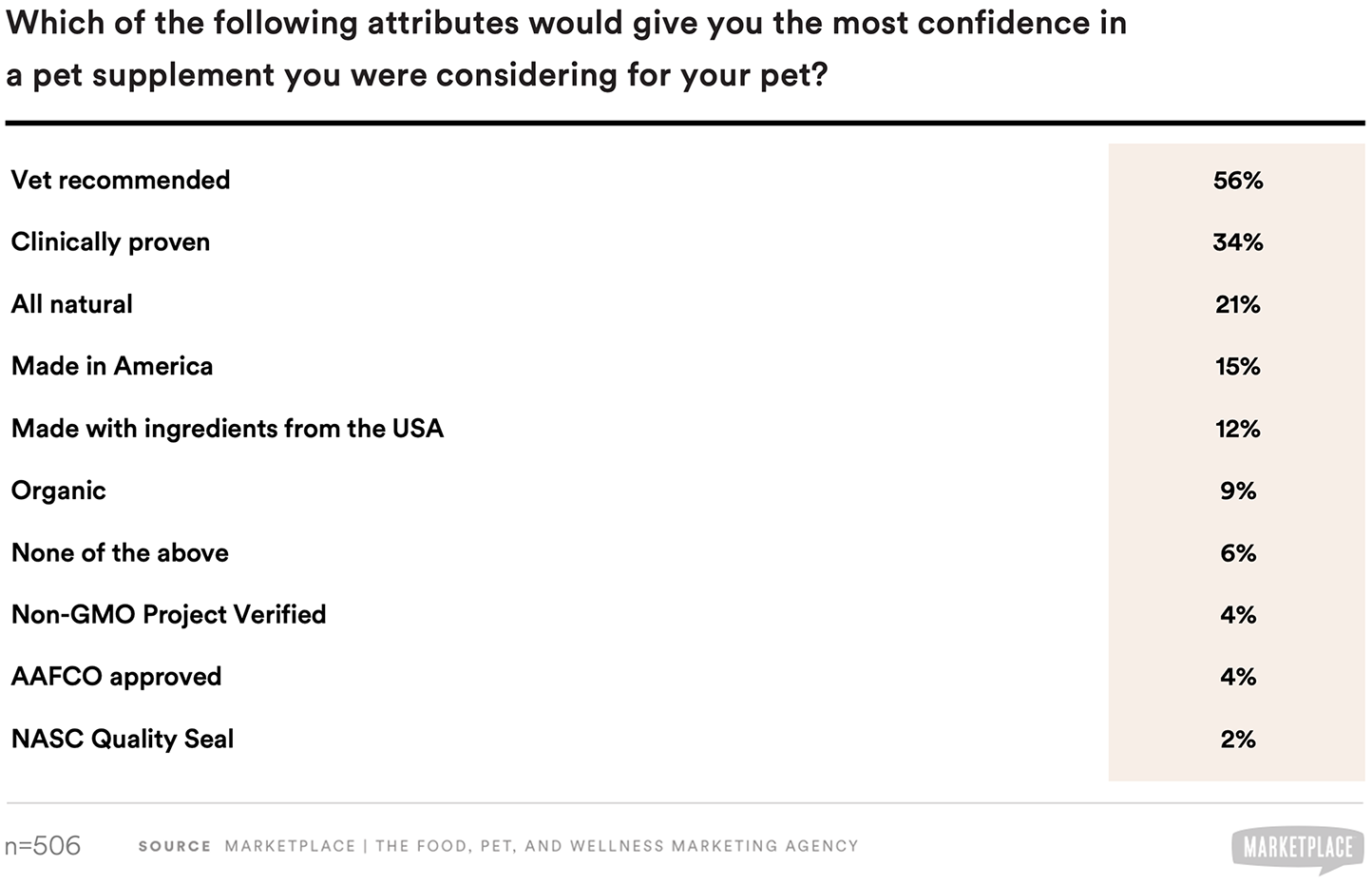

Confidence in Experts

Pet parents trust veterinarian recommendations, clinical studies

When it comes to gaining confidence in a pet supplement, pet parents indicated a strong preference for “vet recommended” (56%) and “clinically proven” (34%). These preferences suggest a preference for experts as sources of authoritative information on pet supplements. Some pet parents also indicated that “all-natural” and “Made in America” claims gave them added confidence in a pet supplement.

Pet parents who take a supplement for themselves at least once per week are more likely than average to prefer “vet recommended” pet supplements (61%). Pet parents who give their pet a supplement at least once per week, are more likely than average to prefer “all natural” (26%).

BRAND INSIGHTS

The data suggest that medically authoritative sources, such as the vet or clinical studies, have the most potential to instill confidence in a consumer for a pet supplement they are considering. Pet supplement brands that can also make “all natural” and made-in-USA claims will benefit from communicating these attributes on package, in advertising, and in other communications.

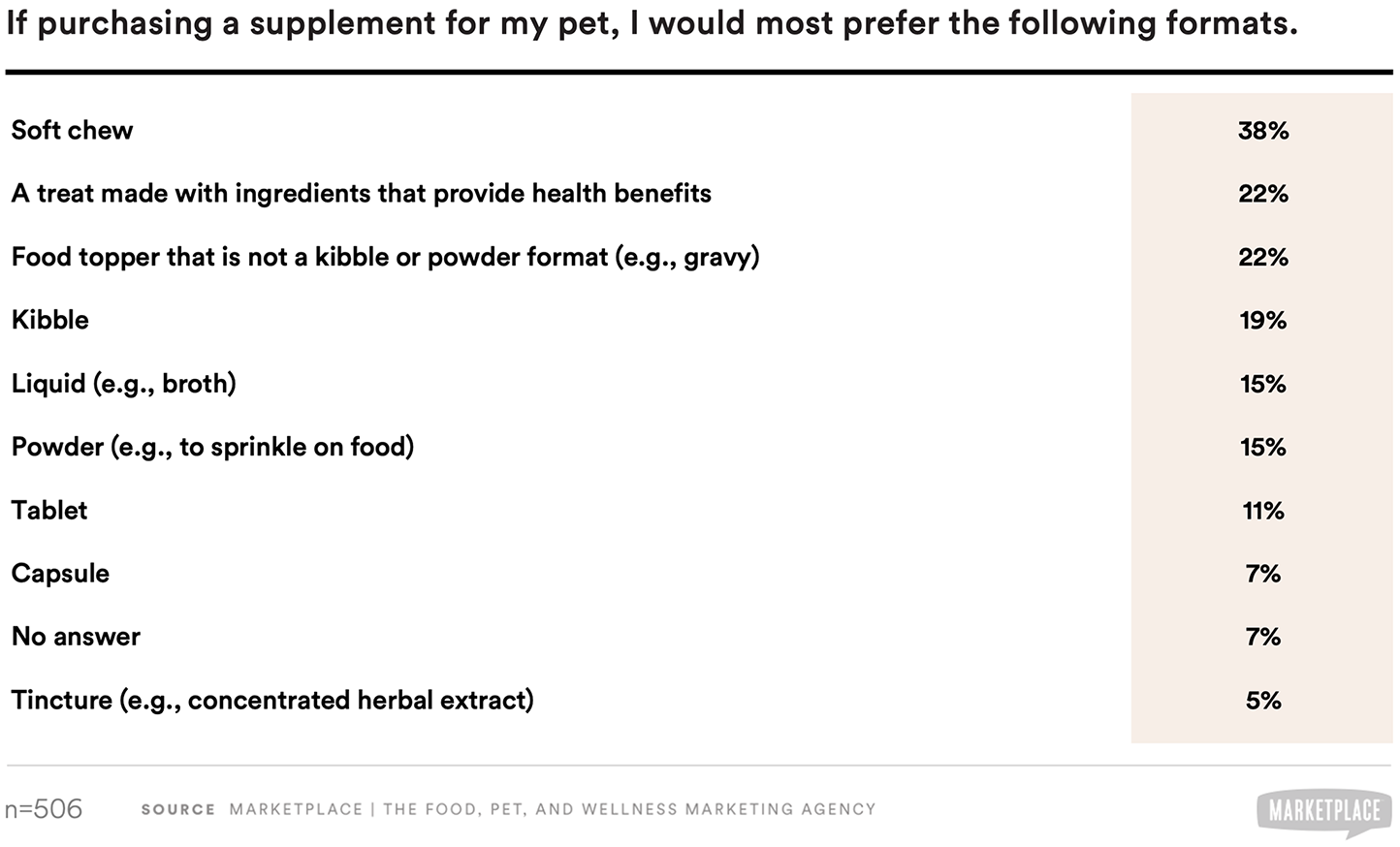

Preferred Format

Soft chews are the most preferred format for pet supplements

Although there was not a format preferred by a majority of pet parents, the most preferred delivery formats for pet supplements are soft chews (38%), treats with health benefits (22%), or toppers (not kibble or powder) (22%). Pet parents who give their pet a supplement at least once per week are more likely than average to prefer soft chews (42%) and toppers (not kibble or powder) (29%).

BRAND INSIGHTS

The data suggest that tablets (11%), capsules (7%), and tinctures (5%) are falling out of favor. Pet supplement brands may be able to carve out a niche within one or more formats. However, soft chews, treats, and toppers will have the broadest appeal and should be a good fit for brands with extended product lines.

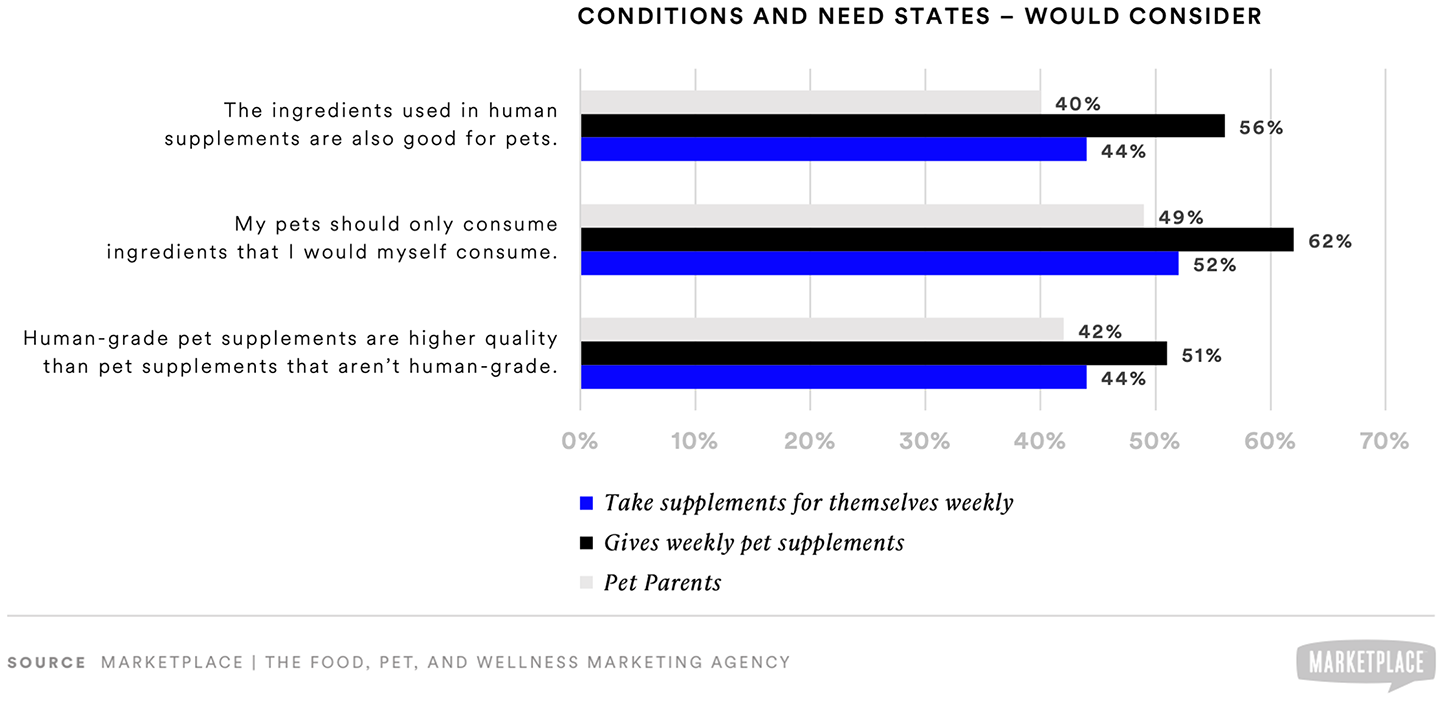

Human-grade Pet Supplements

Pet parents tend to associate ingredients used in human supplements with high quality

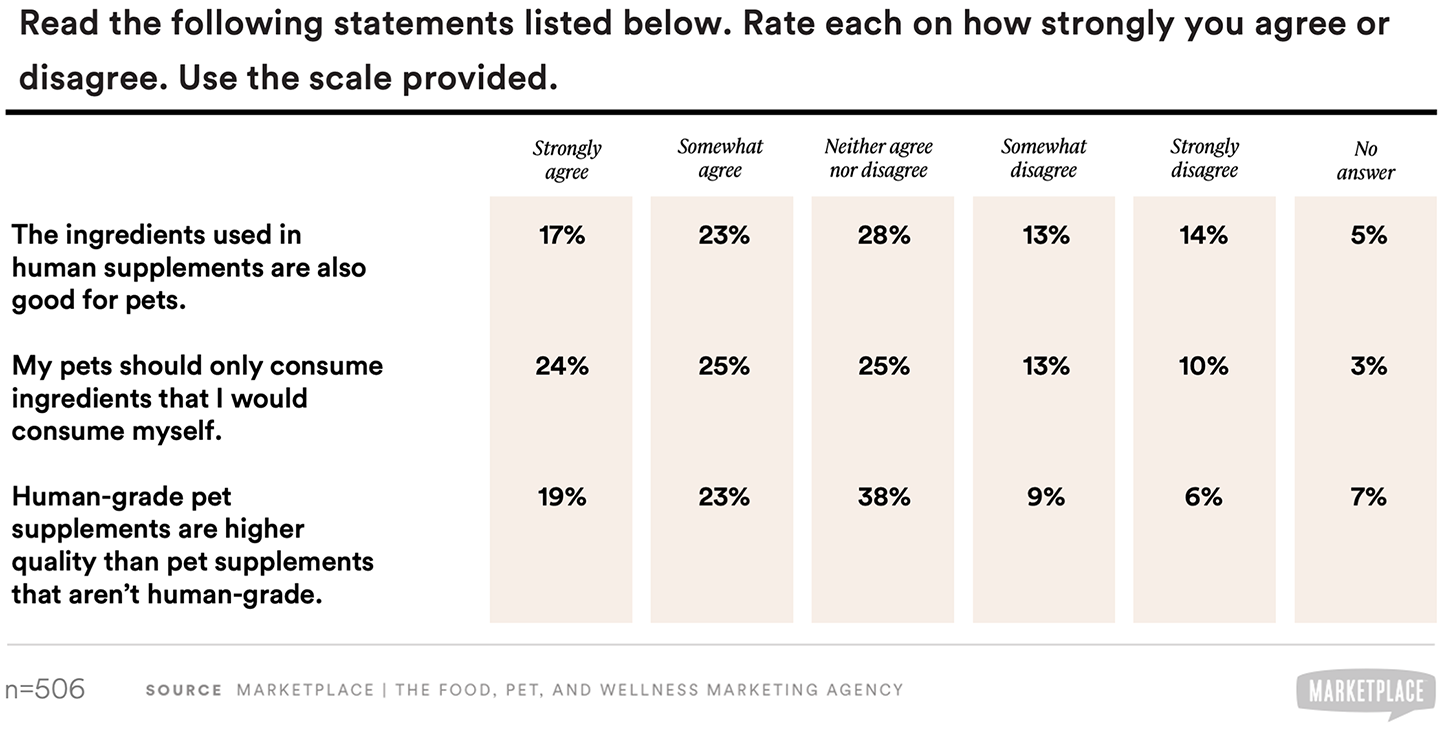

Many pet parents favor pet supplements with ingredients used in human supplements. About four in 10 pet parents (40%) surveyed agreed that ingredients used in human supplements are also good for pets. Nearly half of pet parents (49%) agreed pets should consume only ingredients that they would themselves consume. And 42% of pet parents surveyed agreed that human-grade pet supplements are higher quality than pet supplements that are not human-grade.

