What Shoppers Seek in Pet Supplements

Executive Summary

MarketPlace conducted a survey of dog owners to develop insights into consumer perceptions and behaviors regarding pet supplements, specifically for dogs. Findings from this study were presented at the 2020 Annual Conference of the National Animal Supplement Council.

Key Findings

- COVID-19 affected where and how consumers shop for their dogs. Consumers reported a strong shift to online retailers, such as Amazon and Chewy, from March through May 2020, compared to the prior six months. Pet specialty retail shopping was significantly down. Over half of respondents reported ordering from a website and shipped to their home.

- The pandemic prompted some dog parents to stop buying supplements. However, others said they either started or increased their supplement purchases. Slightly more than 1 in 10 dog parents reported having stopped buying supplements. In contrast, about 14% of dog parents said they either started buying supplements for their dogs or increased their frequency of purchases from March to June 2020.

- Health is the top priority for dog parents. Nearly two out of three said they most want their dog to be healthy. Over half of dog parents said they seek general wellness benefits in products that their dog will consume. However, if purchasing a supplement, over one-third said they would first look for a specific benefit.

- Positioning a new brand should emphasize effectiveness at treating specific conditions. Brands that target younger dog parents may be able to make emotional appeals in addition to emphasizing efficacy.

- The ingredients that dog parents said they would be most likely to seek in a dog supplement are probiotics, fish oil, omega 3s, glucosamine, antioxidants, and CBD.

- If searching online for dog supplements, dog parents are most likely to search for “Vet recommended supplements for dogs” or “Best supplement for dogs.”

Methodology

In May 2020, MarketPlace surveyed an online panel of 578 adults (age 18 and older) who own at least one dog. We asked respondents questions about their retail channel preferences for purchasing pet products, as well as their awareness, attitudes, and behaviors related to supplements for dogs.