Over half of pet parents (52%) who take supplements for themselves agreed that pets should consume only ingredients that they would themselves consume. Pet parents who give their pet a supplement at least once per week are much more likely than average to agree that:

- “The ingredients used in human supplements are also good for pets” (56%)

- “My pets should only consume ingredients that I would myself consume” (62%)

- “Human-grade pet supplements are higher quality than pet supplements that aren’t human-grade” (51%)

BRAND INSIGHTS

Elsewhere in this study, the data point to positive associations with common human supplement ingredients in pet supplements. These include fish oil, probiotics, antioxidants, and omegas 3 and 6 fatty acids. Pet parents who already give their pets supplements at least once per week are more likely to have these positive associations. These findings suggest that pet parents are primed to associate quality with common human supplement ingredients in pet supplements.

Personal Supplement Usage

Pet parents are likely to take supplements for themselves

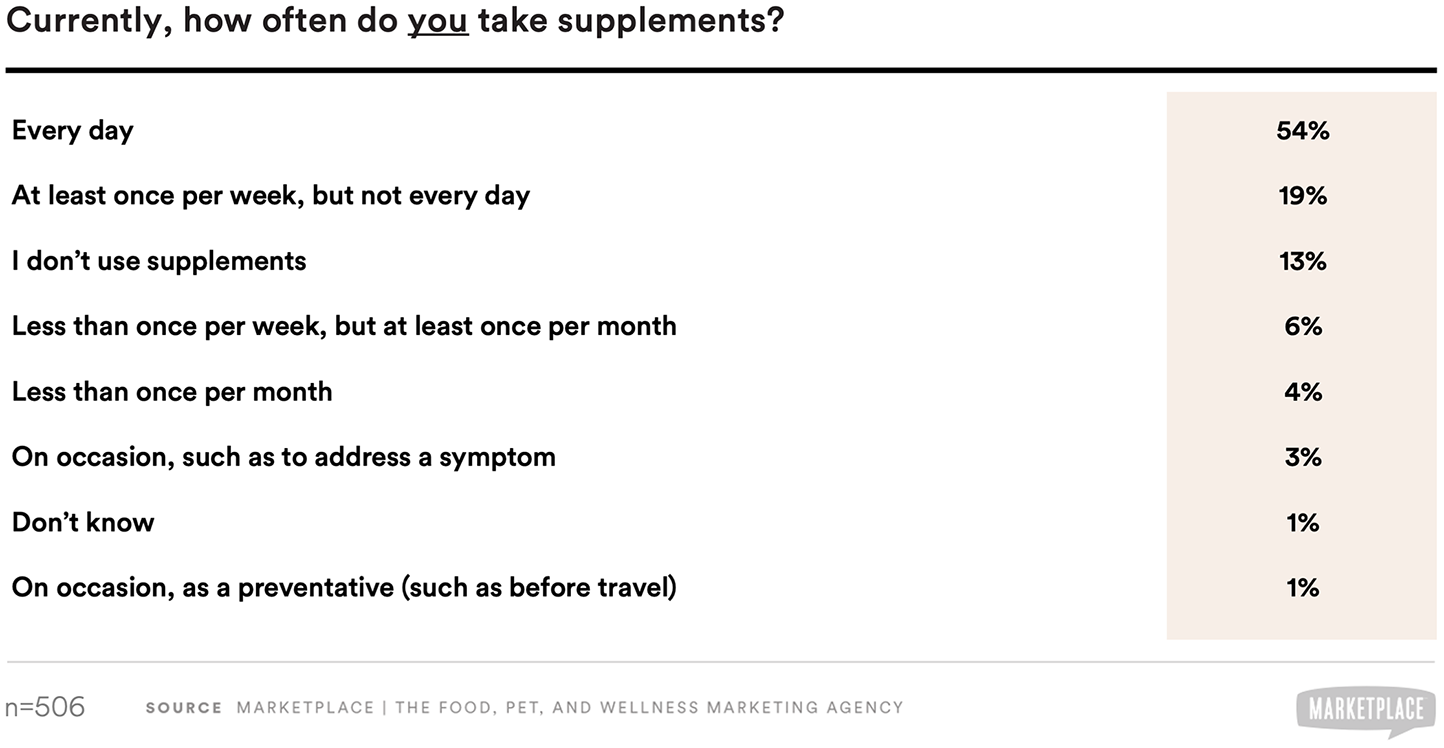

Taking supplements for oneself is popular among pet parents, with over half reporting taking supplements every day (54%). An additional 19% report taking a supplement at least once per week, but not every day. Pet parents who give their pet a supplement at least once per week are much more likely than average to report taking supplements every day (68%).

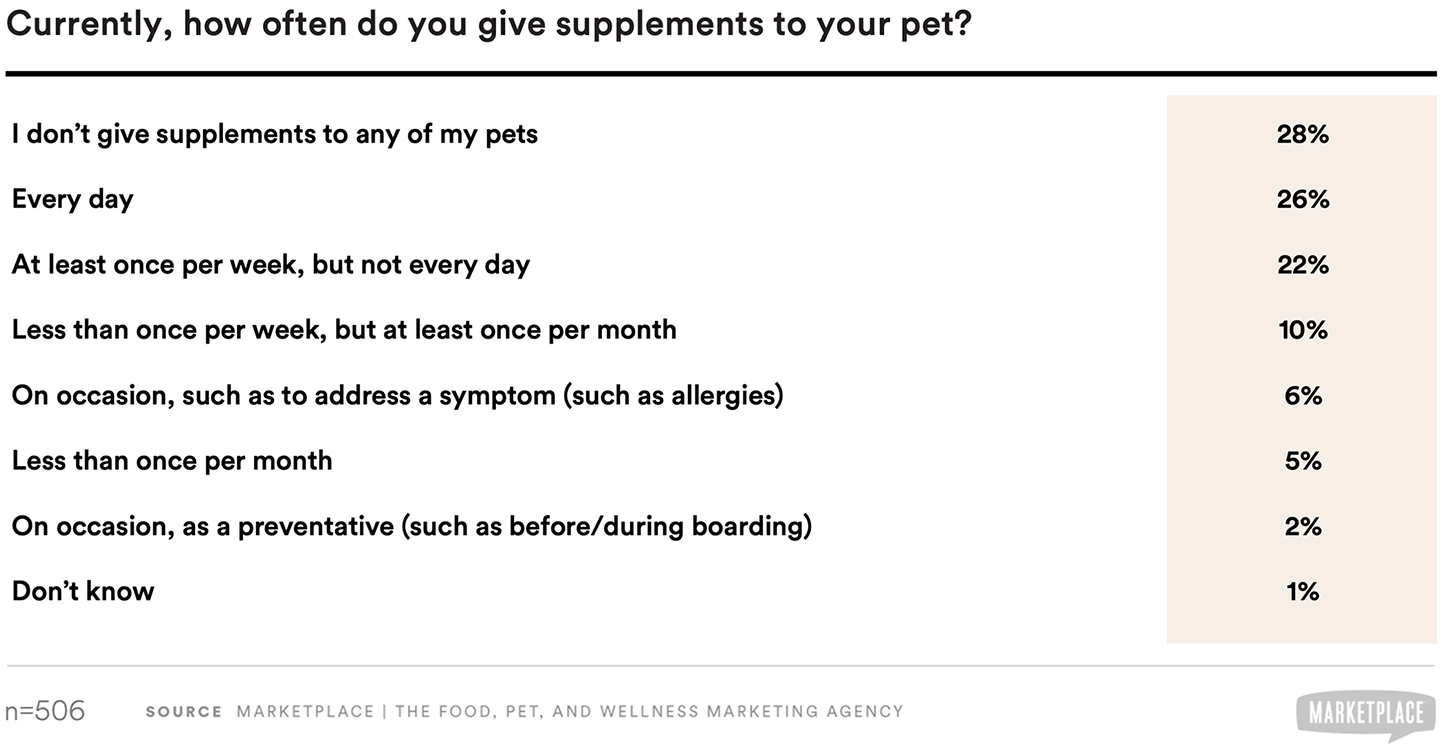

Additionally, about one-fourth of pet parents surveyed said they give their pets supplements every day (26%). Notably, pet parents who take supplements for themselves are more likely than average to give their pets supplements every day (33%).

BRAND INSIGHTS

These data bolster the aforementioned conclusion that pet parents are primed to make positive associations between common ingredients in human supplements and the same ingredients in pet supplements. This finding also suggests potential targeting opportunities in media that are popular sources for information on human supplements.

Condition-Specific Pet Supplements

Pet parents are most likely to purchase, or consider purchasing, skin and coat and joint health supplements for their pets

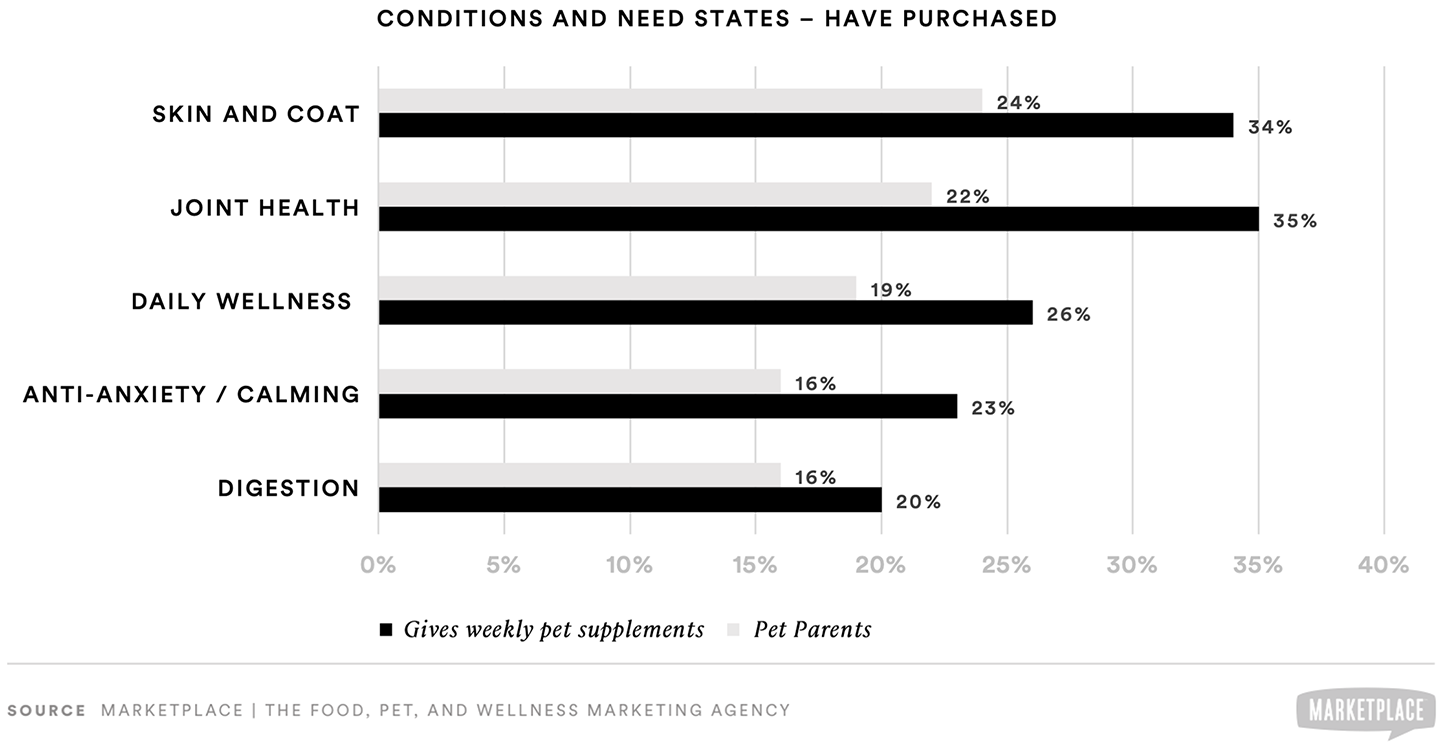

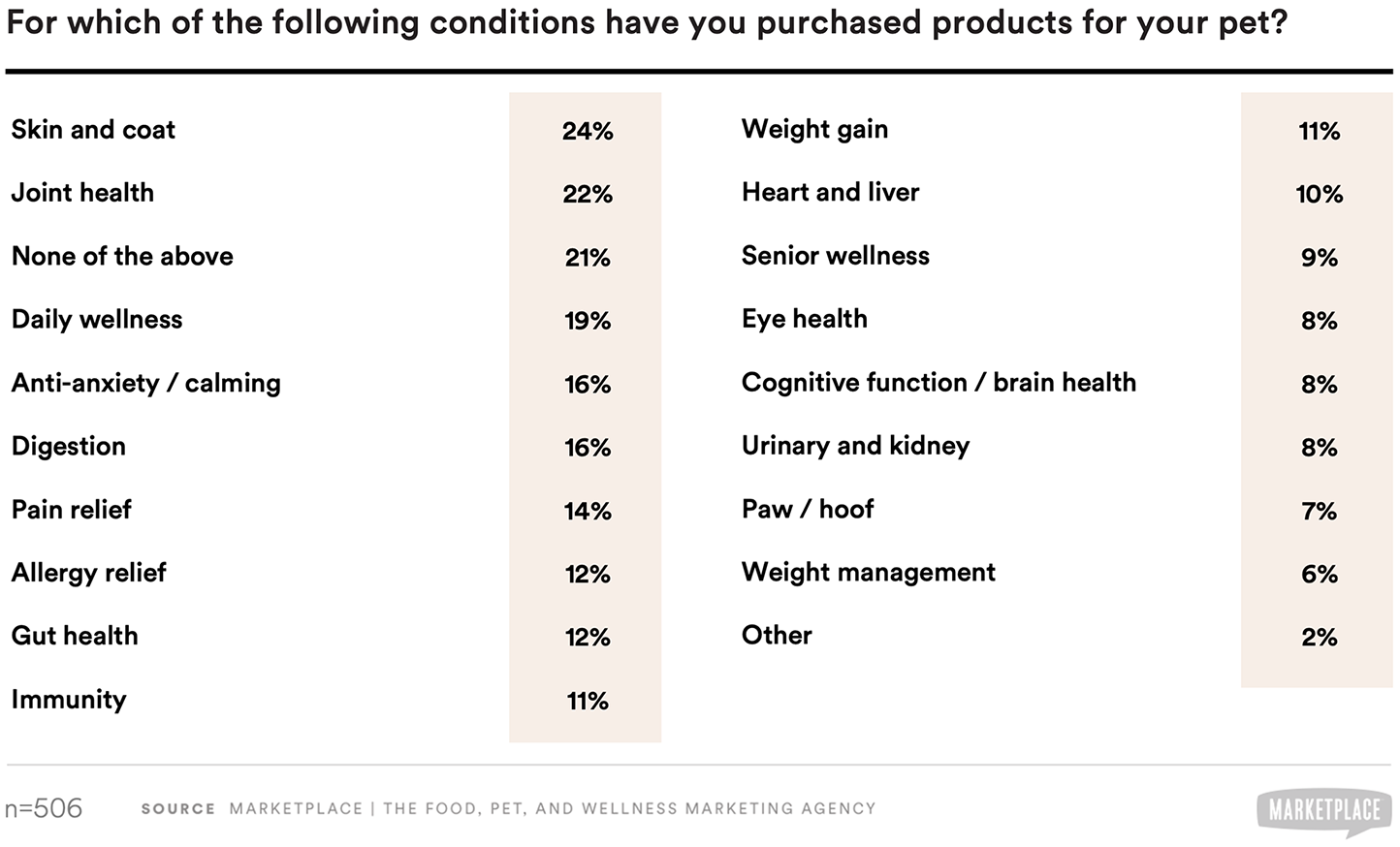

The most purchased pet supplements among pet parents surveyed are skin and coat (24%), joint health (22%), daily wellness (19%), anti-anxiety/calming (16%), and digestion (16%). Pet parents who give their pet a supplement at least once per week are much more likely than average to have purchased certain condition-specific products: skin and coat (34%), joint health (35%), daily wellness (26%), digestion (23%), and immunity (20%).

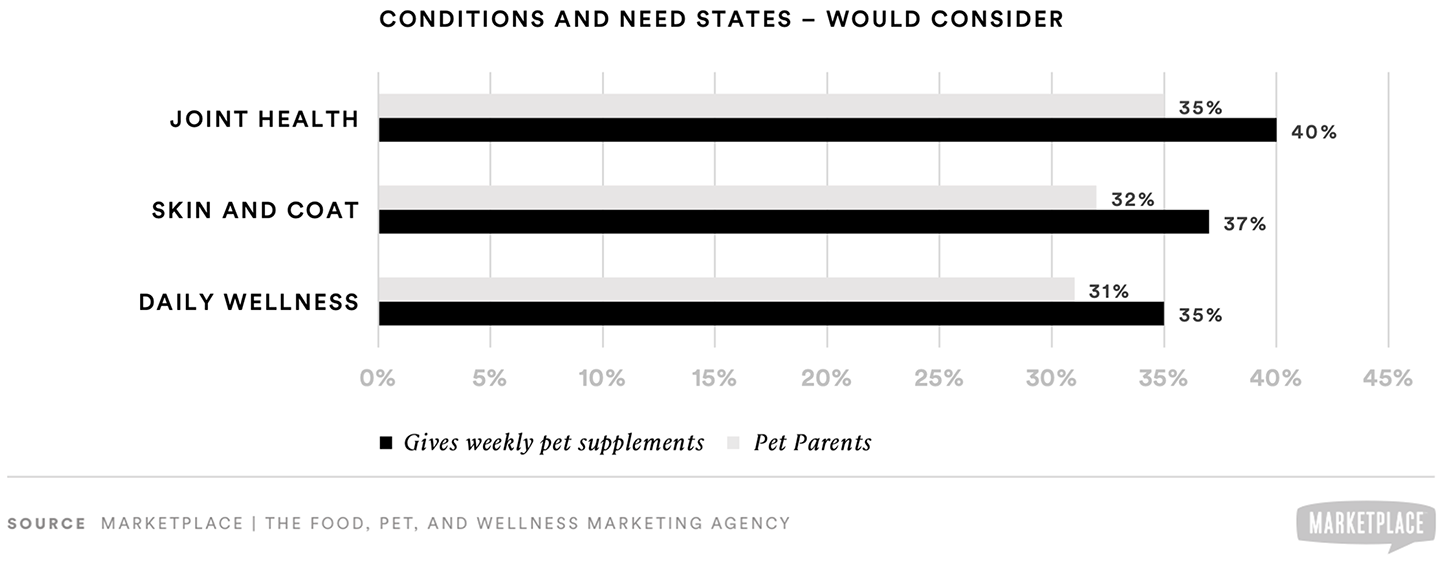

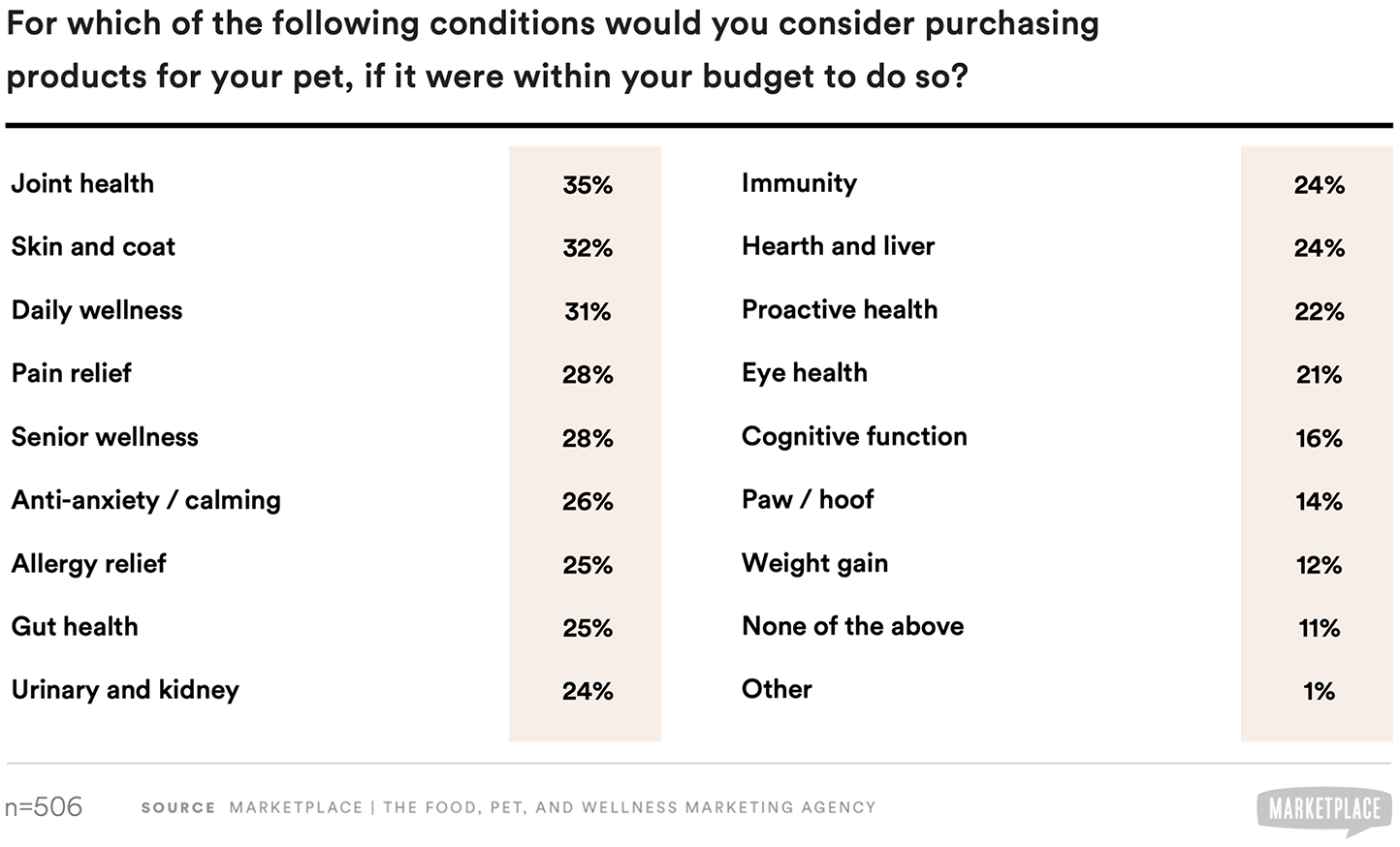

When it comes to the pet supplements pet parents might consider, they indicated that they are most likely to consider supplements for their pets’ joint health (35%), skin and coat (32%), and daily wellness (31%). Pet parents who give their pet a supplement at least once per week are much more likely than average to consider the same condition-specific products: joint health (40%), skin and coat (37%), and daily wellness (35%).

BRAND INSIGHTS

Joint health and skin and coat represent the largest opportunity in condition-specific pet supplements. A significant opportunity also exists for daily wellness products. Supplement brands that are looking to launch or expand product lines should include some or all these categories. However, brands should not overlook niche opportunities in emerging categories, such as senior wellness, anti-anxiety, gut health, and allergy.

Calming and Joint Pet Supplements

Pet parents have various contextual reasons to give, or consider giving, calming and joint supplements to their pets

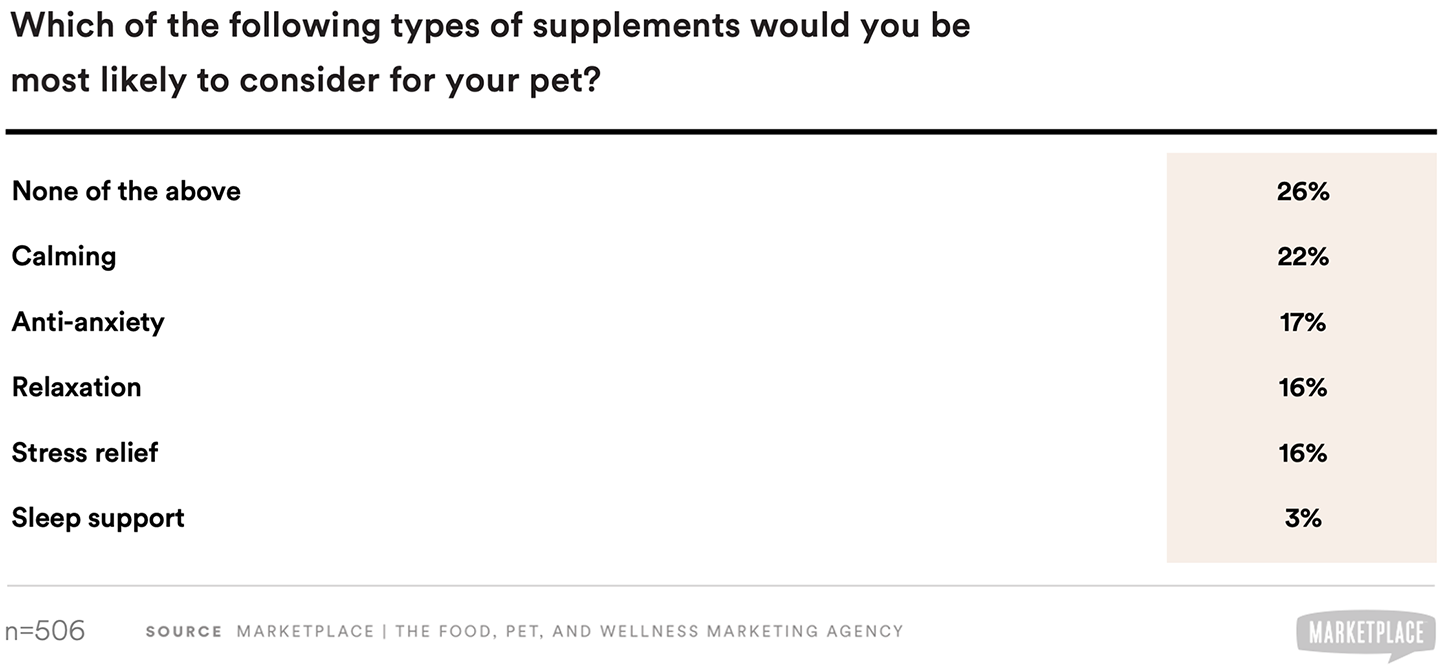

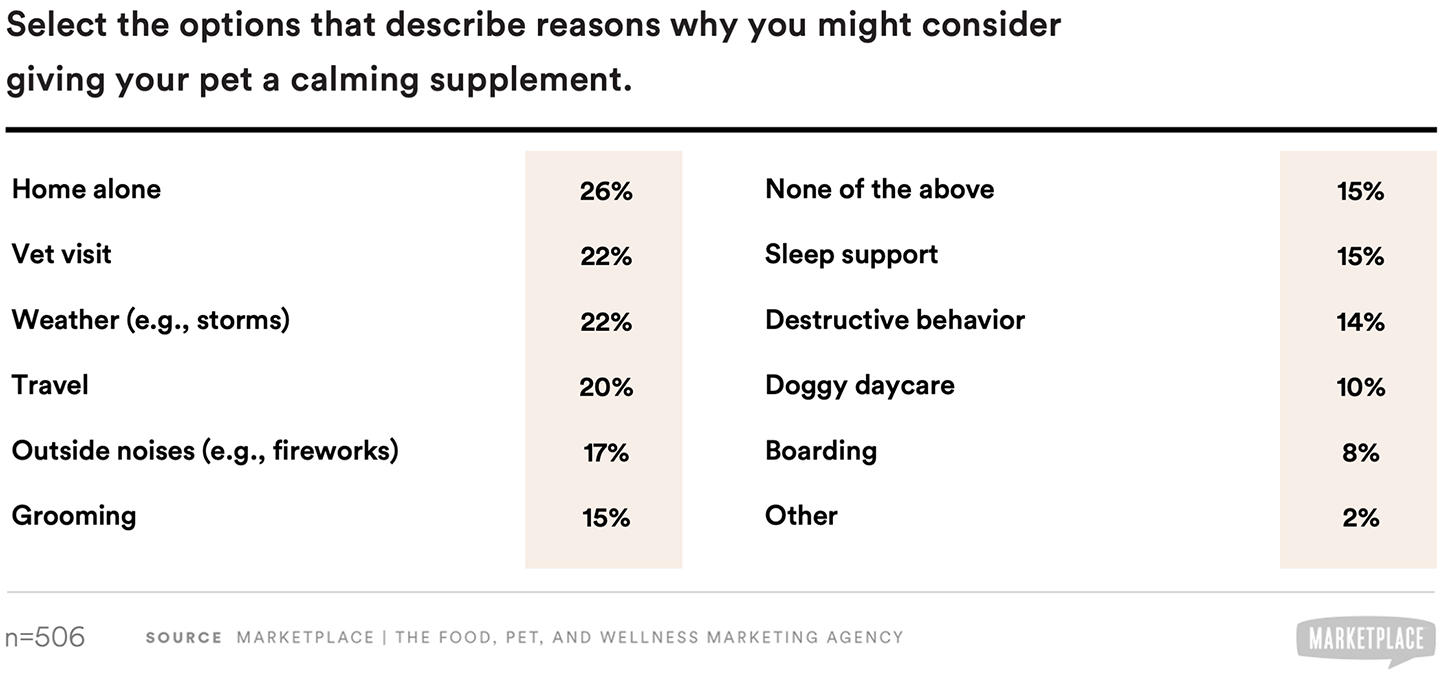

Pet parents are most likely to consider “calming” supplements (22%) over similar types of supplements. However, pet parents who give their pet a supplement at least once per week are much more likely than average to prefer “relaxation” (24%). The top reasons pet parents indicated for considering giving their pet a calming supplement are being home alone (26%), vet visits (22%), weather (storms) (22%), or travel (20%).

Pet parents who give their pet a supplement at least once per week are somewhat more likely than average to consider giving their pet a calming supplement for vet visits (26%), weather (storms) (27%), or travel (23%). These pet parents are much more likely to give calming supplements for grooming (22% vs. 15% average).