Detailed Findings

Channel Preferences Shift in Response to COVID-19

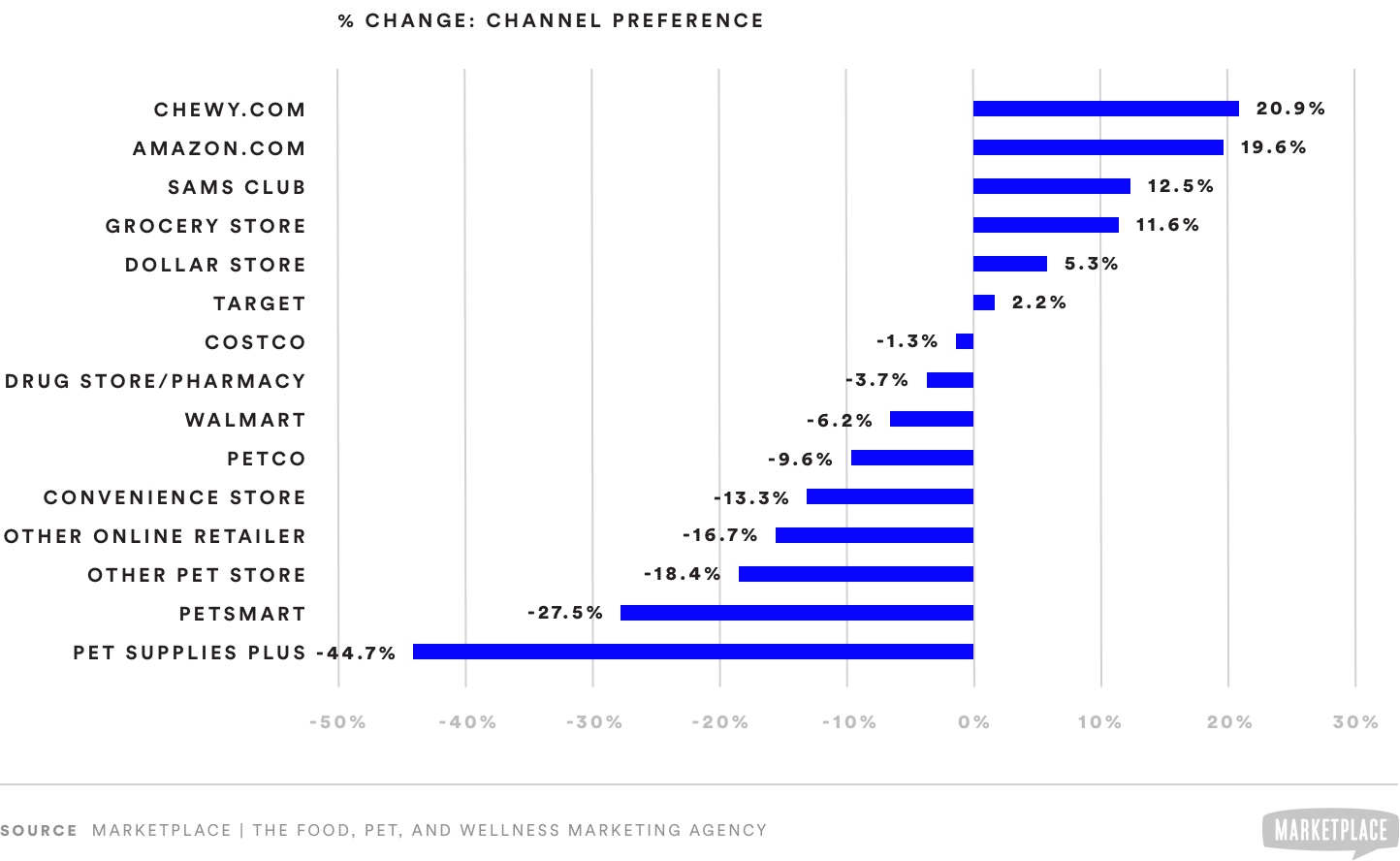

The pandemic is changing where dog parents go to shop for their dogs. The data indicate that purchase behavior among dog parents strongly shifted to online retailers, such as Amazon (+20.9%) and Chewy (+19.6%), from March through May 2020, compared to the prior six months. Furthermore, Amazon and Chewy are the top two channels for dog parents who buy supplements.

The data also suggest that Costco lost market share to Amazon. However, a different club store, Sam’s Club, saw a substantial boost in reported dog parent activity (+12.5%), whereas Costco saw a slight decline (-1.3%). Furthermore, the data show that more dog parents began using Sam’s Club in addition to other channels.

Among FDM stores, Grocery saw a significant increase in dog parent shopping (+11.6%). Target stores saw a small uptick (+2.2%). However, drug stores (-3.7%) and Walmart (-6.2%) decreased from March through May 2020, compared to the prior six months. Pet specialty retail shopping was significantly down, with survey respondents reporting that they had cut back on shopping at Petco (-9.6%), PetSmart (-27.5%), and Pet Supplies Plus (-44.7%).

Dog Parents Change How They Shop for Their Dogs

COVID-19 spurred many dog parents to adjust their shopping habits toward safer, lower-touch methods. Going inside physical stores remained a popular option from March through May 2020, with 57.3% reported having shopped in-store and 19.2% using online ordering with in-store pickup. However, the data suggest that a large number of dog parents are choosing alternatives.

Many of these consumers chose to shop for their dogs from home. Over half (55.8%) ordered from a website and shipped to their home, while 15.4% reported ordering from a physical store for home delivery. Among dog parents who reported having shopped inside a physical store, 44.1% also went online to buy products for their dog; 15.4% also ordered online and picked up in-store.

Dog parents who buy supplements are most likely to order online and ship products to their home. That said, many indicated that they are still shopping in-store.