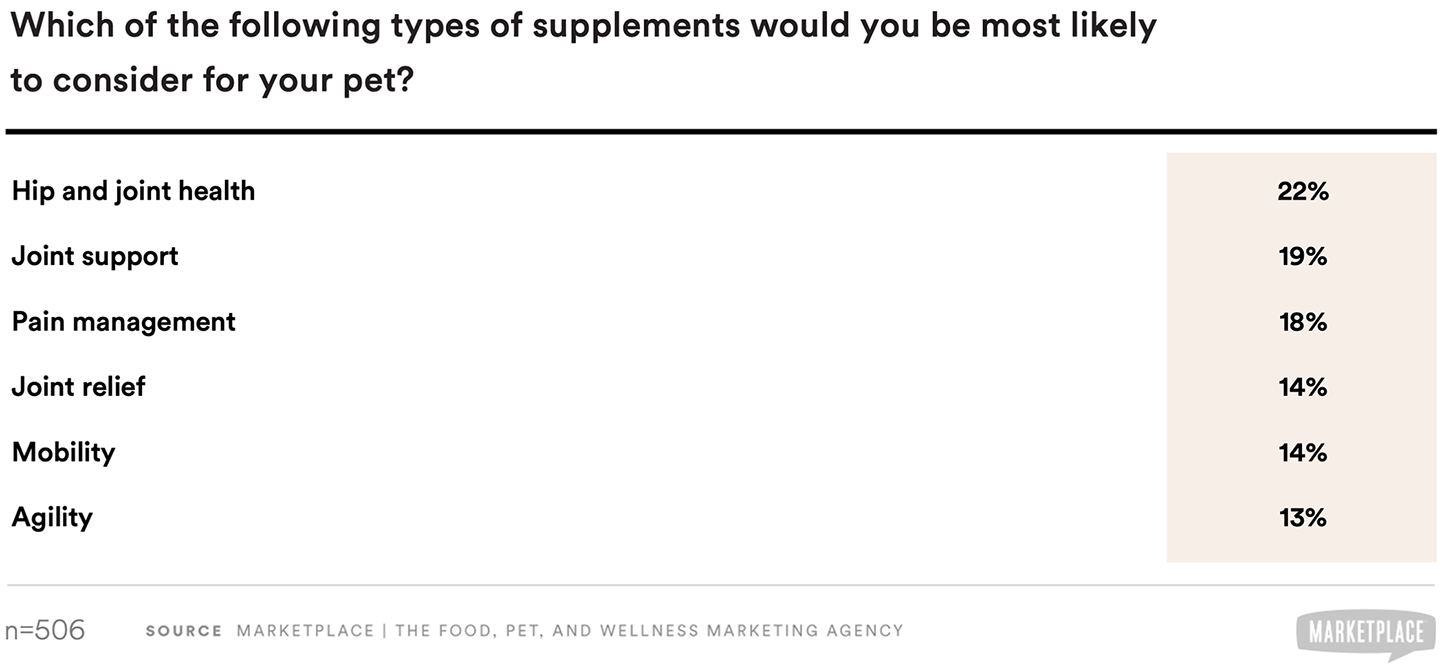

Additionally, pet parents surveyed are most likely to consider “hip and joint health” supplements (22%) over similar types of supplements. Pet parents who give their pet a supplement at least once per week are somewhat more likely than average to prefer “hip and joint health” (25%).

BRAND INSIGHTS

Given the variety of reasons that might prompt a pet parent to give a calming or relaxation supplement, pet supplement brands may wish to consider appeals to multiple contexts in their communication strategy. Advertising, packaging, and other consumer-oriented communications about “calming” or “anti-anxiety” supplements should highlight situations that may prompt a need state, like pets being left home alone, vet visits, weather, and travel. The terms “calming” and “anti-anxiety” appear to resonate most with consumers. Likewise, the term “hip and joint health” resonates with pet parents, particularly those who give their pet a supplement.

Fish Oil and Probiotics for Pets

Pet parents are most likely to associate fish oil, probiotics with health benefits for pets

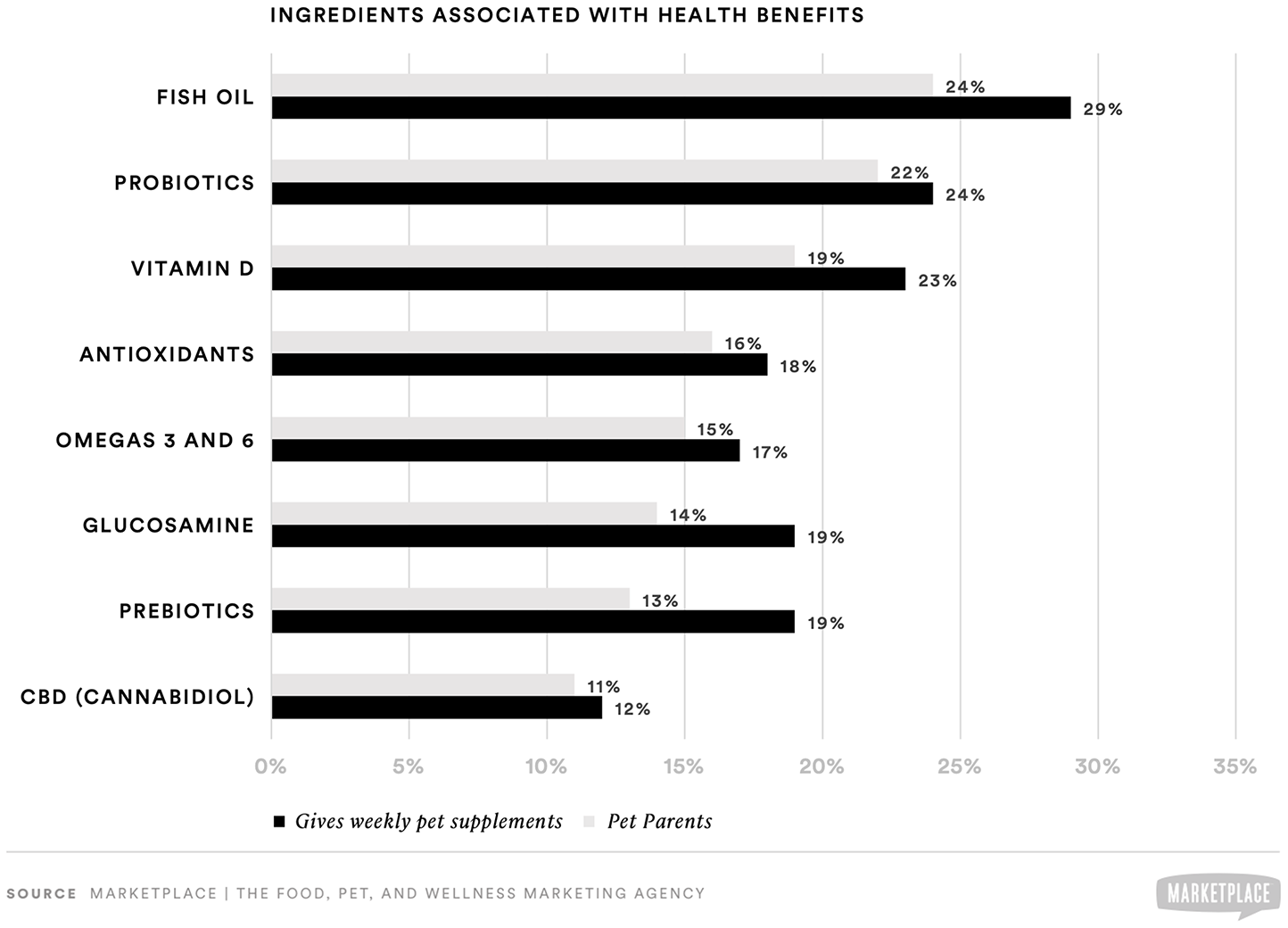

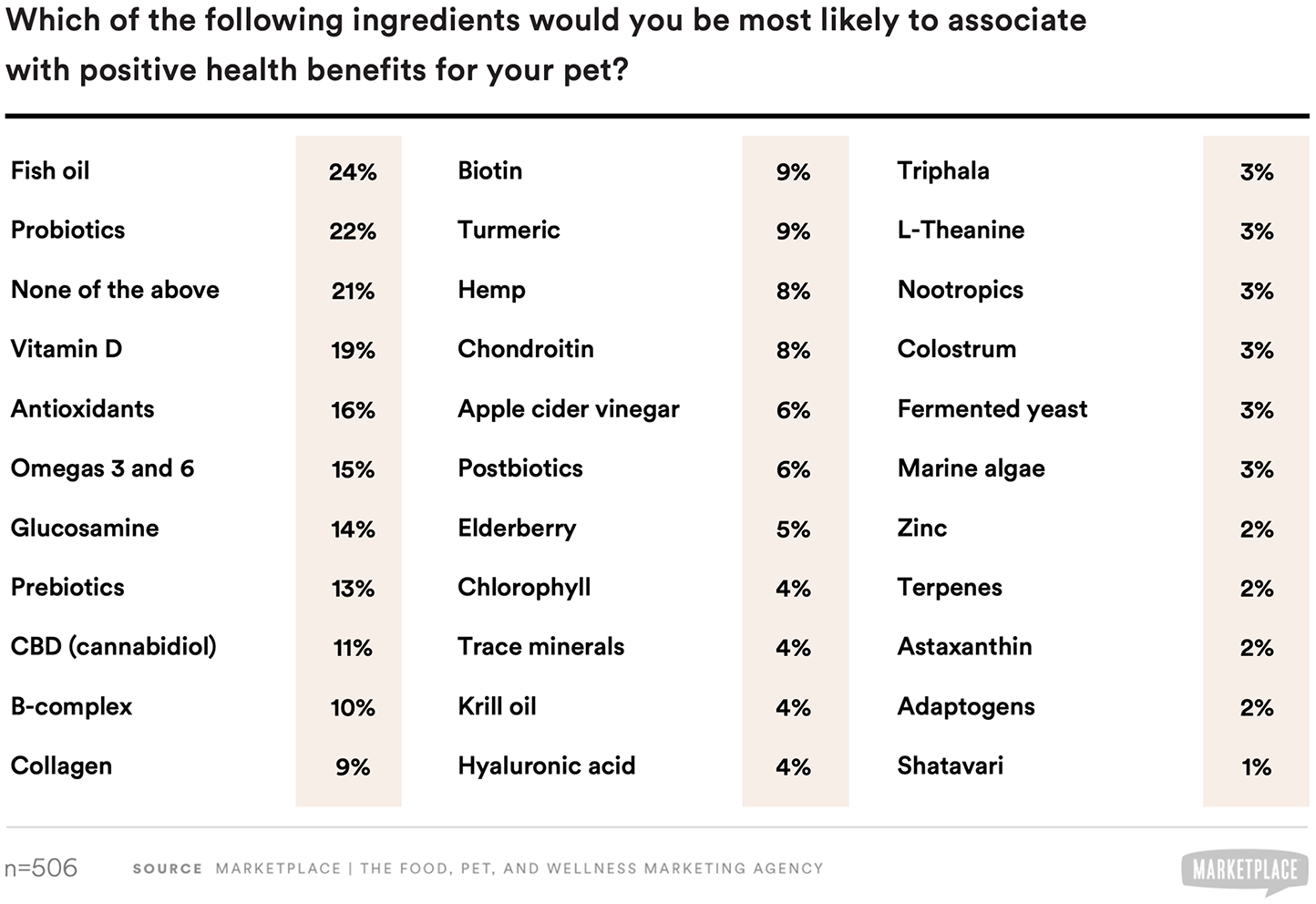

The top ingredients pet parents reported associating with positive health benefits are:

- Fish oil (24%)

- Probiotics (22%)

- Vitamin D (19%)

- Antioxidants (16%)

- Omegas 3 and 6 (15%)

- Glucosamine (14%)

- Prebiotics (13%)

- CBD (cannabidiol) (11%)

Pet parents who give their pet a supplement at least once per week are more likely than average to associate the following with health benefits:

- Fish oil (29%)

- Probiotics (24%)

- Vitamin D (23%)

- Antioxidants (18%)

- Omegas 3 and 6 (17%)

- Glucosamine (19%)

- Prebiotics (19%)

- CBD (cannabidiol) (12%)

BRAND INSIGHTS

Since pet parents are most likely to associate fish oil and probiotics with positive health benefits, these ingredients should be strongly considered for any relevant formulations. The data show that many other ingredients in human supplements, such as antioxidants, omega-3, and glucosamine, are also relevant to pet parents.

Interestingly, pet parents associated vitamin D with health benefits, even though it rarely appears as a standalone supplement. While it is an essential vitamin and needs to be ingested via diet, excessive vitamin D can be toxic to dogs. Consumer interest in vitamin D (for humans) rose during the COVID-19 pandemic. Within this context, the survey finding suggests low awareness about vitamin D and pets but further validates the conclusion that trends in human supplements are drivers of trends in pet supplements.

Made in the USA

Made in the USA claims are strong indicators of quality in pet consumables

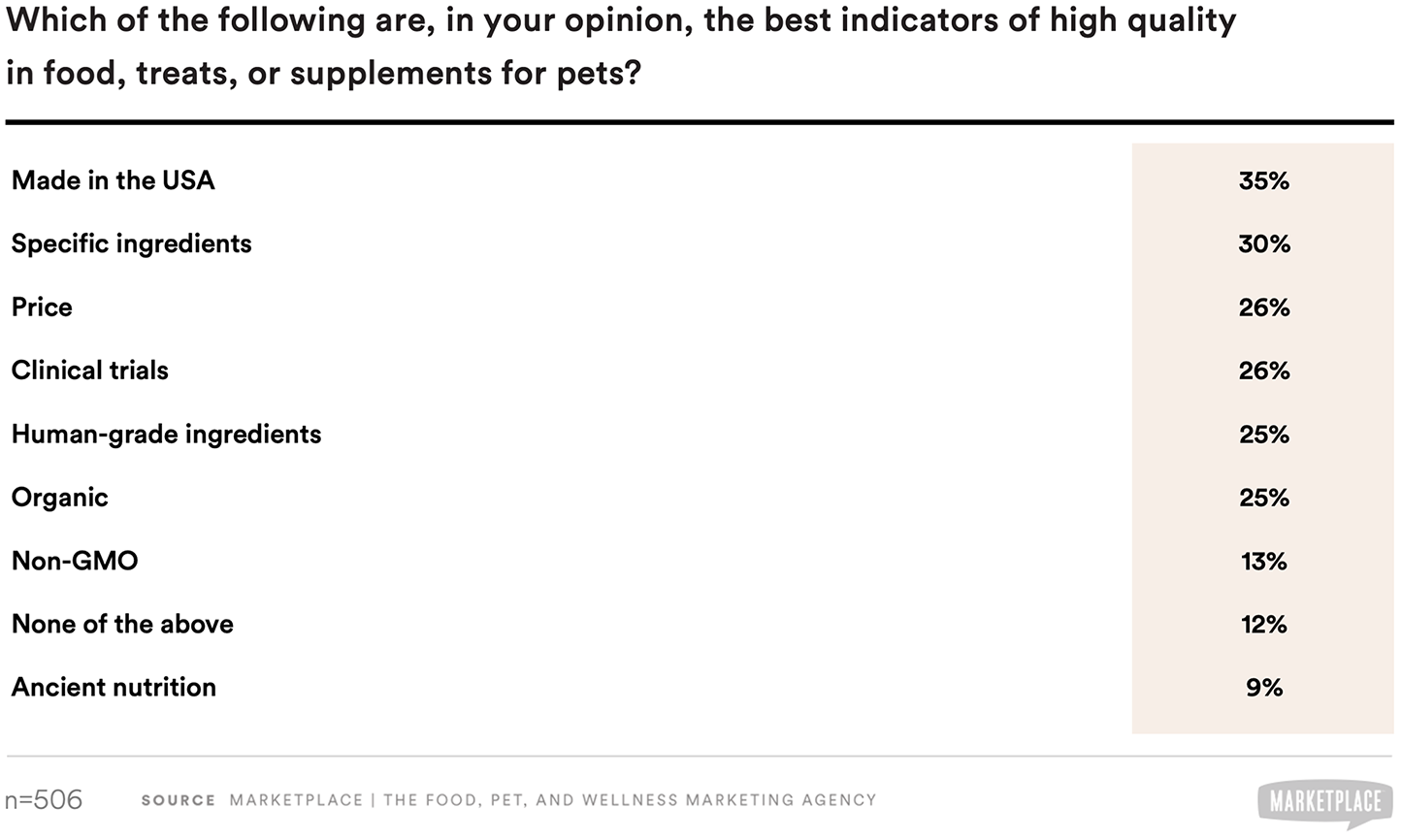

Indicators of quality in pet consumables are “made in the USA” claims (35%), use of specific ingredients (30%), price (26%), clinical trials (26%), human-grade ingredients (25%), and organic claims (25%). Pet parents who give their pet a supplement at least once per week are much more likely than average to associate organic (35%) with high quality.