Pandemic Affects Purchases of Treats, Supplements, and Toppers

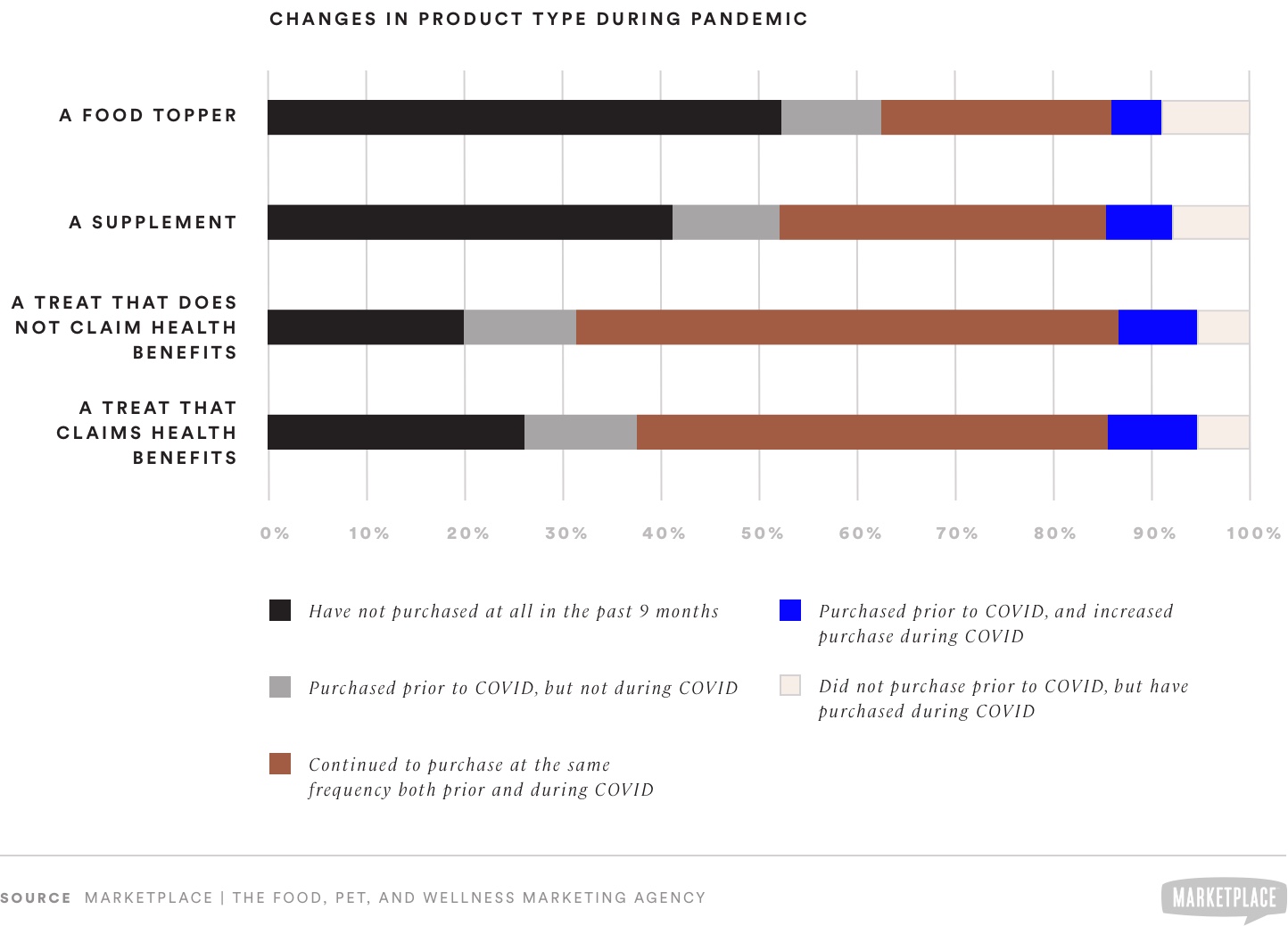

Some consumers report having stopped buying treats, toppers, or supplements. This may be due to economic pressures, as well as changes in shopping habits and access to retail. 1 in 10 dog parents (10%) in the survey said that they had purchased toppers prior to COVID, but not during the outbreak. Similarly, 11% stopped buying supplements. 12% said they stopped buying treats that claim health benefits and 12% also said they stopped buying treats without health claims.

In contrast, about 14% of dog parents either started buying supplements for their dogs or increased their frequency of purchases during this time period. Treats with health claims were the most popular functional non-food edible for dogs during this time period. However, treats without health claims were somewhat more popular than those with health claims.

During the first months of the pandemic in the U.S. (Q2 2020), dog parents older than 45 years old were slightly more likely than those age 44 and younger to have continued purchasing supplements or treats with health claims. Likewise, dog parents with household income greater than $100,000 per year were also more likely than average to have continued to give treats with health claims during the pandemic.

Dog Parents Want Their Dogs to be Healthy

Health is the #1 priority for dog parents. Nearly two out of three (64%) said they most want their dog to be healthy. Dog parents also said that they most want their dog to be well-behaved (31%), pain-free (23.5%), comfortable (21.8%), or friendly (21.8%). (Note: respondents could select multiple descriptions).

General wellness is the benefit that over half of the surveyed dog parents (53.3%) said they seek in products that their dog will consume. Of these consumers who indicated general wellness, 50% also responded digestive health, 42% also responded skin and coat, and 39% also responded hip and joint.