BRAND INSIGHTS

Pet brands that can claim U.S. origins, clinical trials, and organic ingredients may wish to do so on packaging, web assets, and other media. Furthermore, the data suggest that pet parents are looking for specific ingredients. This fact aligns with the finding that noted a preference for specific benefits. Brands should also be cognizant about how price influences perceptions of quality and avoid pricing too aggressively.

Branded Ingredients Awareness

Low overall awareness of branded ingredients among pet parents

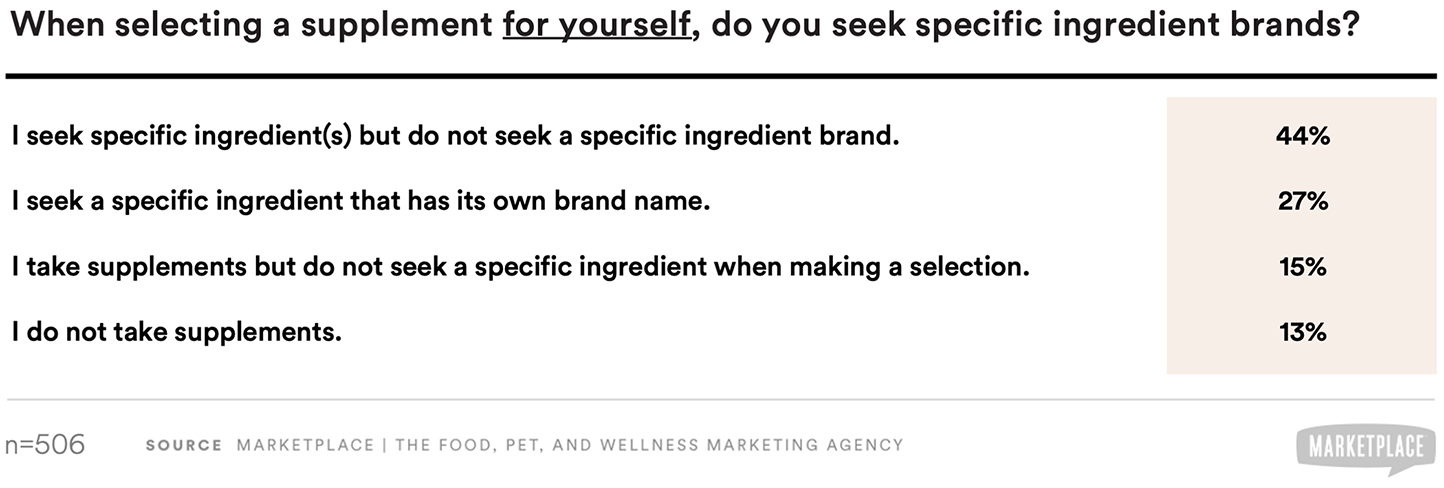

When buying supplements for themselves, pet parents tend not to seek a specific branded ingredient. However, 44% of pet parents indicated that they seek specific ingredient(s) but do not seek a specific ingredient brand. In contrast, 43% of pet parents who give their pets a supplement at least once per week said that, in supplements for themselves, they seek a specific ingredient with its own brand name.

About one-in-four (27%) indicated they seek a specific ingredient with a brand name, though when asked to identify the branded ingredients, pet parents tended to name product brand names or generic names of specific ingredients. This finding suggests low awareness and possible confusion among pet parents as to their understanding of branded ingredients in human supplements.

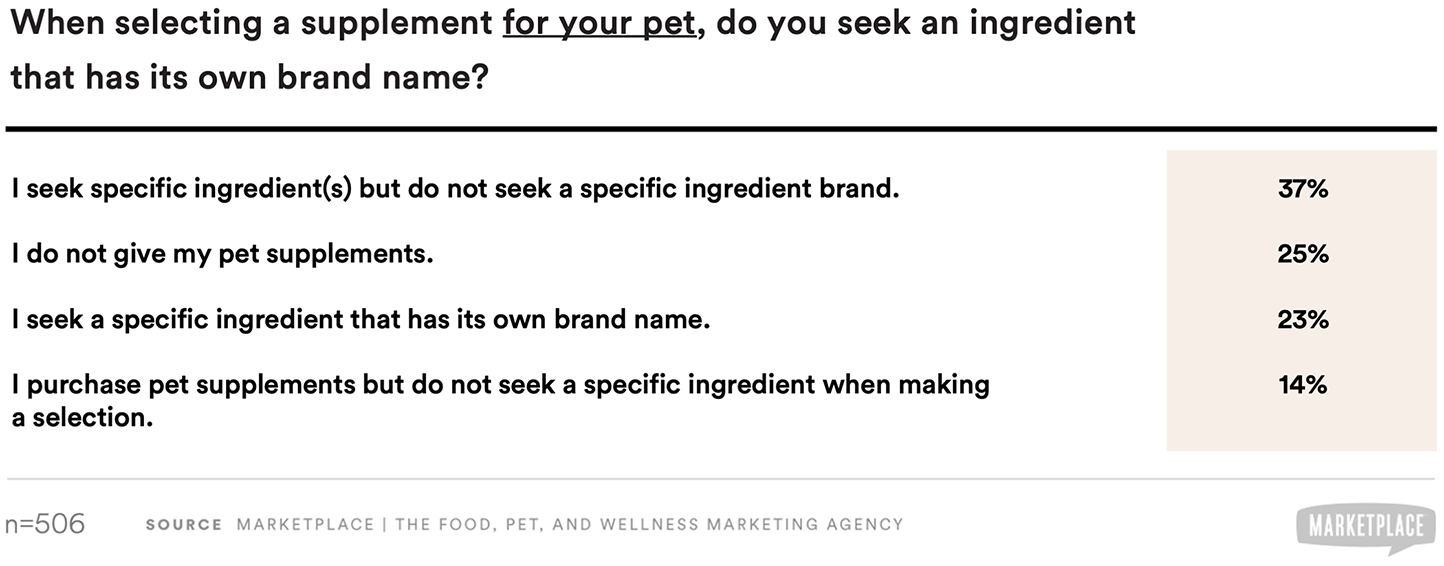

When it comes to pet supplements, nearly four in 10 pet parents (37%) indicated that they seek specific ingredient(s) but do not seek a specific ingredient brand in supplements for their pets. However, the same percentage (37%) of pet parents who give their pets a supplement at least once per week said that, in supplements for their pets, they seek a specific ingredient with its own brand name.

BRAND INSIGHTS

Like the finding in human supplements, when asked to identify the branded ingredients in pet supplements, pet parents tended to name product brand names or generic names of specific ingredients. Formulation of pet supplements with branded ingredients has potential to enhance perceived value but requires strategic communication to raise consumer awareness and understanding of the ingredient’s unique benefits.

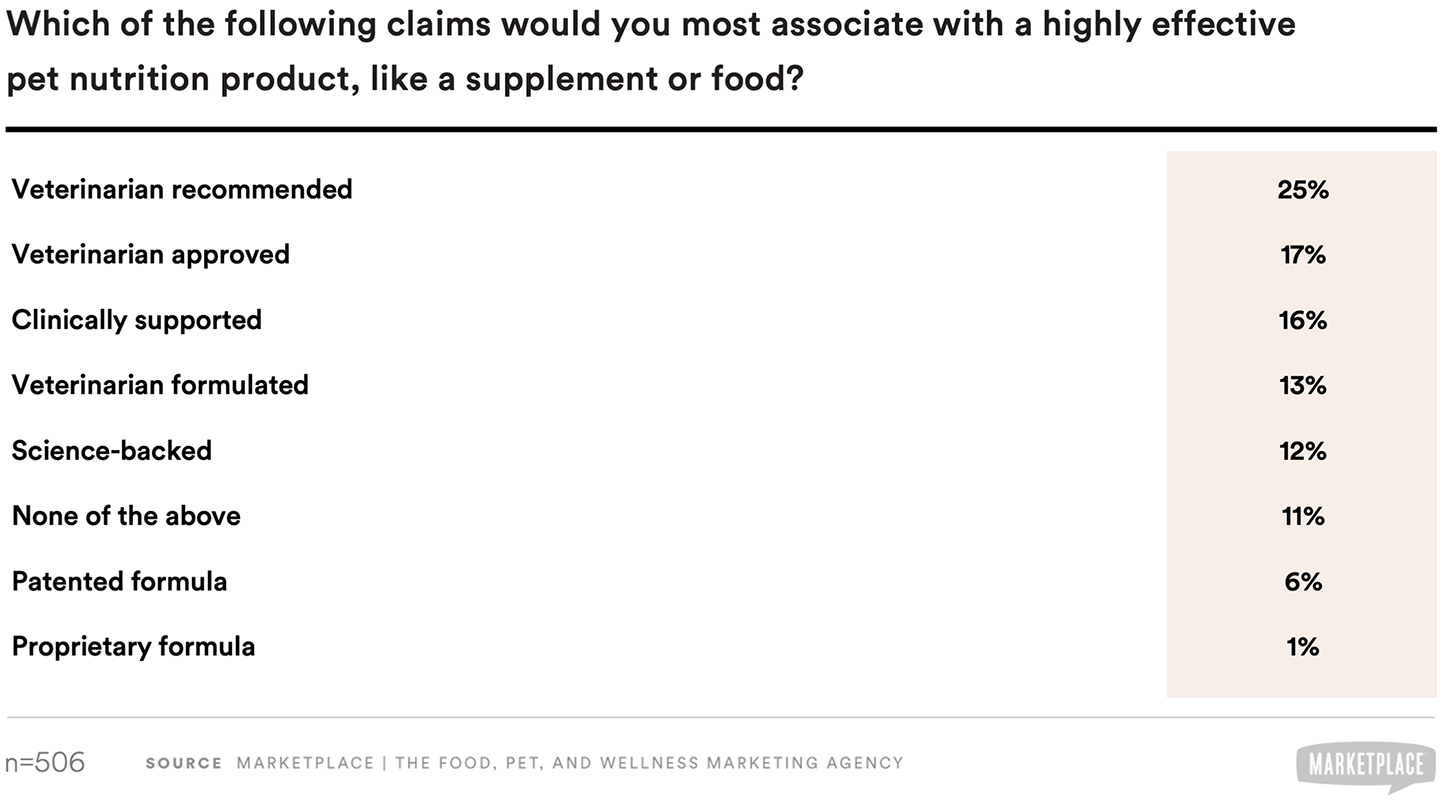

Veterinarian-related Claims

Veterinarian recommendation and approval signals high efficacy in pet nutrition

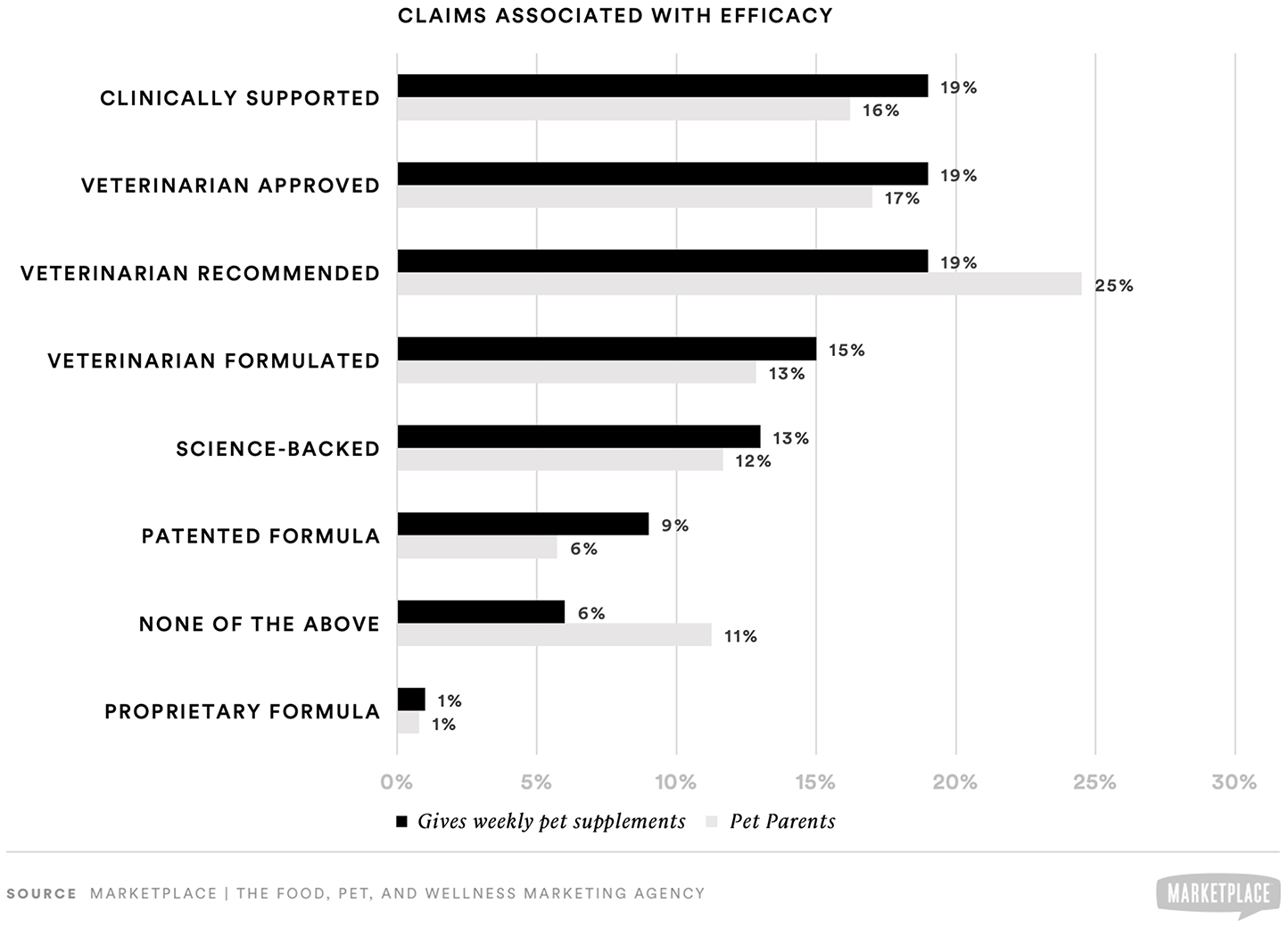

The study tested several scientific or veterinarian-related claims. One in four pet parents (25%) said they associate “veterinarian recommended” with highly effective pet nutrition products. For pet parents who give their pets a supplement at least once per week, the top claims associated with highly effective pet nutrition products are “Veterinarian approved” (19%), “Clinically supported” (19%), and “Veterinarian recommended” (19%).

BRAND INSIGHTS

Efficacy is a key purchase driver for pet parents choosing a pet supplement. Brands that can leverage authoritative sources in pet medicine, such as veterinarians and clinical research, have an advantage in making appeals to efficacy on packaging and in marketing communications.

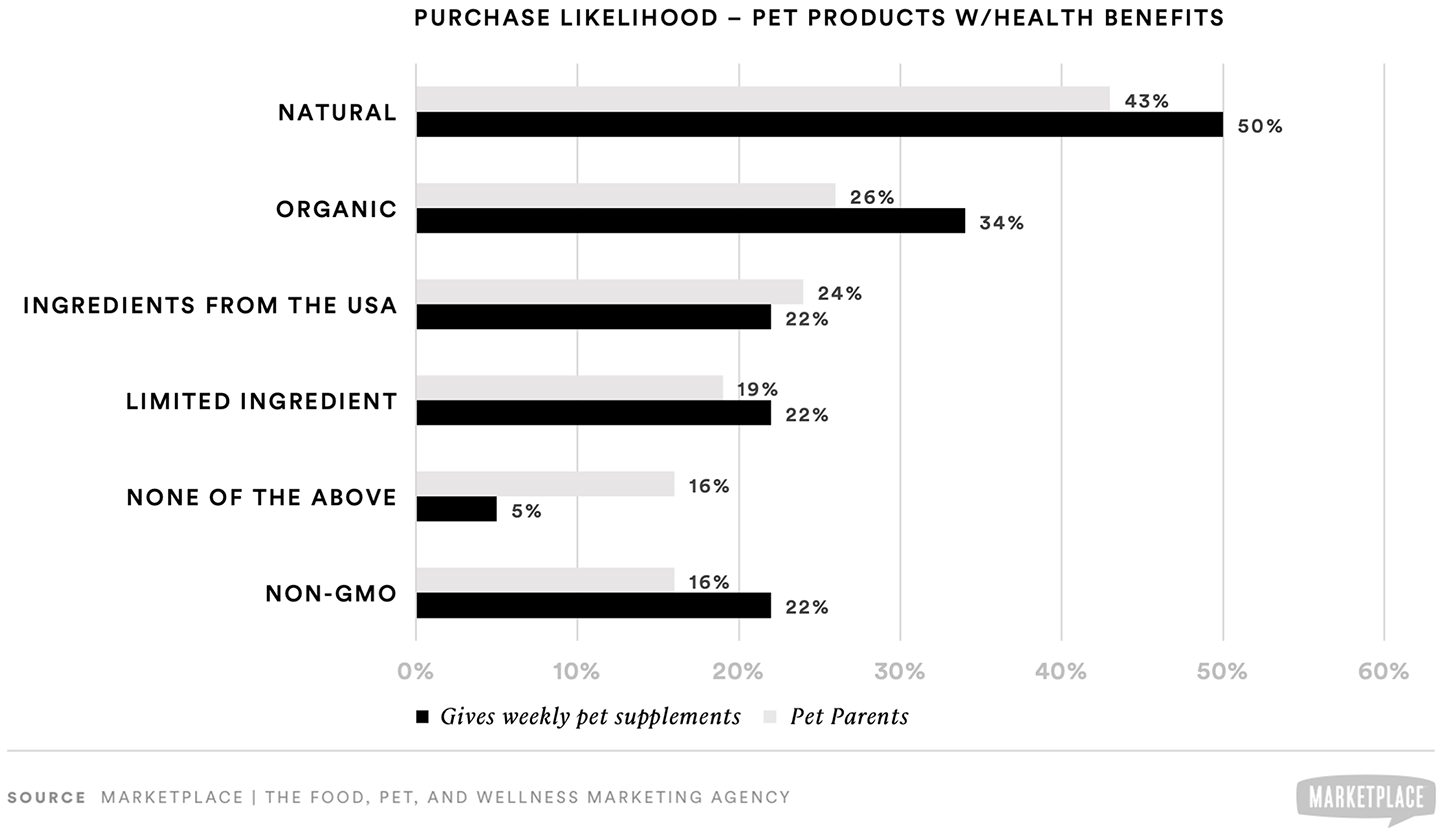

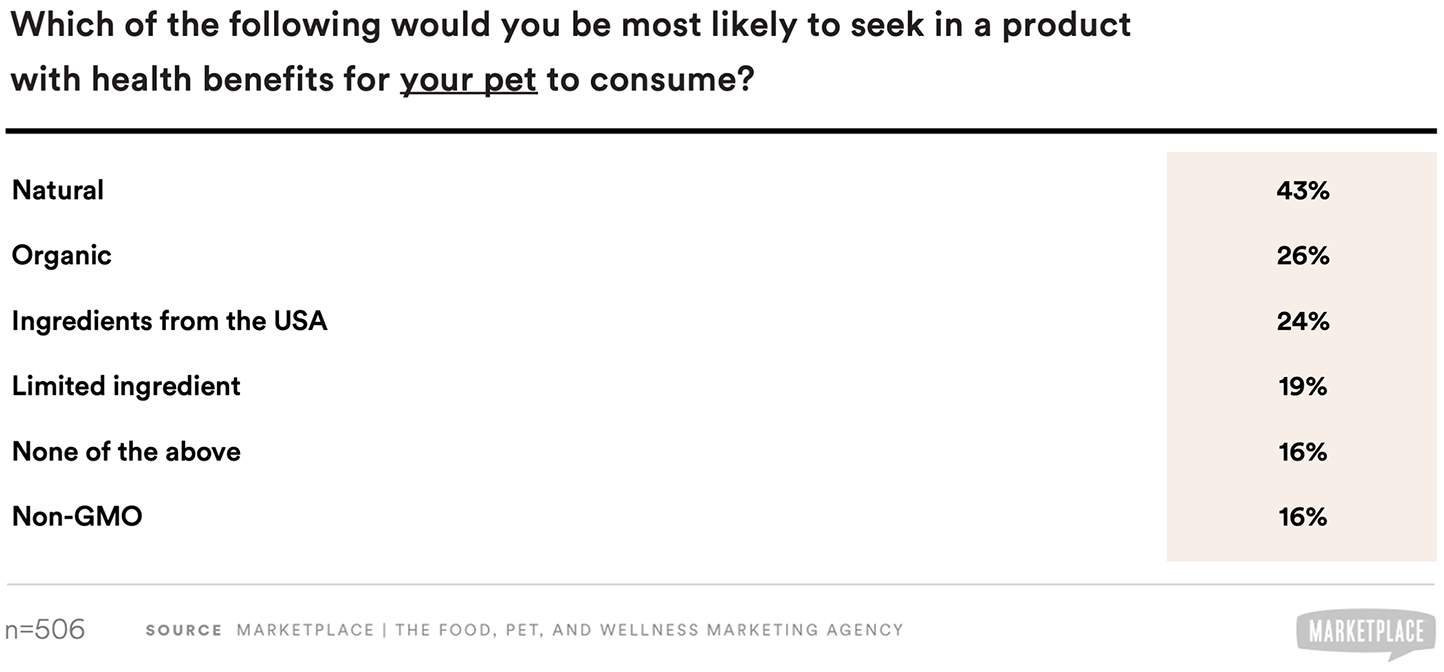

Natural Products

Pet parents likely to seek natural products with health benefits for their pets

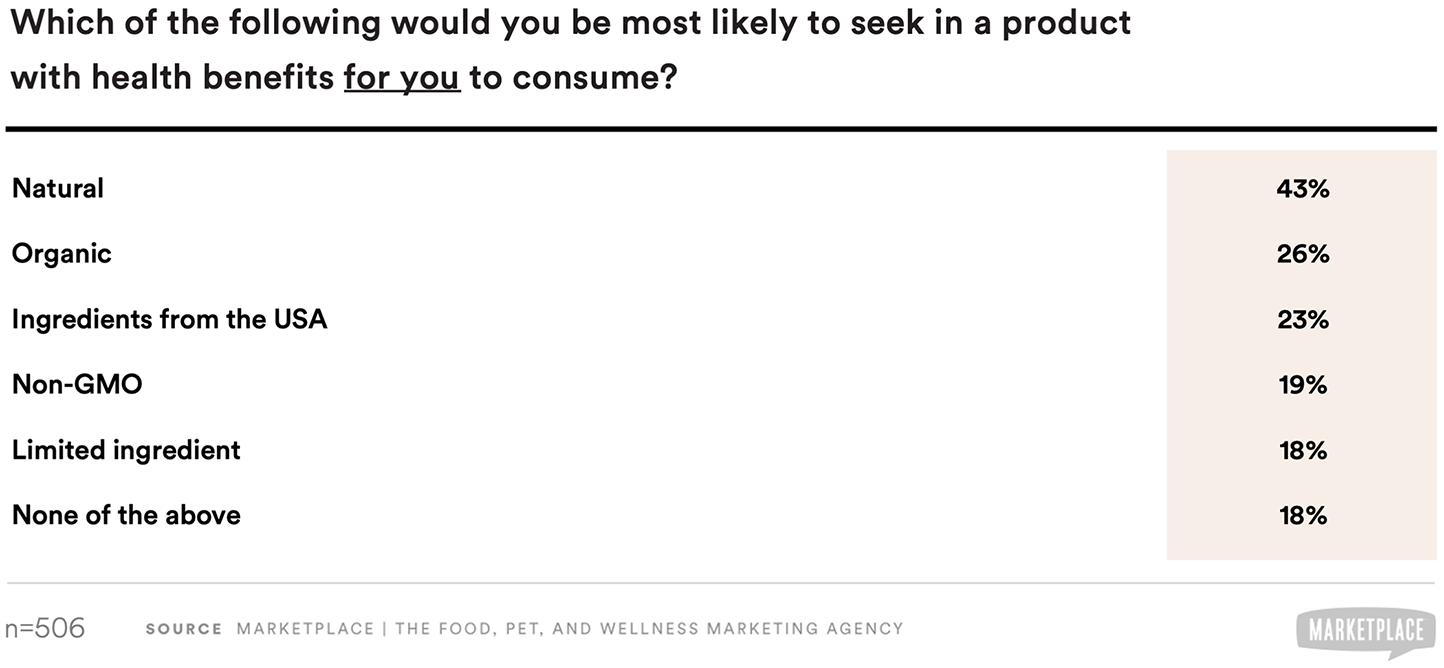

More than four in 10 pet parents (43%) said they would likely seek “natural” products with health benefits for their pet to consume. About one in four (26%) would seek “organic” products. Half of pet parents (50%) who give their pets a supplement at least once per week would likely seek “natural” products with health benefits for their pet to consume, and about one-third (34%) would seek “organic” products.

When asked about health products for themselves to consume, pet parents’ responses were nearly identical to their responses to the previous question. Separately, when asked about health products for themselves to consume, pet parents who give their pets a supplement at least once per week are more likely than average to seek out non-GMO items (26% vs. 16% average).

BRAND INSIGHTS

Pet supplement brands that can make all-natural claims may improve their appeal to pet parents, in general. Although “organic” does not necessarily have broad appeal, it does matter to a sizeable niche of consumers. Among pet parents who already give supplements on a regular basis, non-GMO claims also have niche appeal, though this will matter less when converting new supplement consumers from the general pet parent audience.

High-protein Claims

High protein in nutrition-focused products is desirable to pet parents

The protein trend in human nutrition has likely influenced pet parents’ perceptions of high-protein claims in nutrition-focused food and supplements for their pets to consume. More than four in 10 pet parents indicated that high protein is desirable in these products. Pet parents similarly found high protein desirable in nutrition-focused food and supplements for themselves.

Notably, over half of pet parents surveyed who give their pets a supplement at least once per week (52% vs. 43% average) agreed that high protein is a desirable trait in products for their pets’ nutrition. Additionally, pet parents who give their pets a supplement at least once per week are also more likely than average to find “grain-free” desirable (24% vs. 19% average).

BRAND INSIGHTS

Although most supplement formats are not conducive to delivering a high dose of protein, inclusion of high-quality protein may be an attractive feature in any nutritionally focused product. For example, soft chews, treats, and specialized foods may be effective formats for pairing protein claims alongside specific health benefits.