Consumers Look for Condition-Specific Benefits in Dog Supplements

Dog parents tend to have specific conditions in mind when they look for supplements for their dog. If purchasing a supplement, over one-third of dog parents surveyed said they would first look for a specific benefit (34%). This sentiment was higher among high-income dog parents (over $100k annual household income – 39%) than those with annual income under $100k (32%). Dog parents with annual income less than $50k were much less likely to prioritize specific benefits (27%) and more likely to prioritize price.

Age appears to play a factor in what consumers look for in dog supplements. Dog parents age 45 and older were more likely (40%) to first look for specific benefits than those younger than 45 years old (30%). Nonetheless, specific benefit was the top priority for this younger age group.

For Supplements, Efficacy Matters Most to Dog Parents

When it comes to perceptions of a supplement’s efficacy, treatment of symptoms matters to significantly more dog parents than improvements in appearance, happiness, activity, and longevity. For indicators of whether or not a pet supplement is working, nearly half of dog parents (47%) said they would look for their dog to stop exhibiting prior symptoms. However, the data revealed generational differences.

Dog parents age 45 and older are more likely (50%) than those younger than 45 years old (44%) to consider the absence of symptoms the best indicator that a supplement is working. The “under 45” group is more likely to believe that the appearance that their dog seems happier is the best indicator (20% vs. 10%). Dog parents age 29 and younger were even more likely to view happiness as the best indicator (25%).

Overall, a dog supplement’s brand, flavor, and format are not top considerations for most dog parents. Positioning a new brand should emphasize effectiveness at treating specific conditions. Brands that target younger dog parents may be well-served to make emotional appeals in addition to emphasizing efficacy.

Probiotics, Fish Oil Ingredients Most Likely to be Sought After in Supplements for Dogs

The survey data identified the ingredients most likely to drive purchase decisions. The ingredients that dog parents said they would be most likely to seek in a dog supplement are probiotics (25.6%), fish oil (20.6%), omega 3s (20.4%), glucosamine (18.7%), antioxidants (18.5%), and CBD (13.7%). The study also sought to identify correlations between motivations for specific benefits and likelihood to seek certain ingredients.

General wellness was the most common desired benefit. The ingredients most likely to be sought after by those who were motivated by general wellness are: probiotics (28%), omega 3s (24%), glucosamine (20%), antioxidants (19%), and fish oil (19%). Ingredients that correlated the most with wellness were also, independently, the most likely to be sought. Notably, the relative importance of fish oil for this subgroup was less than indicated in the aggregate.

While probiotics were the most likely ingredients sought overall, prebiotics were only minimally acknowledged, with 8% (both overall and among digestive health seekers) noting it as an ingredient they would seek in pet supplements. The ingredients most likely to be sought after by those who were motivated by digestive health are: probiotics (29%), antioxidants (24%), omega 3s (23%), and fish oil (23%).

As a pair, omega 3s and fish oil—two of the top three ingredients sought—most correlated with skin and coat, anti-anxiety/calming, and allergy relief. Glucosamine is most associated with hip and joint health, with its second greatest association being mobility (28%). CBD is most associated with anti-anxiety / calming, with its second greatest association being allergy relief (19%). Perhaps surprisingly, CBD did not strongly correlate with pain relief.

Consumers Find Confidence in Recommendations and Reviews of Supplements

If searching online for dog supplements, dog parents are most likely to search for “Vet recommended supplements for dogs” (41%) or “Best supplement for dogs” (29%). Dog parents with annual HH income $100K+ are much more likely than average to search “vet recommended supplements for dogs” (52%).

“Vet recommended” is an attribute that 44% of dog parents feel would boost their confidence in a pet supplement. “Clinically proven” is an attribute that boosts confidence for nearly one third of dog parents (32%). Income and age may play a role in likelihood to find confidence in certain claims.

Dog parents with annual household income of $100K or more are more likely than other households to be confident in pet supplements that are vet recommended (49% vs. 43%). For dog parents age 29 and younger “Vet recommended” (38%) is the top confidence-boosting attribute but less so than for older audiences. This younger age group said they are somewhat more likely to be oriented toward “all natural” (23%) and “organic” (18%) claims.

Thank You For Reading

If you have any questions or would like to request more information about our study, please contact us at hello@marketplacebranding.com.

Working With MarketPlace

Founded in 2002, MarketPlace is a strategic partner to health and wellness, pet and animal, and food and beverage brands. Through business strategy, industry focus, and marketing expertise, we help our partners grow.

If you’re working to launch a pet supplement brand, we do that, too—let’s talk!