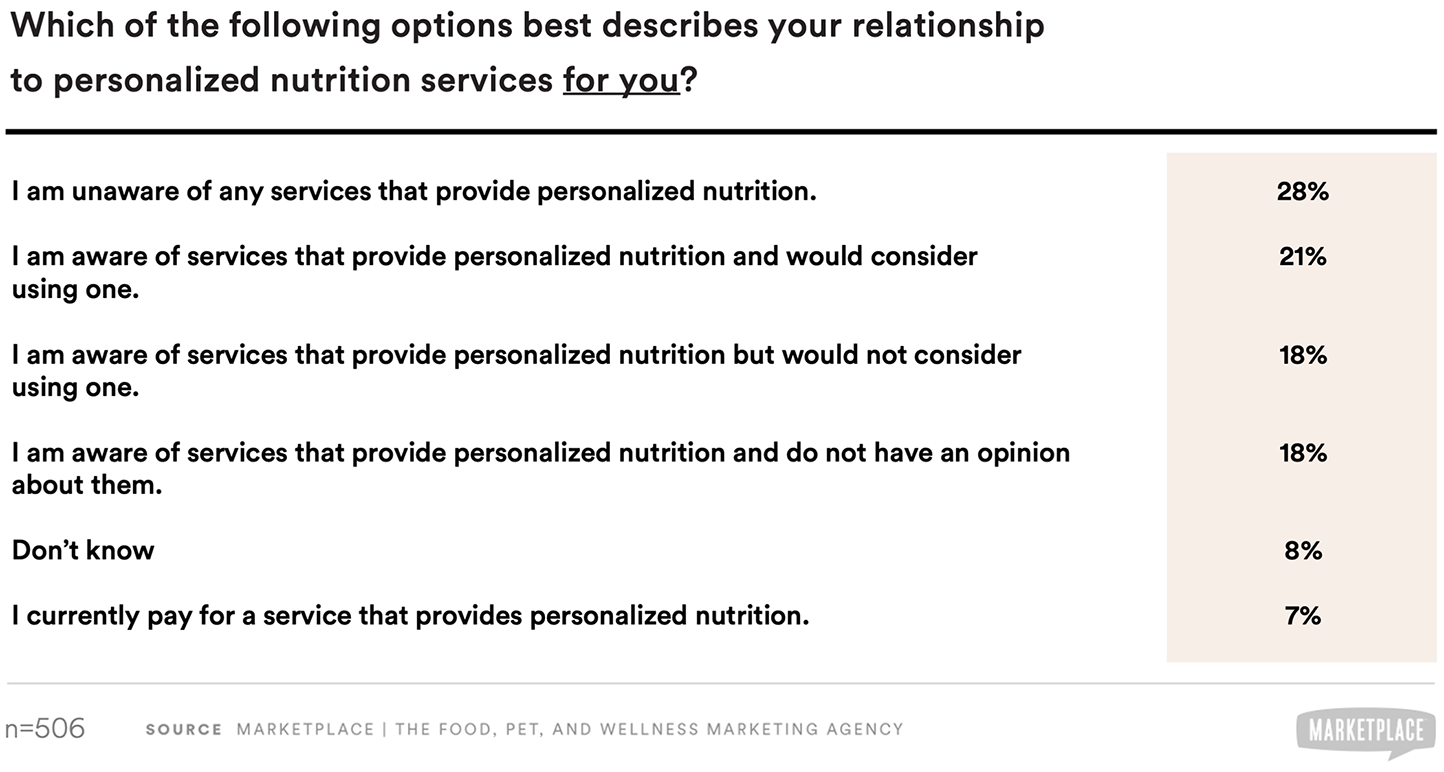

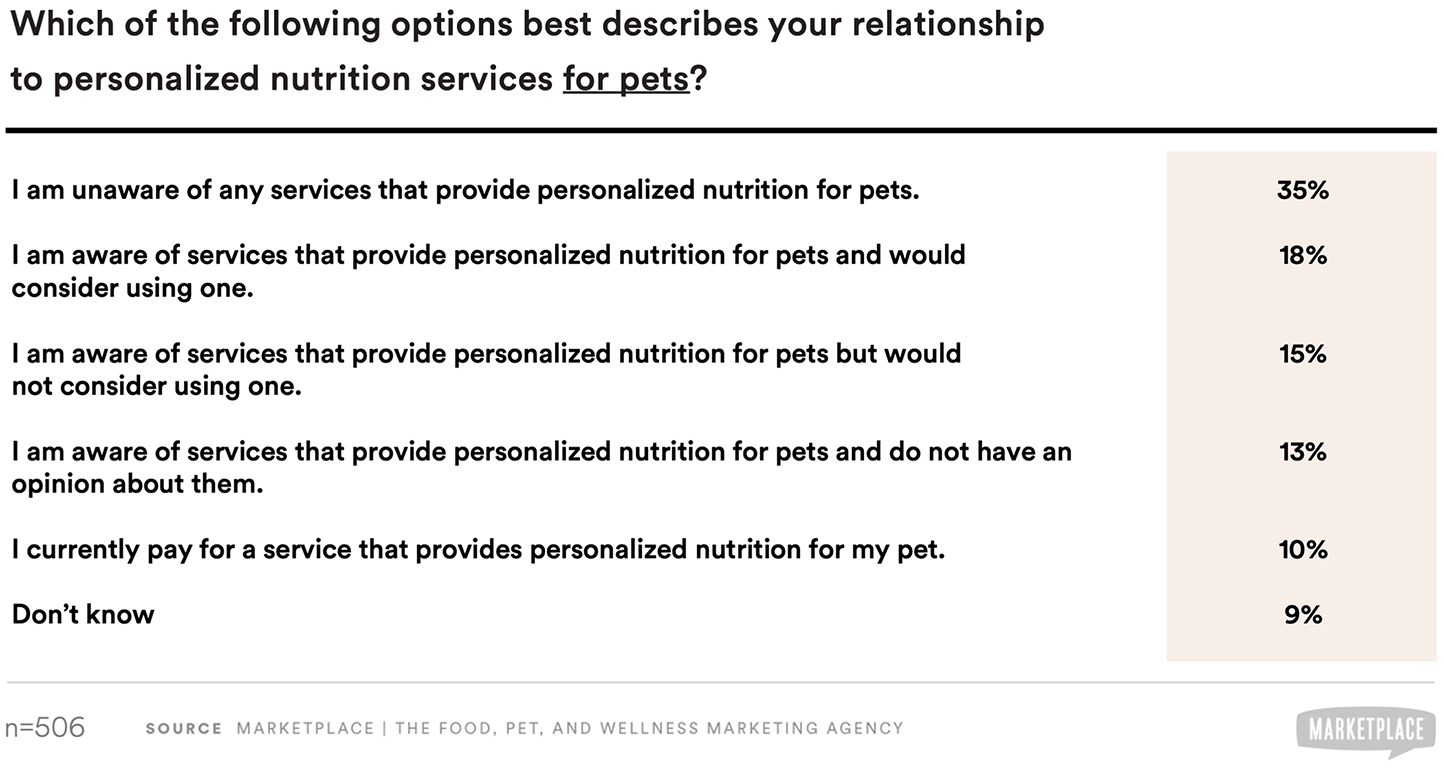

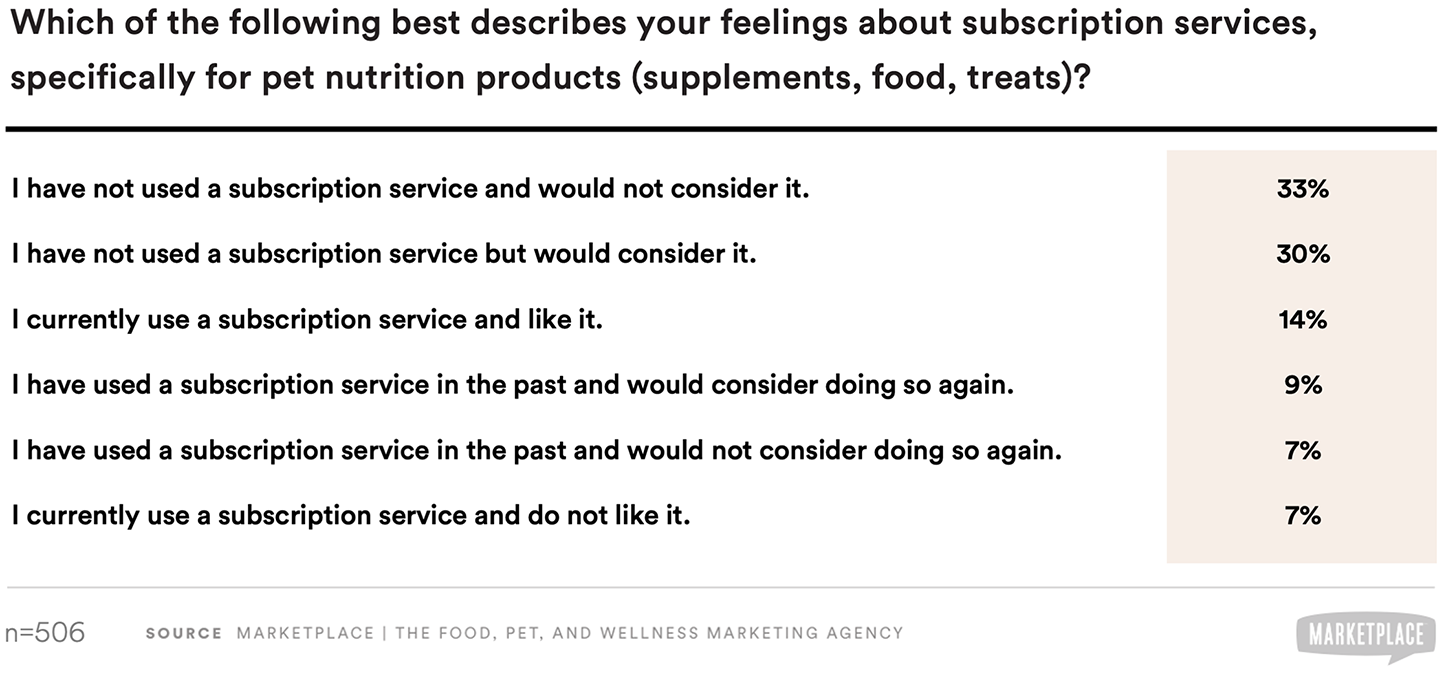

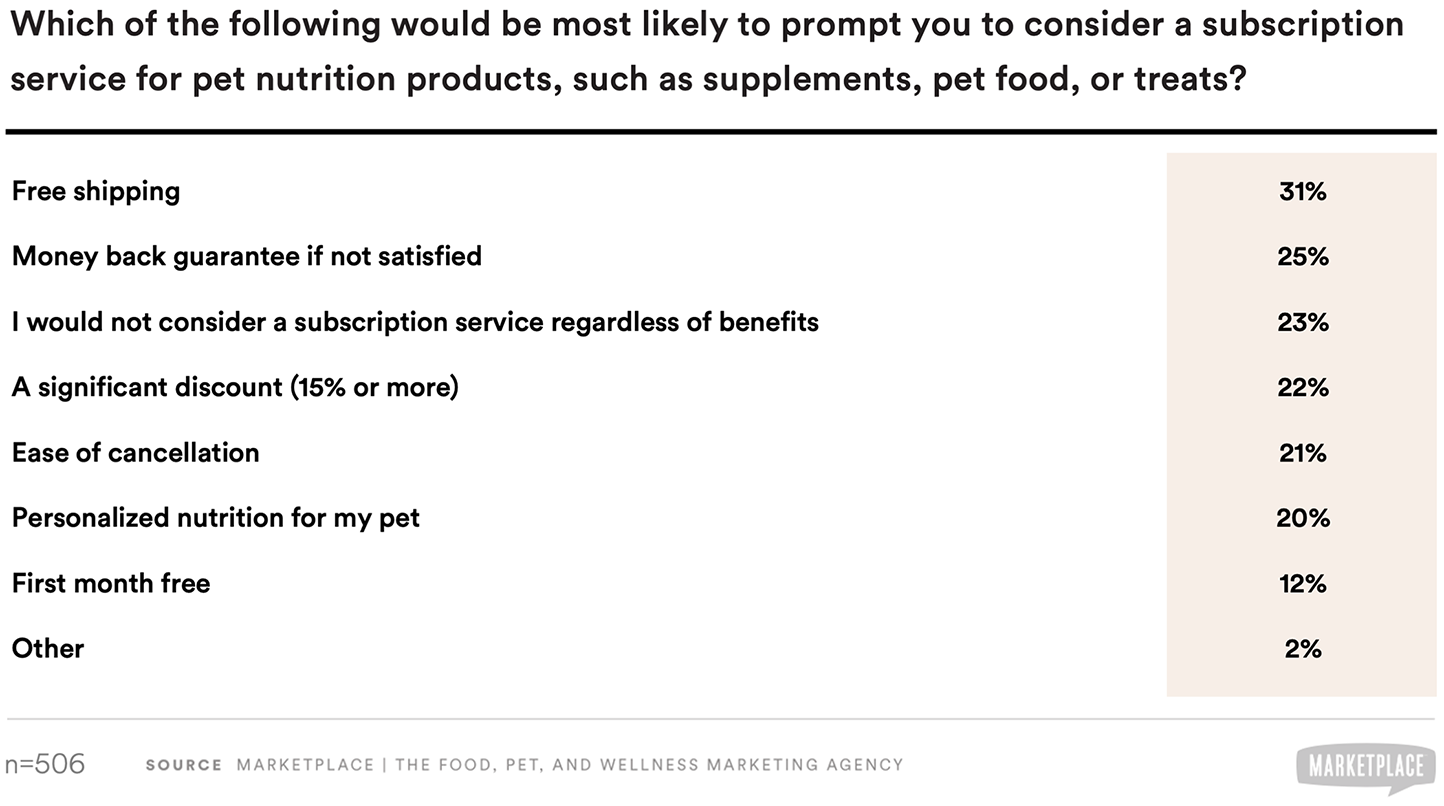

Subscription Services

Pet parents who give supplements are more likely to consider using a subscription service

Subscription services may provide opportunities for pet supplement and nutritional brands. For the most part, most pet parents have some level of awareness of subscription services that sell nutrition services for humans. Only 28% of pet parents are unaware of any services that provide personalized nutrition for themselves. However, pet parents who give their pets a supplement at least once per week are more likely to be aware of these services for themselves and to consider using one (29% vs. 21% average).

Although awareness is lower for such services for pet products, pet parents who already give supplements to their pets on a regular basis are more likely to consider using them. On average, over one-third (35%) of pet parents surveyed are unaware of any services that provide personalized nutrition for their pets. On the other hand, pet parents who give their pets a supplement at least once per week are more likely to be aware of these services for their pets and to consider using one (24% vs. 18% average).

BRAND INSIGHTS

Only about one-third (33%) of pet parents said they have not used a subscription service for their pet nutritional products and would not consider it. In contrast, far fewer (21%) pet parents who give their pets a supplement at least once per week said the same.

Pet parents, in general, said free shipping (35%), money back guarantees (25%), and significant discounts (22%) would prompt them to consider a subscription service. These data suggest that pet parents are willing to consider supplement-focused subscription services, which opens new avenues for brands to attract new customers.

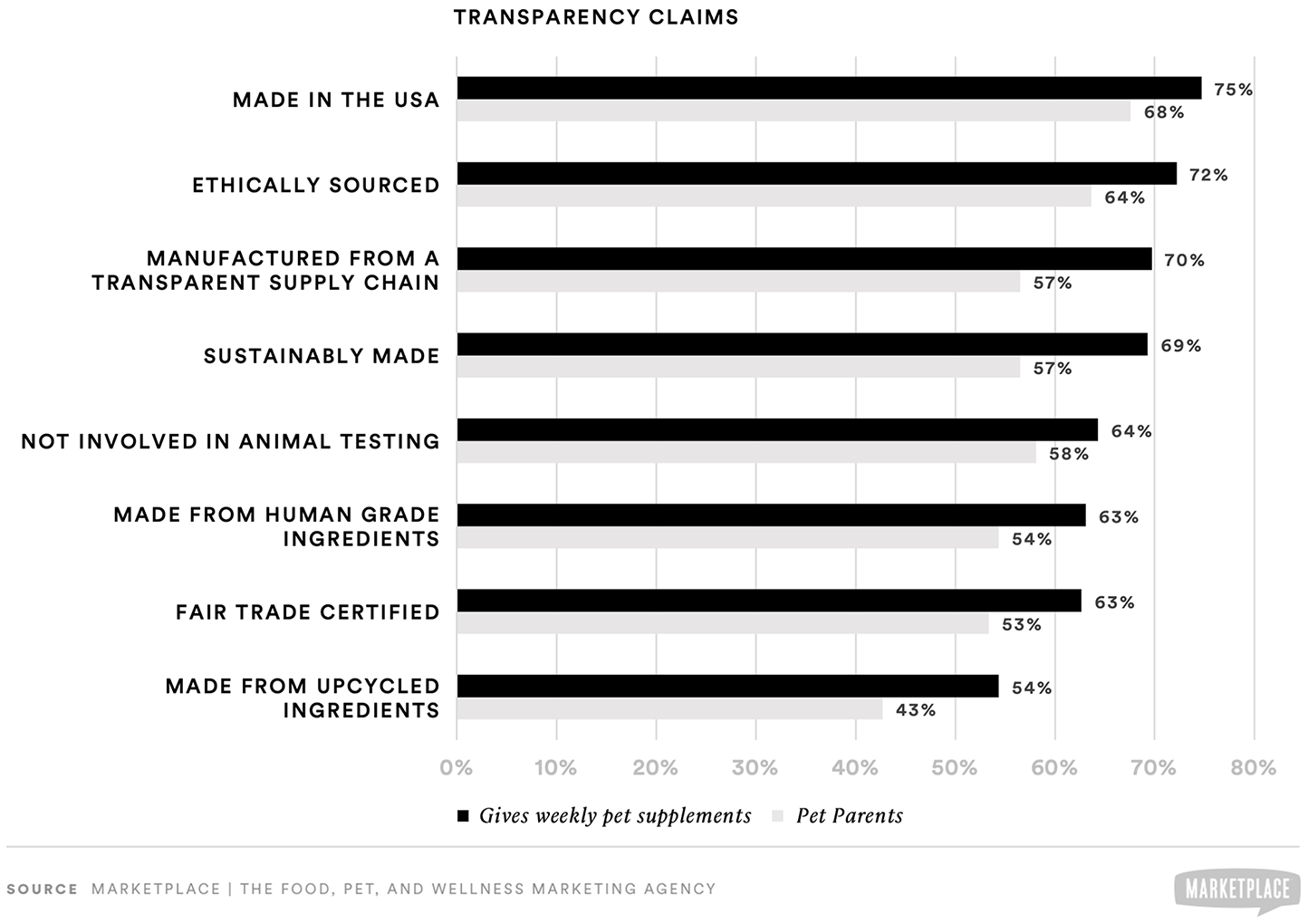

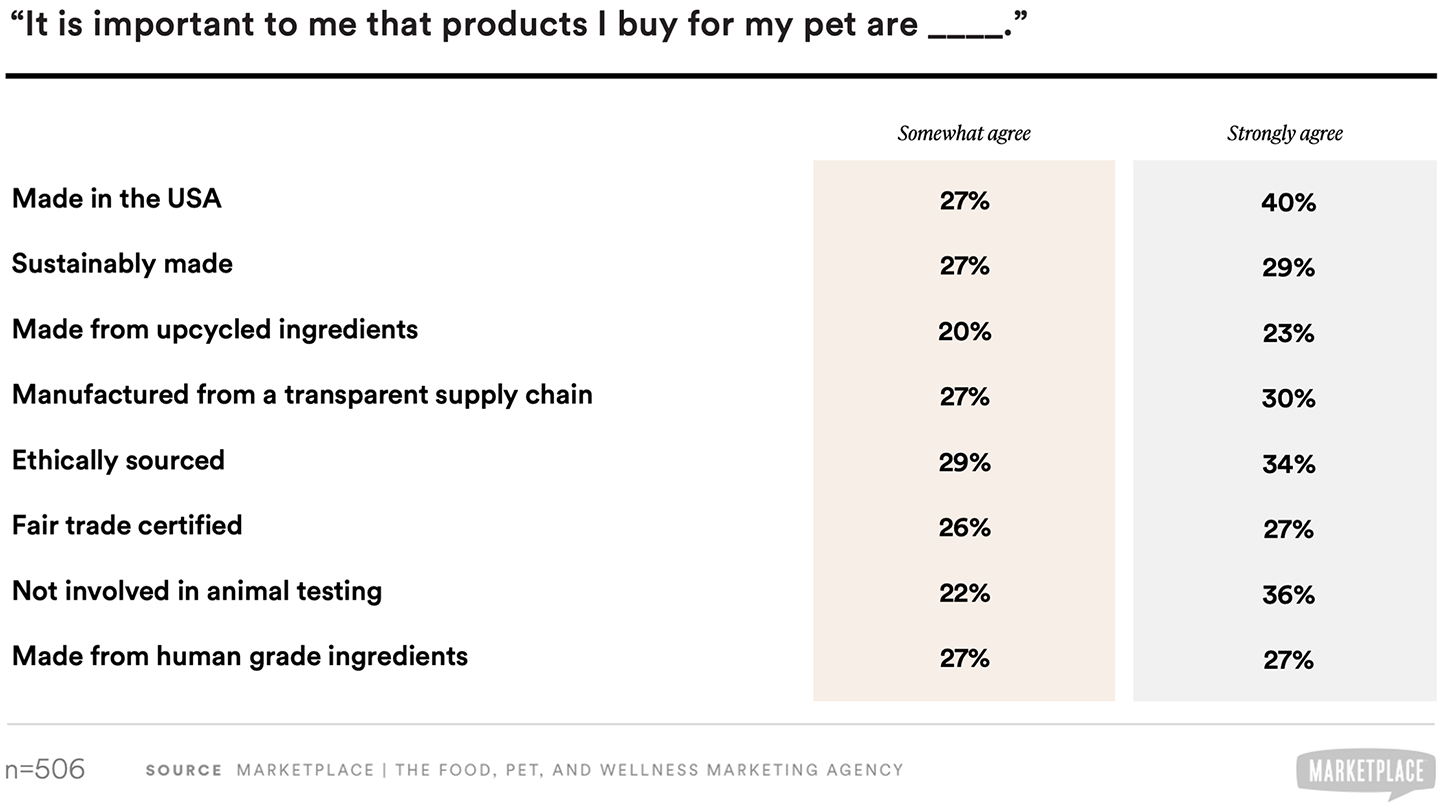

Important Pet Product Attributes

Transparency, sustainability, and ethical practices are important to pet parents when buying pet products

Pet parents tend to agree that, when buying products for their pets, it is important to them that the products are made in the USA (67%), sustainably made (56%), made from upcycled ingredients (43%), manufactured from a transparent supply chain (57%), ethically sourced (63%), fair trade certified (53%), not involved in animal testing (58%), and made from human grade ingredients (54%).

Moreover, pet parents who give their pets a supplement at least once per week were more likely than average to say it is important to them that the products they buy for their pets are made in the USA (75%), sustainably made (70%), made from upcycled ingredients (54%), manufactured from a transparent supply chain (70%), ethically sourced (72%), fair trade certified (62%), not involved in animal testing (64%), and made from human grade ingredients (63%).

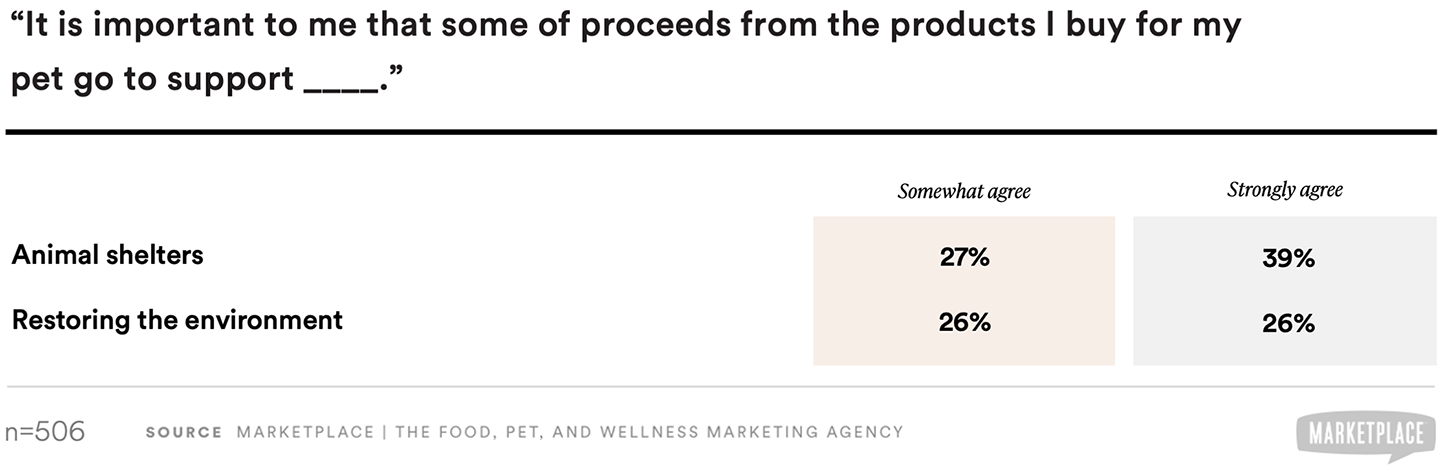

Furthermore, pet parents who give their pets a supplement at least once per week are highly likely to want their purchases to support shelters (75%) or want their purchases to support restoring the environment (65%).

BRAND INSIGHTS

The high agreement among pet parents who give their pets supplements indicates that these attributes may be especially meaningful to this target audience. Pet supplement brands may gain credibility by appealing to transparency, sustainability, and ethical practices. Doing so may serve as a potential differentiator and encourage first-time trial and repeat purchase.

Sustainability and Pet Products

Pet parents prefer sustainable packaging

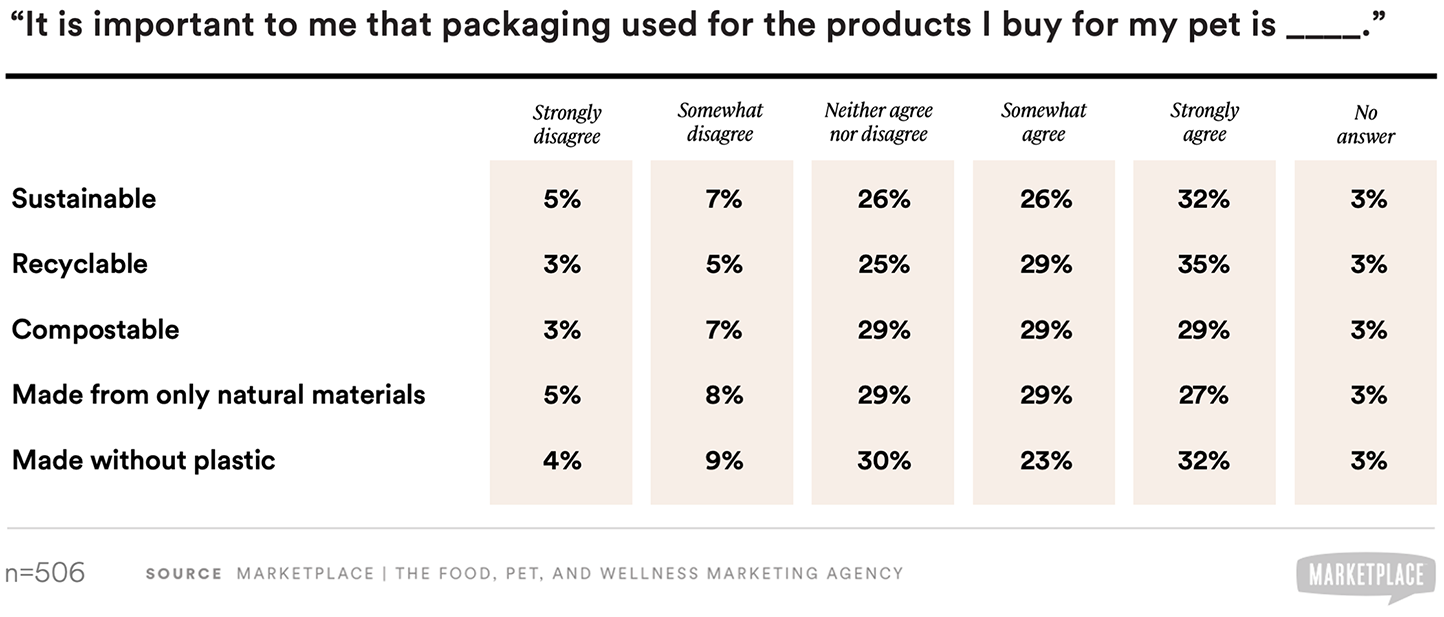

Pet parents tend to agree that it is important to them that the packaging for pet products is sustainable (58%), recyclable (64%), compostable (58%), made from only natural materials (56%), or made without plastic (55%). This sentiment was even higher among pet parents who give their pets a supplement at least once per week. This subgroup agreed that it is important to them that the packaging for pet products is sustainable (72%), recyclable (77%), compostable (69%), made from only natural materials (69%), or made without plastic (66%).

BRAND INSIGHTS

Sustainable packaging is another potential key differentiator for pet supplement brands. Manufacturers should take into consideration packaging materials and post-consumer use as a medium to emphasize their brand values.

Health and Wellness Sources

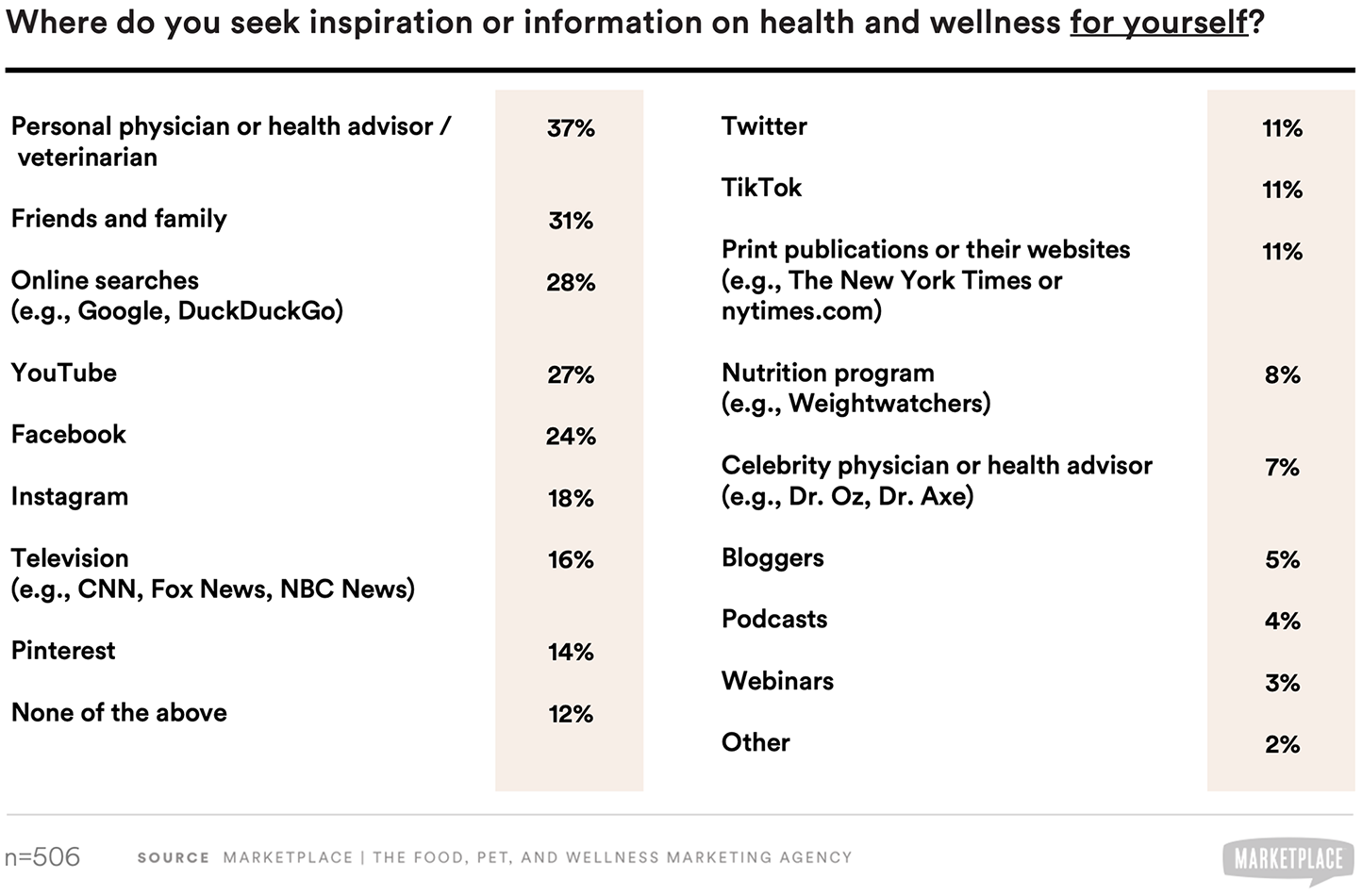

Online sources, friends, and family are key information sources about health and wellness, for themselves and their pets

When pet parents seek inspiration or information about health and wellness for themselves, they tend to go to a personal physician (37%), friends and family (31%), online searches (28%), YouTube (27%), or Facebook (24%). However, for pet parents who give their pets a supplement at least once per week, they tend to go to YouTube (38%), friends and family (37%), online searches (32%), a personal physician (32%), or Facebook (29%).

When it comes to seeking inspiration or information on health and wellness for their pets, pet parents tend to go to their personal vet (41%), online searches (26%), friends and family (26%), YouTube (25%), and Facebook (16%). On the other hand, YouTube is more popular with pet parents who give their pets a supplement at least once per week (33%).

BRAND INSIGHTS

Investing in strong online assets, search engine optimization, and social media planning are critical to raising awareness and shaping attitudes about pet supplement brands. Content should be easily shared with friends and family. Brands may also benefit from highlighting veterinarian recommendations or encouraging pet parents to ask their personal vet about a supplement product.

Thank You For Reading

If you have any questions or would like to request more information about our study, please contact us at hello@marketplacebranding.com.

Working With MarketPlace

Founded in 2002, MarketPlace is a strategic partner to health and wellness, pet and animal, and food and beverage brands. Through business strategy, industry focus, and marketing expertise, we help our partners grow.

If you’re working to launch a pet supplement brand, we do that, too—let’s talk!